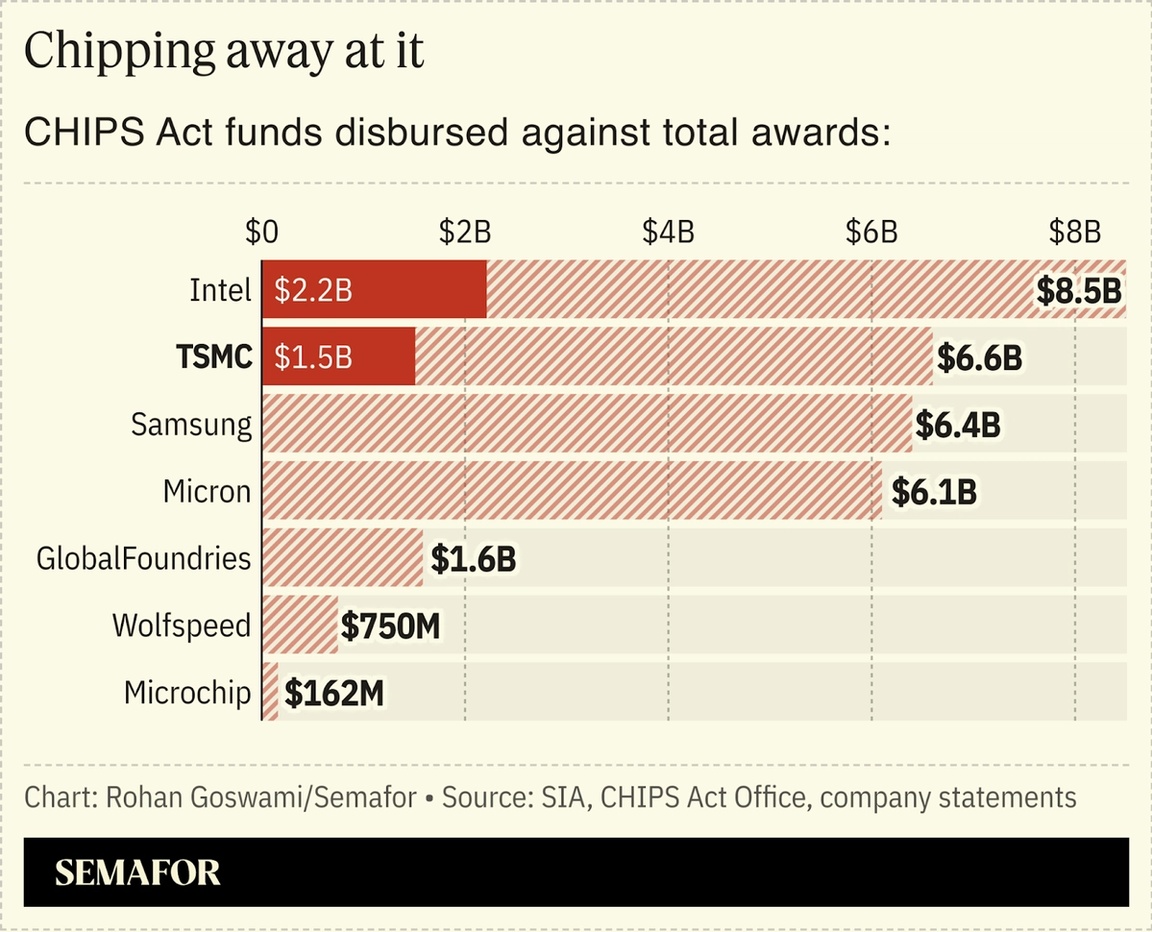

TSMC, the Taiwanese chips giant of strategic importance to the US, has big business before the White House, from CHIPS Act funding to discussions of a potential tie-up with Intel. To navigate Washington, the $1 trillion company has sought advice from an unlikely place: middle market investment firm Cantor Fitzgerald, Semafor’s Rohan Goswami reports. Bankers at the firm, run for decades by Commerce Secretary Howard Lutnick — and, until this week, majority-owned by him, too — have been providing informal advice to government-affairs executives at TSMC, according to people familiar with the matter.  TSMC’s senior leadership separately met with Lutnick in his Midtown offices earlier this year — a meeting requested by Lutnick as he prepared to become Commerce Secretary. He had by then stepped away from day-to-day management of Cantor, installing his two sons in nominal control of the firm. TSMC isn’t paying Cantor for its advice, one of the people said, but its in-house lobbyists have turned to its bankers to understand Lutnick’s thinking. And Cantor bankers have referenced a relationship with TSMC, whose customers include Apple and Nvidia, in new business pitches, according to one of the bank’s clients. “The statements regarding Cantor Fitzgerald are baseless and false,” a spokesperson for the firm said. A spokesperson for TSMC declined to comment. “Secretary Lutnick has been focused on delivering President Trump’s directive to reshore manufacturing back to the United States,” a Commerce spokesperson said. |