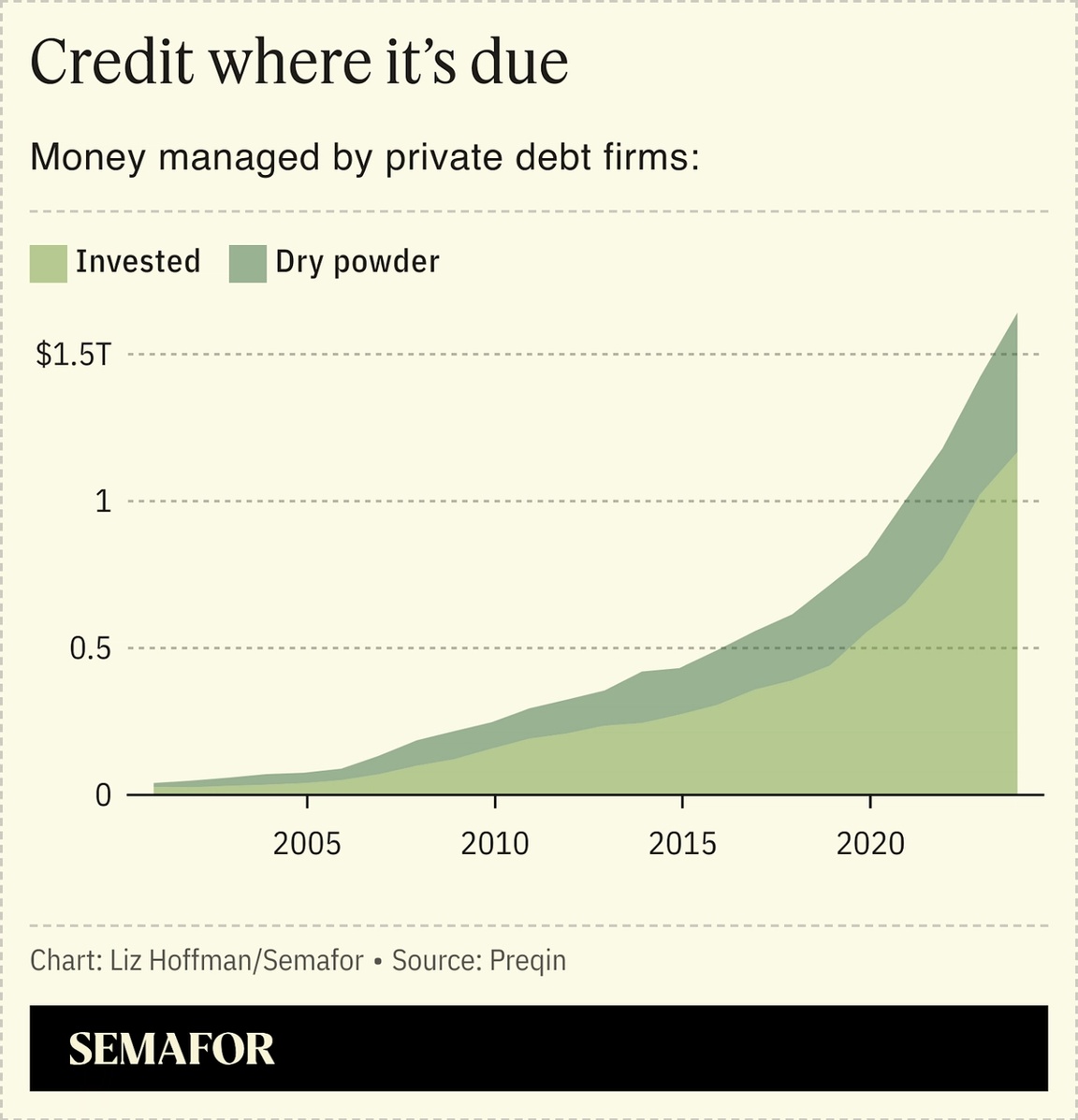

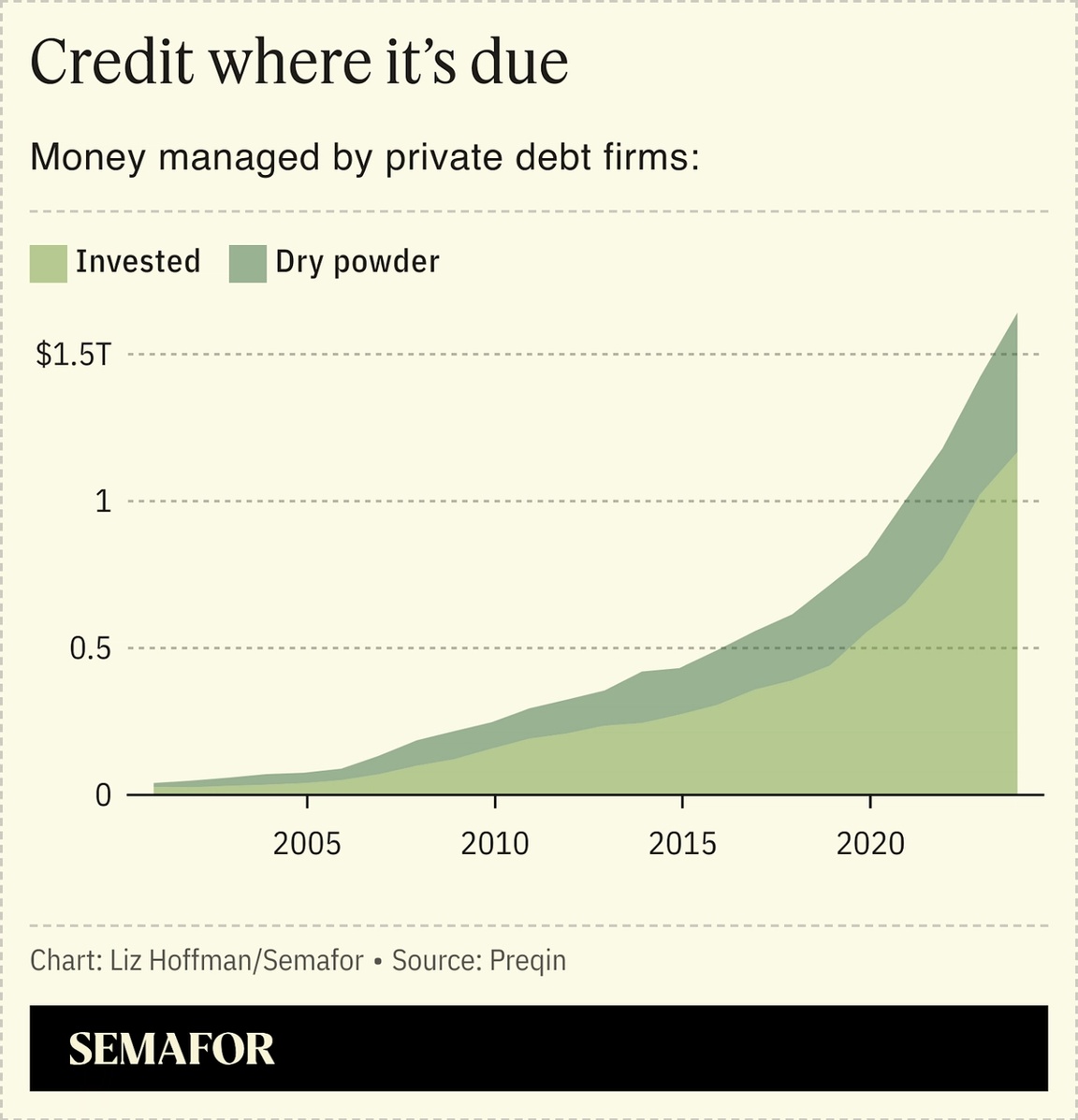

THE SCOOP The world of private credit spent the past few years blooming. Now comes the pruning. Hundreds of funds have cropped up over the past decade to do the job that banks used to do, before post-2008 regulations penalized them for riskier activities. Loans made by private investment funds have doubled since 2019 to $1.6 trillion, and with banks continuing to nurse their balance sheets and tangle with regulators, it’s likely to continue. A Blackstone executive recently said the industry is “still in batting practice,” and sees it hitting $25 trillion eventually — twice the total loans at all US banks right now. But that growth is being concentrated at the biggest firms, and smaller players are being squeezed. At least half a dozen lending shops are currently running sales processes, an acknowledgment that niche strategies can no longer compete. Crestline, with $18 billion under management, is seeking a buyer. So are Waterfall, with $12.5 billion, and MGG Investment Group, with $5.5 billion, people familiar with the matter said. Last week, Blue Owl, one of those $100 billion-plus giants, bought Atalaya Capital, which has about $10 billion in structured credit products. A handful of others are being less formally shopped, industry participants said. Crestline declined to comment. Waterfall and MGG did not respond to requests for comment.  LIZ’S VIEW The first wave of private credit, in the 2010s, focused on loans to midsized companies, especially for leveraged buyouts. That’s a fairly basic financial product — underwriting matters, but it’s not rocket science. The wave that’s building now is in more complex types of borrowing, backed by everything from equipment leases to restaurant franchise fees to fiber-optic cables. Billions of dollars of structured credit gizmos are being offloaded by banks, whose regulators don’t like them, to private investors. Atalaya’s CEO, Ivan Zinn, recently pegged the size of that “asset-backed financing” market at $7 trillion, and estimated that private investment firms only have about 5% share. Firms like Blue Owl got big during the first wave, and are now buying their way into the second. |