| | Startups are racing to sell carbon credits from enhanced rock weathering, but haven’t agreed on a pr͏ ͏ ͏ ͏ ͏ ͏ |

- Shell’s climate retreat

- Better EV messaging

- Rocky carbon math

- Carbon market shakeout

- Manufacturing overload

A crackdown on climate activists, and a juicy federal loan for lithium mining. |

|

| |  | Tim McDonnell |

| |

Reuters ReutersShell watered down some of its mid-term emissions reduction targets, giving itself more wiggle room to prolong its core fossil fuel business and pump the brakes on sales of clean electricity. In a report on its energy transition strategy Thursday, the company said it will aim to reduce the carbon “intensity” (emissions per unit of volume) of its products 15-20% by 2030, walking back from its previous goal of 20%. And it scrapped a follow-up goal to cut its carbon intensity 45% by 2035, citing “uncertainty in the pace of change in the energy transition.” But the company did introduce one new target, promising to reduce absolute emissions from customers’ use of its oil products 15-20% by 2030. Taken together, the shifting goalposts illustrate the path CEO Wael Sawan is trying to plot out through the energy transition, one that can placate climate-conscious shareholders and regulators in Europe without alienating less scrupulous investors in the U.S., as well as some dividend-focused pension funds, by needlessly sacrificing profit while fossil fuels remain dominant in the energy market. Meeting the new oil emissions goal will be easy, HSBC analyst Kim Fustier said in a note, as it can be achieved largely through already-planned moves including withdrawing from Pakistan and closing refineries in Singapore and Germany. Those emissions savings will most likely be offset by the company’s increasing trade in liquefied natural gas, Fustier said. And the carbon intensity rollback is based on Shell’s desire to step away from some of its unprofitable renewable power businesses, Sawan wrote in the report. The report throws down a gauntlet to governments, arguing that more ambitious carbon-cutting targets are impossible without policies to drive down consumer demand. I expect to hear a lot of this theme — don’t blame us for selling what people want to buy — from Sawan and other top executives at the CeraWeek oil and gas conference in Houston next week, which I’ll be attending (drop me a line if you’ll be there too!). The implicit message here is that, try as it might, Big Oil hasn’t found a way to make the energy transition sufficiently profitable. |

|

| |  | Prashant Rao |

| |

REUTERS/Florence Lo/File Photo REUTERS/Florence Lo/File PhotoU.S. politicians on both sides of the aisle are making a mistake by framing support for electric vehicles exclusively in terms of how they impact jobs. That’s the conclusion of a new report published by Potential Energy, a nonprofit that focuses on climate marketing. Based on several nationwide and state-level messaging tests, Potential Energy found that politicians of all stripes would be better off focusing their EV-related messaging on affordability, choice, and the cars’ impact on pollution. “The message that polarizes the most is actually that it supports the auto industry and jobs because it feels like something that a politician would say,” John Marshall, Potential’s founder and CEO and a professor of marketing at Dartmouth University, said in an interview. “Most politicians have gone to the conceptual economic argument, when the human arguments are better.” The bottom line: Increasingly stringent vehicle-pollution standards tested better than outright bans on gas cars, a focus on affordability tested well across all political affiliations, and respondents prioritized choice. “If I’m advising a leader on how to communicate this — any leader, on both sides — I would say, ‘Every American should have the right to make their next car a clean car’,” Marshall said. |

|

The no-brainer climate solution with a big problem |

| |  | Katie Brigham |

| |

Creative Commons Creative CommonsA new carbon capture technique that accelerates a millenia-old process is drawing major investor interest — most recently with a $57-million bet in December. By some estimates, enhanced rock weathering (ERW) could remove up to 2 billion metric tons of carbon dioxide per year, equivalent to a fifth of the amount that climate scientists say the world needs to remove annually by 2050. Actually calculating the amount of carbon removed is tricky, however, and the technology risks running into the same kind of problems that have led to widespread greenwashing in the embattled carbon credits market. That may ultimately hold it back from gaining widespread legitimacy. The process of ERW involves spreading crushed up rocks like basalt onto farmer’s fields. When rainwater hits these volcanic rocks, it triggers a chemical reaction that converts the carbonic acid in the rain into dissolved bicarbonate, releasing beneficial nutrients into the soil. The bicarbonate is eventually carried by rivers and streams to the ocean, where it can become the shells of sea creatures like phytoplankton and oysters. When the organisms die, the carbon remains permanently sequestered on the ocean floor. This process normally takes hundreds of thousands of years, but ERW companies say they can speed it up to a few years’ time. When compared with more expensive and technologically immature approaches to carbon removal like DAC, ERW looks like a safer bet for investors, and should be able to scale with relative ease. The fundamental science behind it is well established and understood, the materials used in the process are readily available, and farmers have seen clear benefits from spreading silicate rocks like basalt on their fields. |

|

Share of credits available in the global carbon market that will “confidently” be able to pass an ongoing industry-wide audit, according to a report this week from the carbon credit firm Abatable. Following widespread accusations of greenwashing, the methodologies used by carbon project developers and registries to calculate how much carbon a given project can offset, and for how long, are currently under review by an independent oversight group. Later this year, the group will begin issuing a seal of approval to projects that meet a high bar on criteria like additionality and permanence. Nearly half — especially those based on forest conservation — have a low or medium chance of passing muster, Abatable found, and the small share with a high likelihood of passing are mostly projects that focus on cutting emissions from industrial sectors. The review process is unlikely to lead to many projects being fully pulled from the carbon market, Abatable co-founder Maria Eugenia Filmanovic said. Instead, expect to see a wider divergence in pricing, with non-certified credits selling on the cheap. |

|

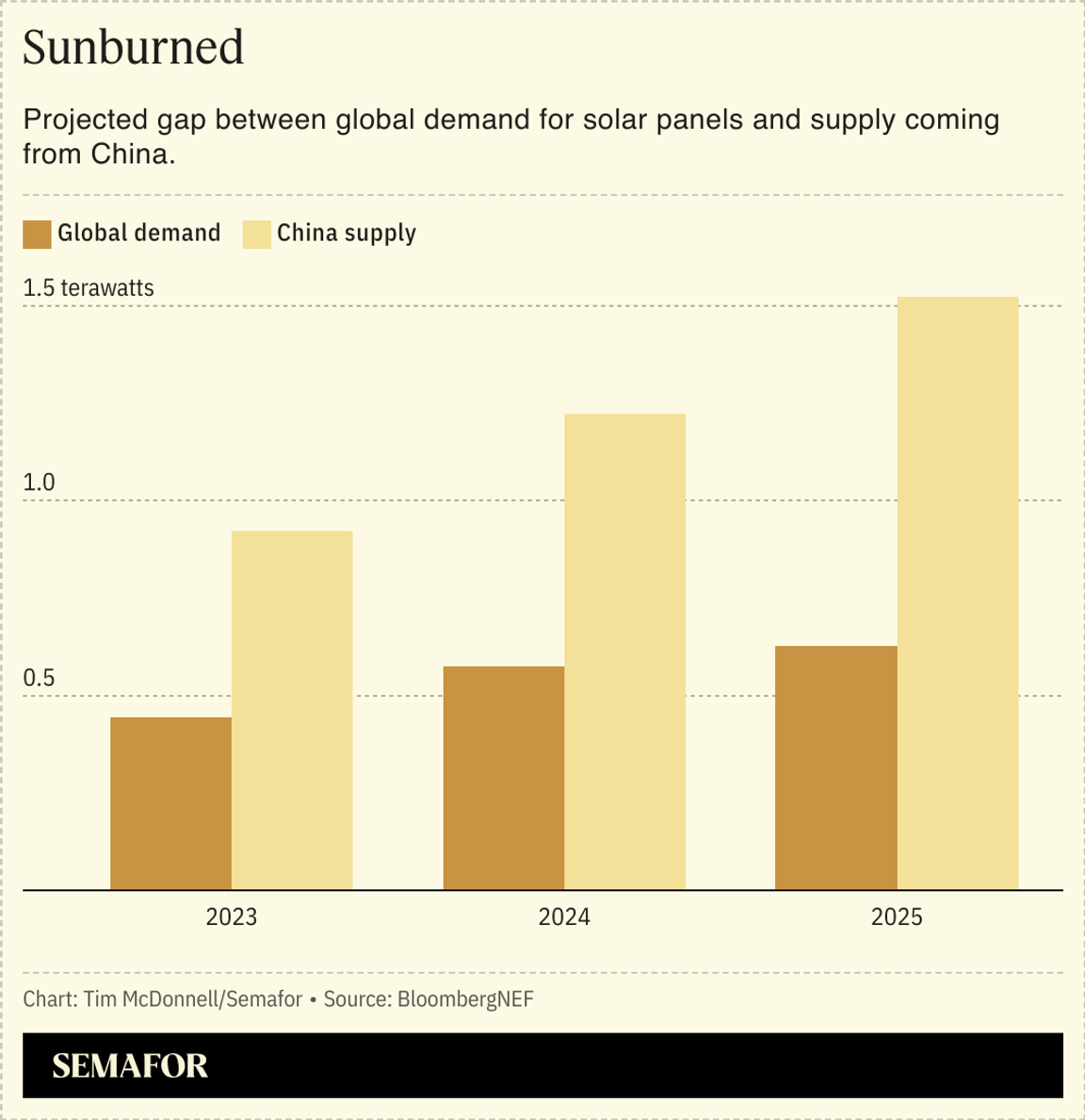

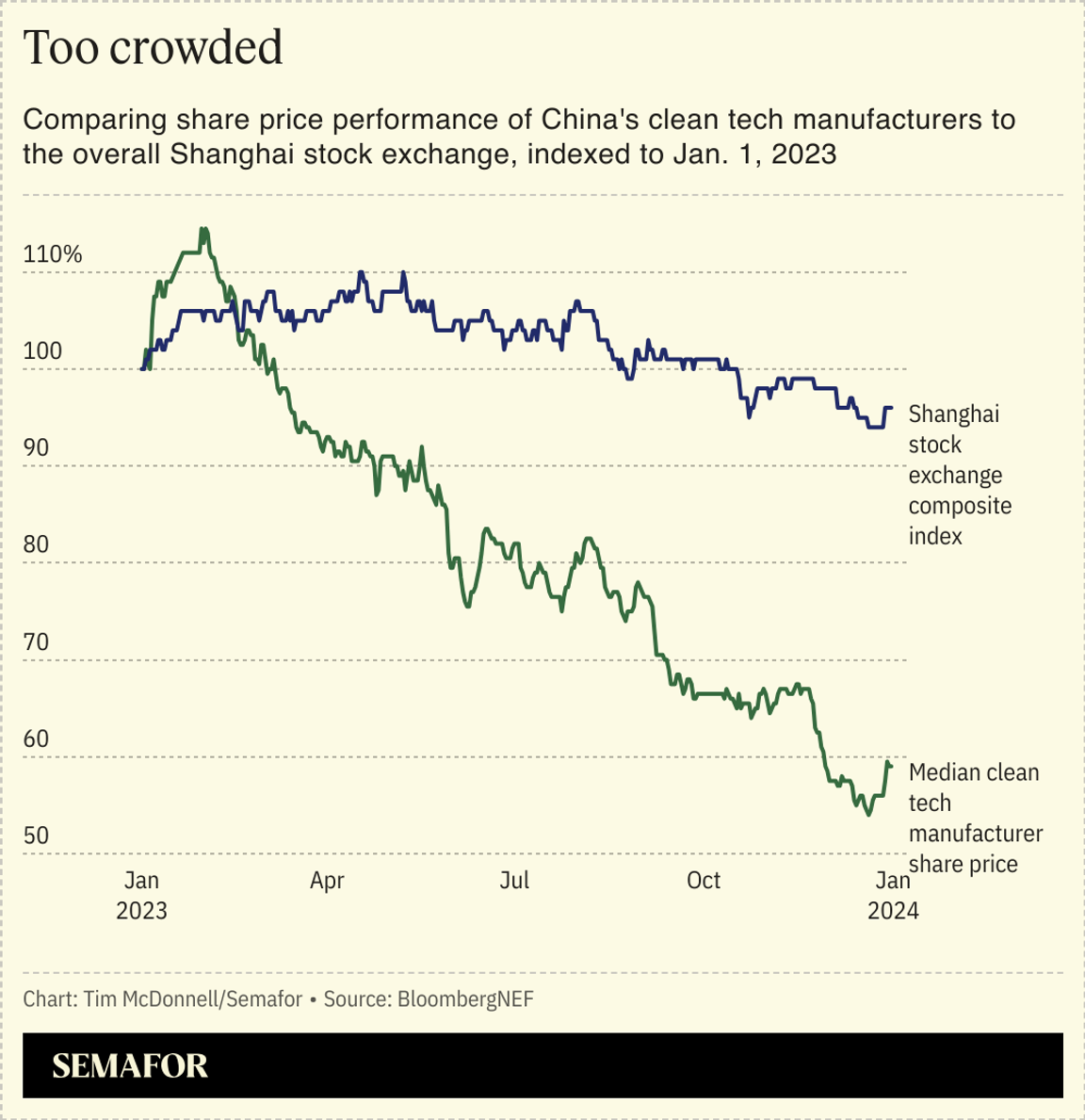

China’s capacity to produce solar panels and EV batteries has blown far beyond what the entire global economy would need even in the most rigorous decarbonization scenario, a BloombergNEF analysis found.  By 2025, the country will be producing more than twice as many panels and batteries as the world needs, as the result of what Antoine Vagneur-Jones, head of trade and supply chains at BloombergNEF, calls “off-the-chain capitalism in its rawest form, with massive, white-hot competition” between manufacturers. In general, this is good news for the climate, as the supply glut has prices plummeting. But it’s bad news for manufacturers, both within China — where share prices of cleantech companies are tumbling and bankruptcies are proliferating — and in the U.S. and Europe, where protectionist trade policies simply can’t keep pace with the supply glut. That glut appears likely to persist for the foreseeable future, Vagneur-Jones said, largely because there’s still a drumbeat of engineering innovation in the background for both solar panels and batteries, meaning that manufacturers have to continually invest in facility upgrades to keep up to date with their rivals even if new production capacity isn’t needed.  China’s manufacturing overload is undermining one of the key assumptions Western governments have been working under at this stage of the energy transition: That a small premium on locally-made cleantech, resulting from protectionist trade policies, was worthwhile from a job-creation and supply chain security perspective even if it ran counter to climate goals. That premium is now greater than anyone anticipated, and China’s manufacturing capabilities are so far ahead of the market that government subsidies for would-be U.S. competitors are nowhere near enough to make domestic manufacturing viable. The upshot is that without a significant escalation in protectionism, which invites a backlash from China on other goods, much of the $156 billion in U.S. clean tech manufacturing plans announced since the Inflation Reduction Act was passed may not come to fruition, Vagneur-Jones said. In other words, the law may fail on both rapid clean tech adoption and job creation. “Policymakers are going to have their hands forced by these market dynamics,” he said. If more aggressive protectionism is unpalatable, the U.S. may need to cut its losses on domestic solar manufacturing and redirect those resources to even greater consumer subsidies, he said. The government should also use this moment to build strategic stockpiles of cleantech hardware, which would at least serve the aim of supply chain security. |

|

Sen. Michael Bennet; Sen. Ron Wyden; John Waldron, President & COO, Goldman Sachs; Tom Lue, General Counsel, Google DeepMind; Nicolas Kazadi, Finance Minister, DR Congo; and Jeetu Patel, EVP and General Manager, Security & Collaboration, Cisco have joined the world class line-up of global economic leaders for the 2024 World Economy Summit, taking place in Washington, D.C. on April 17-18. See all speakers and sessions, and RSVP here. |

|

Latitude Media, helmed by Stephen Lacey and Scott Clavenna, delivers the latest B2B news on emerging clean energy technologies, markets, and deals. Every week, their flagship newsletter The Latitude goes deeper on the trends that matter most to the industry, delivering the best of their coverage straight to your inbox. Subscribe for the latest. |

|

New Energy- The first commercial-scale offshore wind farm in the U.S. is finally finished and operating. The South Fork project off the coast of New York is generating enough power for 70,000 homes. Projects in Massachusetts and Rhode Island are also nearing completion, indicating a possible reversal in the fortunes of the embattled offshore wind industry.

- The Biden administration is preparing to hand out $20 billion to a group of nonprofits that they’ll use to make cheap loans to low-income households for solar panels, heat pumps, and other green upgrades.

Fossil Fuels- U.S. oil and gas fields may be producing three times as much methane as official reports indicate, a new study concluded. In New Mexico, up to 9% of all gas produced is leaking into the atmosphere.

- Israel’s siege of Gaza is threatening its offshore gas industry. BP and the Abu Dhabi National Oil Company suspended a $2 billion deal for a controlling interest in Tel Aviv drilling company NewMed Energy “due to the uncertainty created by the external environment.”

Finance- The Securities and Exchange Commission is already getting hammered from all sides over its new carbon disclosure rules. The Sierra Club and the U.S. Chamber of Commerce joined the ranks of those suing the agency this week — albeit from opposing viewpoints as to whether the SEC is doing too much, or not enough.

Minerals & Mining- The Biden administration is expected to approve a $2.26 billion loan to the country’s biggest lithium mining project. Lithium Americas, the company behind the Thacker Pass mine in Nevada, will use the money to build an on-site lithium refinery.

EVsFood & Agriculture ANTARA FOTO/Reuters ANTARA FOTO/Reuters- New regulations in Europe to crack down on deforestation in the supply chains of consumer goods from leather to chocolate has farmers in southeast Asia panicking. Officials in Malaysia and Indonesia, which produce much of the world’s palm oil, call the rules “regulatory imperialism.”

Personnel- John Podesta, the top U.S. climate diplomat, is under investigation by Congressional Republicans who allege that his appointment to the role bypassed due process. Podesta is in Japan this week, asking the country to set a deadline for phasing out coal power.

- Michael Polsky became a billionaire building the largest renewable energy project development firm in the U.S. Just don’t call him an environmentalist.

|

|

| |