| The inaugural edition of Semafor Gulf, with exclusive stories about Abu Dhabi’s AI ambitions, fixing͏ ͏ ͏ ͏ ͏ ͏ |

| Ben Smith |

|

When I’ve told friends and sources about trips to Riyadh, Abu Dhabi, Dubai, and Doha this year, their assumption is: You’re raising money.

And it’s nice to be able to answer: No, we’re chasing the story.

I’m thrilled to be sharing this launch of Semafor Gulf with you, most of all because what’s happening right now in the Arabian Peninsula is one of the greatest stories in the world.

We’ll be covering the huge economic transformation of the Gulf to people who need to understand the region deeply. We’ll be looking at the ways in which the Gulf’s power shapes the world. And we’ll be serving you the key reads from across regional and global media, in English and Arabic, to keep you across the big ideas and trends.

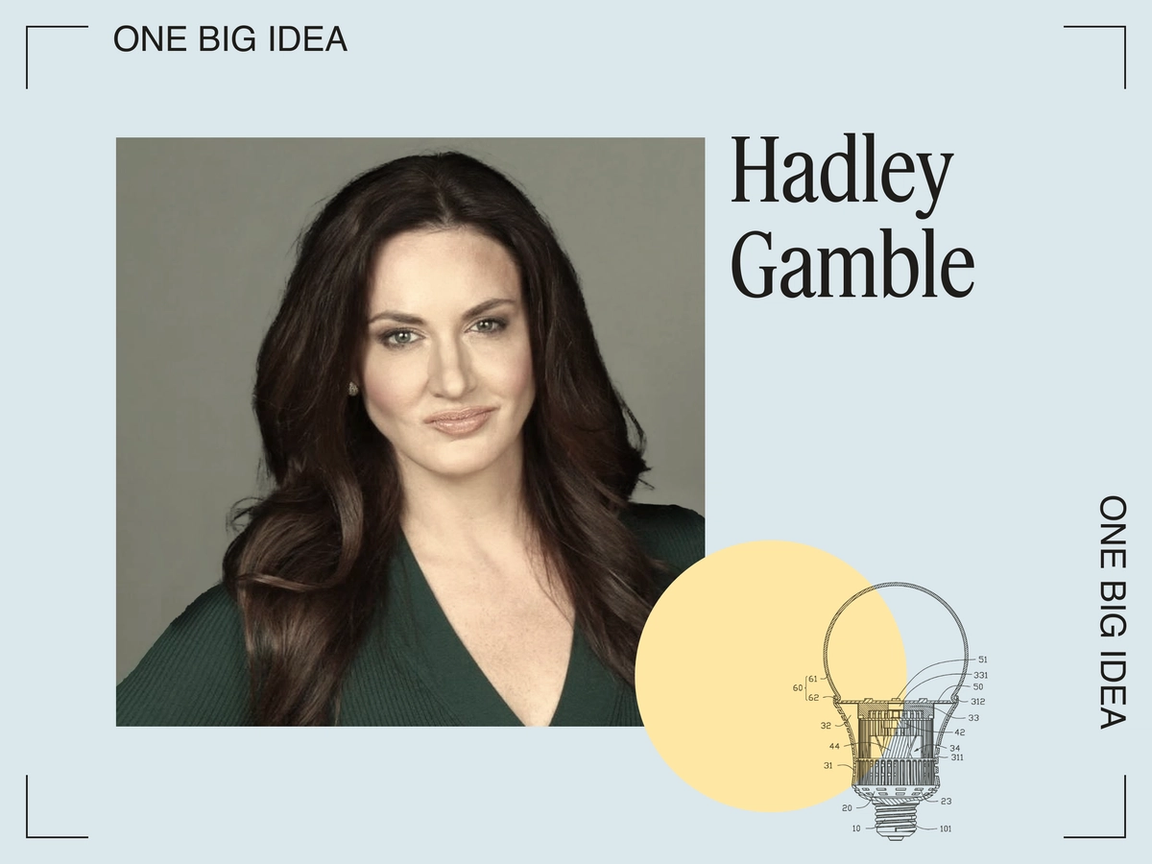

We’re launching with a team of experienced journalists and contributors in the region, led by Mohammed Sergie, who opened the Dow Jones office in a very different Riyadh in 2008 before joining Bloomberg. Kelsey Warner, based in Abu Dhabi, joins us from The Circuit, and Sarah Dadouch, recently of The Washington Post, will be focused on Saudi Arabia. They’ll be joined by some of the biggest voices in the region: Al Arabiya Chief International Anchor Hadley Gamble writes her first column for us today, and you’ll also hear from Arab News Editor-in-Chief Faisal Abbas, economist Omar Al-Ubaydli, energy expert Wael Mahdi, and the Dubai-based writer Camilla Wright.

We’re proud of the start we’ve already made: We broke stories last week about the consulting giant APCO, and RedBird IMI’s sale of the Telegraph. Kelsey and Semafor Tech Editor Reed Albergotti, in Riyadh and Dubai for the AI summits, broke market-moving news on chip giant Nvidia’s deal with G42 and its progress toward doing business in Saudi Arabia.

We are arriving in this booming, complex region with, above all, humility. Please reply to this email and tell us what you want to know, and what you think we ought to already know. Please send us tips, and tell us when we’ve made mistakes. And thank you for coming along for the ride!

— Ben Smith, editor-in-chief

- G42 now holds the chips

- UAE’s climate stimulus

- Qatar’s costly gas crown

- Gulf can’t afford Trump

- Saudi deficits to persist

- UAE’s diplomatic push

- Man City trial opens

Dubai’s viral chocolate gets a royal collab so exclusive, it’s not for sale |

|

G42 secured Nvidia chips for the AI race |

G42 G42US approval of the sale of advanced Nvidia chips to G42 is a major coup for the UAE’s tech ambitions and could spur a new wave of investment in the country’s AI industry. Semafor first reported last week that G42 had scrapped Chinese hardware amid a sweeping security overhaul of its data centers, a successful drive to meet US security demands. With ample energy resources — including its new nuclear power plant — the UAE is fast becoming a hub in the race to develop the world’s most advanced AI models: Microsoft in April made a $1.5 billion investment in G42, and sees the company as a conduit to expand its Azure data center business. Meanwhile, OpenAI is in talks with Abu Dhabi’s $100 billion technology fund MGX as part of its $7 billion fundraising push, The Information reported. |

|

| |  | Mohammed Sergie |

| |

Amr Alfiky/Reuters Amr Alfiky/ReutersAbu Dhabi’s $30 billion climate fund has attracted global fund managers to finance green projects in developing countries in part by capping its own returns on high-risk investments. “We are developing an innovative concept,” Majid Al-Suwaidi, chief executive of ALTÉRRA and COP28 director-general, told Semafor in an interview in his office. The strategy, which adds an element of capitalism to concessional loans, aims to plug a huge gap in private climate finance for developing countries: Abu Dhabi has experience in the space, both as a donor and investor in renewable energy projects in these countries. Still, even if ALTÉRRA can elicit a tenfold match of its commitment by 2030 — an enormous success — the $50 billion the fund would have generated pales in comparison to the trillions needed every year for clean energy investments to achieve global net-zero targets. |

|

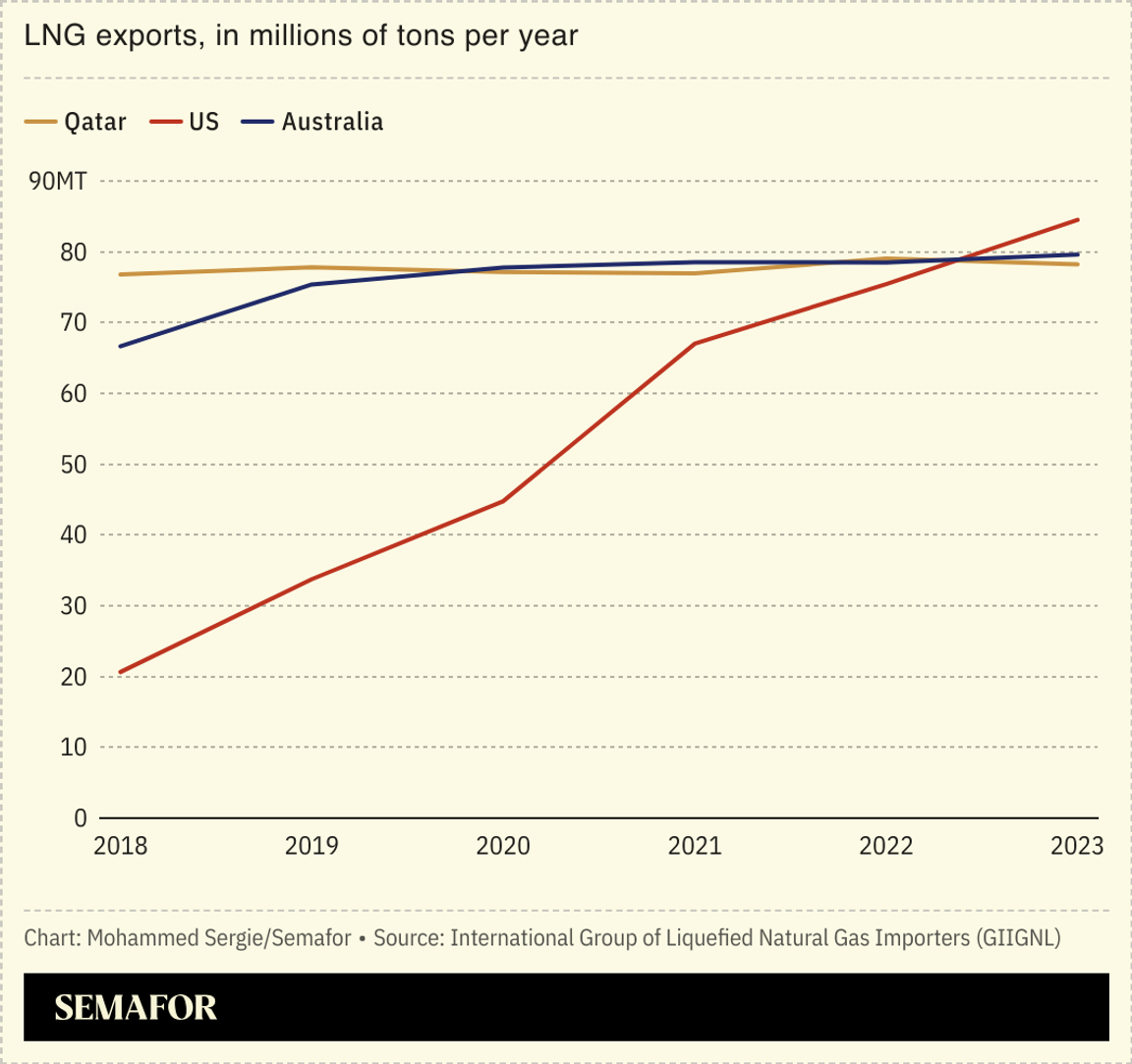

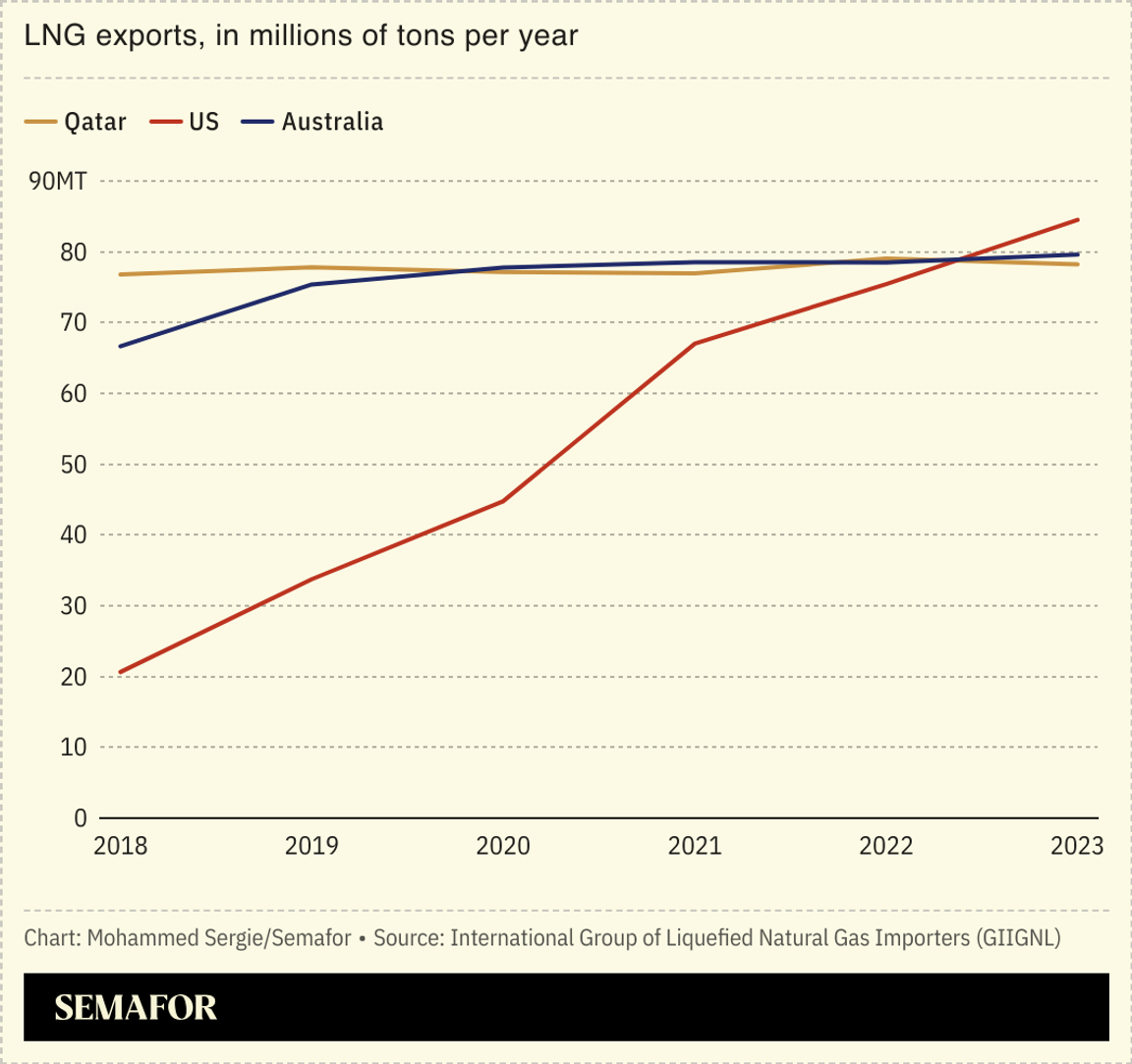

Qatar is spending big on LNG |

QatarEnergy awarded a $4 billion contract to an Italian energy infrastructure firm, underlining the country’s quest to regain gas supremacy. Saipem will build six platforms and around 100 km of undersea pipelines and cables to sustain output from the North Field. The deal follows a $4.5 billion contract QatarEnergy awarded to Saipem in 2022, then the biggest offshore project ever for Saipem. Qatar plans to expand output by 85% by 2030: Its share of the global LNG market dropped to 20% in 2023 from 25% in 2018 as Australian and US exports ramped up, according to the International Group of Liquefied Natural Gas Importers. |

|

Donald Trump may look like the ideal partner for the governments of the Arabian Gulf. But a second Trump presidency could come at too high a cost for the region, Al Arabiya’s Chief International Anchor writes in her inaugural Semafor column. Trump is pro-business, staunchly pro-oil, and so uncompromising on Iran that he assassinated its foremost military leader on the tarmac — making him the target of its assassination plots and election interference. But the past decade has seen huge change on the part of Gulf governments. And Trump’s promise of US “energy dominance” would prioritize US oil production at their expense. “Trump’s straightforward support and tough stance on adversaries benefit the Gulf in the short term. But his aggressive domestic energy policies might undermine the region’s economic stability and reform plans,” Gamble wrote. “Bottom line: they may prefer Trump but they probably can’t afford him.” |

|

S&P turns positive on Saudi |

Brendan McDermid/Reuters Brendan McDermid/ReutersA top ratings agency expects Saudi Arabia to run deficits and raise debt through 2027 as it refashions its economy to reduce reliance on oil. S&P raised its outlook on the kingdom from stable to positive, and opened the door for a ratings upgrade in the next two years if momentum in non-oil growth continues. Government debt, foreign direct investment, and returns from its sovereign wealth fund will allow the kingdom to finance its domestic development plans, S&P said. The outlook upgrade comes amid a dip in oil prices, forcing OPEC+ to delay production increases that would have generated additional revenue for Saudi Arabia, the country bearing the biggest share of crude output cuts. |

|

UAE’s diplomatic flex still has some hard power |

Zohra Bensemra/Reuters Zohra Bensemra/ReutersTwin announcements over the weekend exhibited the UAE’s growing diplomatic heft and ambition. Abu Dhabi on Saturday mediated a prisoner exchange between Moscow and Kyiv, the eighth this year, resulting in the release of 1,994 prisoners so far. The same day, its foreign minister said in an Arabic-language post on X that the UAE won’t participate in the rebuilding of Gaza until a Palestinian state is established — a rare, explicit statement in support of a two-state solution. The UAE’s efforts to play a mediating role may help bolster its international standing, which has been hit by its support for a paramilitary group in Sudan’s civil war. |

|

Man City faces financial charges |

Phil Noble/Reuters Phil Noble/ReutersA hearing into allegations that the English soccer champions Manchester City broke the Premier League’s financial rules begins today. City was bought by the Abu Dhabi royal family in 2008 and now dominates English football. “Financial fair play” rules say that teams’ spending should be limited by their revenue, to prevent teams bankrupting themselves or billionaire owners buying success: Man City faces 115 charges related to efforts to circumvent those rules by artificially inflating apparent revenue streams. Two other Premier League teams had league points docked last season after admitting smaller breaches: City denies all charges, but if found guilty, could face expulsion from the Premier League, in what would be one of the biggest sporting scandals in European history. |

|

Deals- New York-listed aluminum maker Alcoa will sell a 25.1% stake in its Ma’aden joint venture, which includes a bauxite mine in Saudi Arabia, to Ma’aden for $1.1 billion.

- Mubadala’s push into European investments is gaining steam as it picked up a stake in Revolut. The share sale landed the London-based fintech a $45 billion valuation. Revolut is now eyeing the UAE as its next market. — FT, Bloomberg

- One of the UAE’s first homegrown fintech offerings is seeing an exit: Dubai-listed Mashreq Bank plans to sell a 65% stake in its payments processing platform Neopay to alternative asset manager Arcapita and Turkey’s Dgpays.

Tech- California-based AI startup Groq Inc. signed a partnership with Aramco to build a giant data center in Saudi Arabia. The facility is set to be the world’s largest AI inference center. — Bloomberg

Courtesy Groq Courtesy Groq- Dubai-based news startup Blinx has gained 6.5 million followers on Instagram and TikTok since its launch in September 2023. — Variety

- Fintech investment in Saudi Arabia grew 231% year-on-year in 2023, reaping $791 million in investments at a time when global fintech funding is facing substantial decline, according to KPMG.

Checking In- In a bid to lure European tourists to Abu Dhabi, UAE national carrier Etihad Airways is upping its number of daily flights to cities like Paris, Milan, Frankfurt, and Barcelona.

Flickr Flickr- Gulf Air will re-enter American airspace for the first time in nearly 30 years as the Bahraini carrier makes plans to launch flights to the US in mid-2025, pending approval by the US FAA approval and aircraft availability.

Out of Office- Korean beauty products fans: head to the Mall of Qatar for K-Beauty Exhibition, which promises professional advice and dermatologist tips from experts in the exploding Korean skincare industry, going on until Sep. 21.

- Paris’ Salon du Chocolat festival is returning to Dubai this week in Madinat Jumeirah Arena from Sep. 18-20. Meet professional ‘chocolate tasters’ and ask, for a friend, how to land a job like that.

|

|

fixdessertchocolatier/Instagram fixdessertchocolatier/InstagramThe Gulf’s most popular foodie fad this summer was the “Dubai chocolate.” You’ve probably seen it: a bar that, when cracked open, reveals chunky loaded insides, the most popular version oozing out a mixture of Kunafa and pistachio butter. The $20 treat from FIX Dessert Chocolatier would sell out minutes after a daily 5 pm drop. If that wasn’t exclusive enough, there’s now a collaboration you can’t even buy: Emirati Halwa-stuffed bars tailored for Dubai’s crown prince Sheikh Hamdan, AKA Fazaa. Everyone else will have to settle for the other flavors on sale, created by British Egyptian Sarah Hamouda who drew inspiration from her pregnancy cravings. Knock-offs have popped up in Istanbul, Beirut, Dallas, and home cooks are in on the action. Many a suitcase leaving Dubai has been stuffed with the original at the behest of friends and family keen for a taste. |

|