The News

Nippon Steel has offered to nearly quadruple its additional investment into US Steel to try to win over the US government in protracted deal talks, according to people familiar with the matter.

Japanese executives, who have been shuttling between Tokyo, New York, Pittsburgh, and Washington, DC for the last few weeks, pitched increasing a $2.7 billion investment to roughly $11 billion, through 2028. An additional $3 billion could also be allocated beyond 2028.

The fresh offer, earlier reported by trade publication CTFN and Reuters, reflects months of engagement between the company and Trump administration officials, including Commerce Secretary Howard Lutnick, Treasury Department staffers, and White House officials, people familiar with the matter said.

Semafor has previously reported that Nippon was already offering to increase its additional investment, to as much as $7 billion. The enlarged number includes a roughly $1 billion commitment to a new, “greenfield” facility — a fresh steel mill at a time when companies around the world are closing them down — and the protection or creation of tens of thousands of jobs. Nippon hasn’t committed to where that facility would be located, although presumably it would be near to US Steel’s facilities, which are spread across Pennsylvania, Indiana, Michigan and Ohio.

A national security review by the Committee on Foreign Investment in the United States expires on Tuesday.

In this article:

Rohan’s view

Investing $11 billion on top of the $14.9 billion purchase price is a hefty number, but makes sense if you think tariffs are here to stay. And it may very well be the cost to make those facilities as productive as possible. Also, it’s not as though Nippon Steel is doing this alone: The Japanese government has already gotten involved in these deal talks, and might be willing to backstop some of the spending for a national champion — especially if it gets tied to a trade deal, as former US Trade Representative Robert Lighthizer has argued it should be.

Room for Disagreement

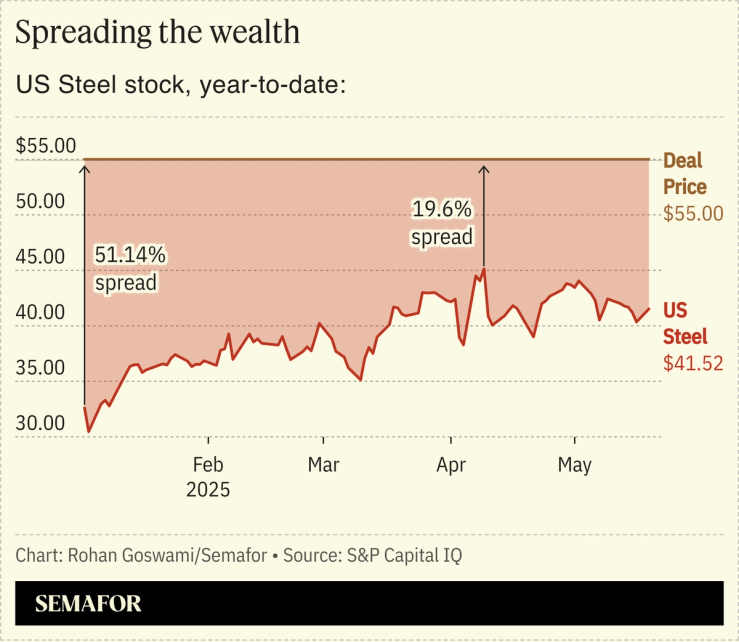

M&A professionals have a phrase — “deal heat” — which applies here. Instead of walking away from this steadily-more-expensive deal, Nippon continues to push the topline number higher and higher, all in a bid to close a deal that Trump has said he opposes. “We don’t want to see it go to Japan,” the president said earlier this year. His comments have caused confusion among investors, but what is plain as day is that it would be an uphill — and expensive — climb to convince him to back the bid.

Notable

- An interloper bid from Cleveland Cliffs has faded into the background as that company grapples with its own issues, the Pittsburgh Post-Gazette’s editorial board notes.

- A fascinating piece from the Washington Examiner’s Salina Zito (which ran in the Washington Post) on the real-world stakes at hand in the potential deal.