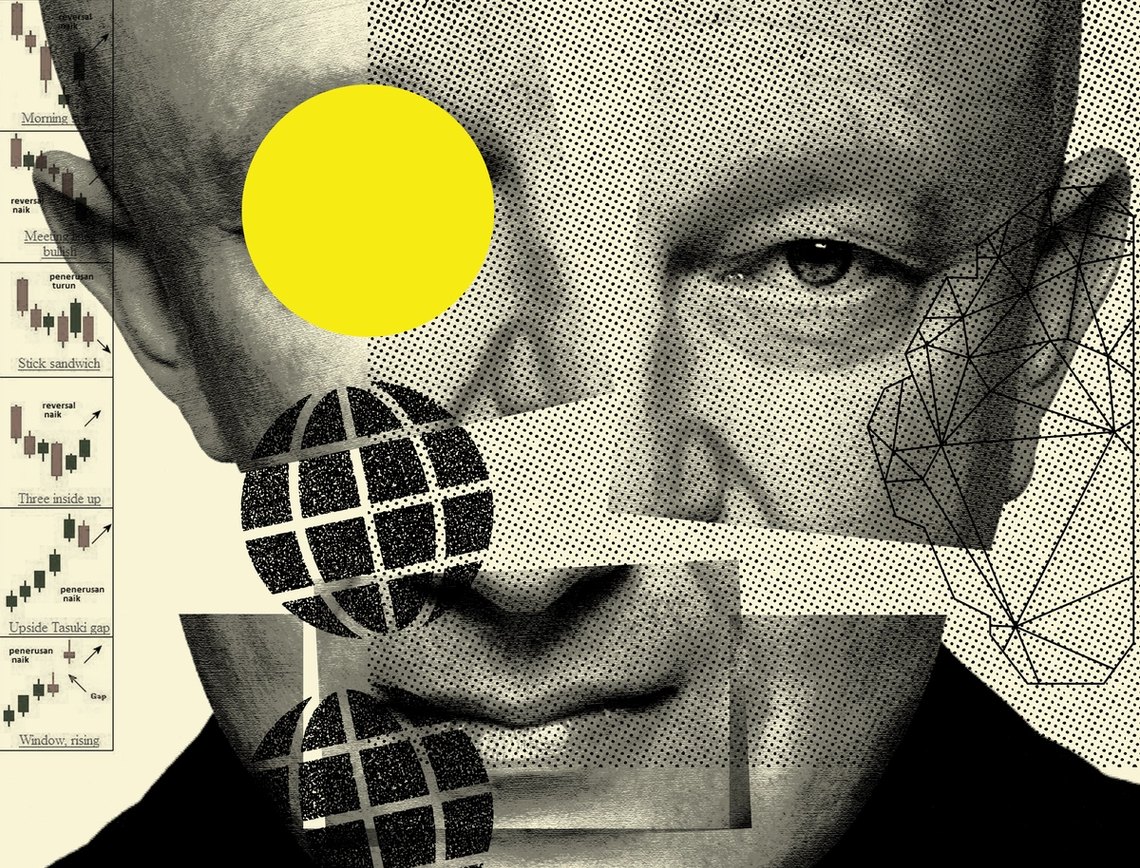

Semafor/Al Lucca Semafor/Al LuccaIgor Tulchinsky is the founder and CEO of WorldQuant, which manages billions within fund manager Millennium. Q: What’s been the biggest change in quant investing since you started WorldQuant and what does the field look like in 10 years? A: The explosion of big data, and the development of machine learning and AI technologies. In the next five to 10 years, I see the potential for even more powerful tools that can analyze even more data and make more precise investment decisions. Q: How has a recent AI or machine-learning breakthrough changed WorldQuant’s processes? A: We have been looking at how text-to-image technology might help us interpret information in new and revealing ways. According to an Oxford study, the human mind understands images differently to how we interpret text. Using AI to move between visual and text is an interesting way of harnessing algorithms to potentially identify opportunities or shape conclusions that may be more obvious when seen by the human eye. Q: How quickly will we see these types of breakthroughs now that AI is a focus for the biggest tech companies? A: The world has become more complex and breakthroughs are happening at a greater pace than ever before. While the past is not guaranteed to repeat, one way to think about this is to look back at the last five years to see what has changed and evolved. Five years ago, there was less computing power, fewer investment signals, less data available to use, and technology was less developed. Take all of those elements, double each of them annually, and that might be what the world will look like in the near future. It’s a hugely exciting time to be an investor. Q: You have a new book coming out in August about AI changing how we think about risk. What are people missing? A: The book is my attempt to trace the evolution of predictive technologies in a range of different areas, from medicine to finance. The central idea — which I believe is less understood than it should be — is that it is necessary to grasp the symbiosis between advances in predictive technology and the increasing complexity of the world that technology is attempting to comprehend. Only by pairing radical openness and intuition in the human mind that approaches these new technologies will we truly be able to harness their power. Q: The firm applies its “quantity is quality” mantra to talent as well. How do you recruit globally in a world that’s become more closed-off? A: I continue to believe that talent is distributed around the world, but opportunity is not. We continually look to find innovative ways to recruit the best talent. This might be through actively recruiting in areas where we believe there are talented individuals but a scarcity of opportunities: In Vietnam, India, and Hungary, among other regions, or through new talent models that expand our ability to reach individuals in geographies around the world. For example, we launched WorldQuant BRAIN last year. BRAIN is a web-based simulation platform enabling certain users to become consultants if they build and submit mathematical models, for which they may be compensated. |