| A possible domestic peak in carbon emissions, as well as huge growth in renewables and electric vehi͏ ͏ ͏ ͏ ͏ ͏ |

| Tim McDonnell |

|

Hi everyone, welcome back to Net Zero.

It looks like blocking highways is a more effective form of climate-related protest than throwing soup at paintings.

In France, climate activists threw soup on the glass case protecting the Mona Lisa on Sunday, while throughout the week up to 10,000 farmers used their tractors to blockade highways nationwide. The actions are unconnected, but both aim to draw attention to climate policy: In the case of the soup, to argue that governments aren’t doing enough, and in the case of the tractors, to argue they’re doing too much, or at least unfairly distributing the burden. The soup protest, like other attacks on art museums over the past year, doesn’t seem to have achieved much more than a few headlines. The farmers, however, were able to convince the European Commission to push off until next year a requirement that they set aside a section of their farmland for conservation.

Some activists argue that the soup attacks are part of a longer-term strategy to make milder forms of climate protest more palatable and effective. Personally, I remain unconvinced, and tend to think the most important form of climate messages at this stage are those that demonstrate the job-creation and cost-saving benefits of clean energy. The farmers’ protests, like France’s Yellow Vest demonstrations that started in 2018, reinforce the opposite message — that climate policy raises costs and damages the economy — and reveal important inequalities in European energy policy.

If Europe wants its farmers to do more on climate, policymakers may need to consider the same kind of protective trade barriers they are implementing for high-emissions industrial sectors, and find a way to include agricultural products in their new carbon border tariff system. That may not be what the farmers want, since that system entails a lot of bureaucracy and costly accounting. But if there’s a middle path between the soup and the tractors, it may look something like that.

If you like what you’re reading, spread the word.

The World Today |  - Big Oil beats

- BCG’s flight shaming

- China’s climate year ahead

- Solar burnout

- Battery recycling shortfall

Environmentalists vs. clean energy, and Big Beef vs. itself. |

|

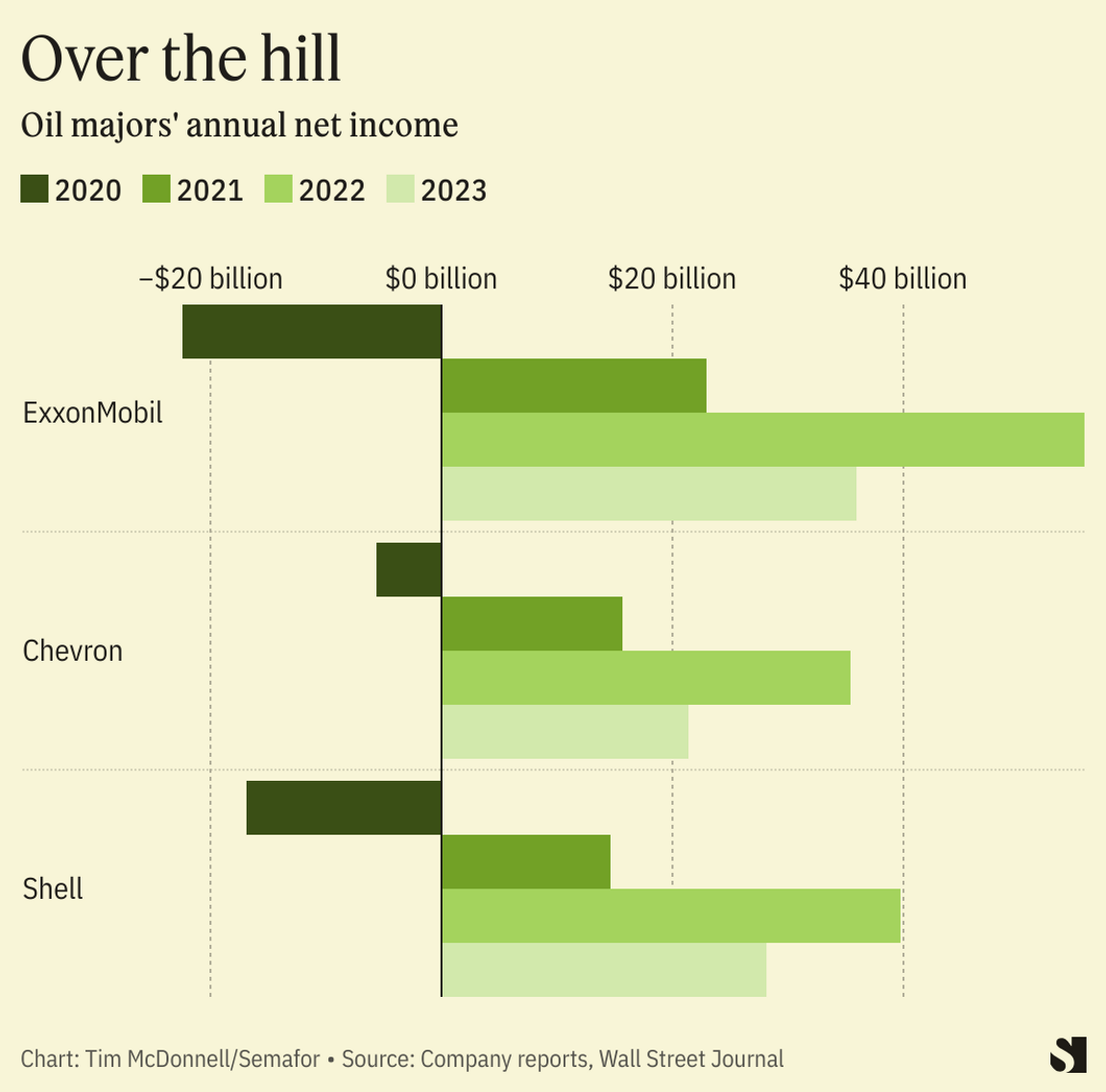

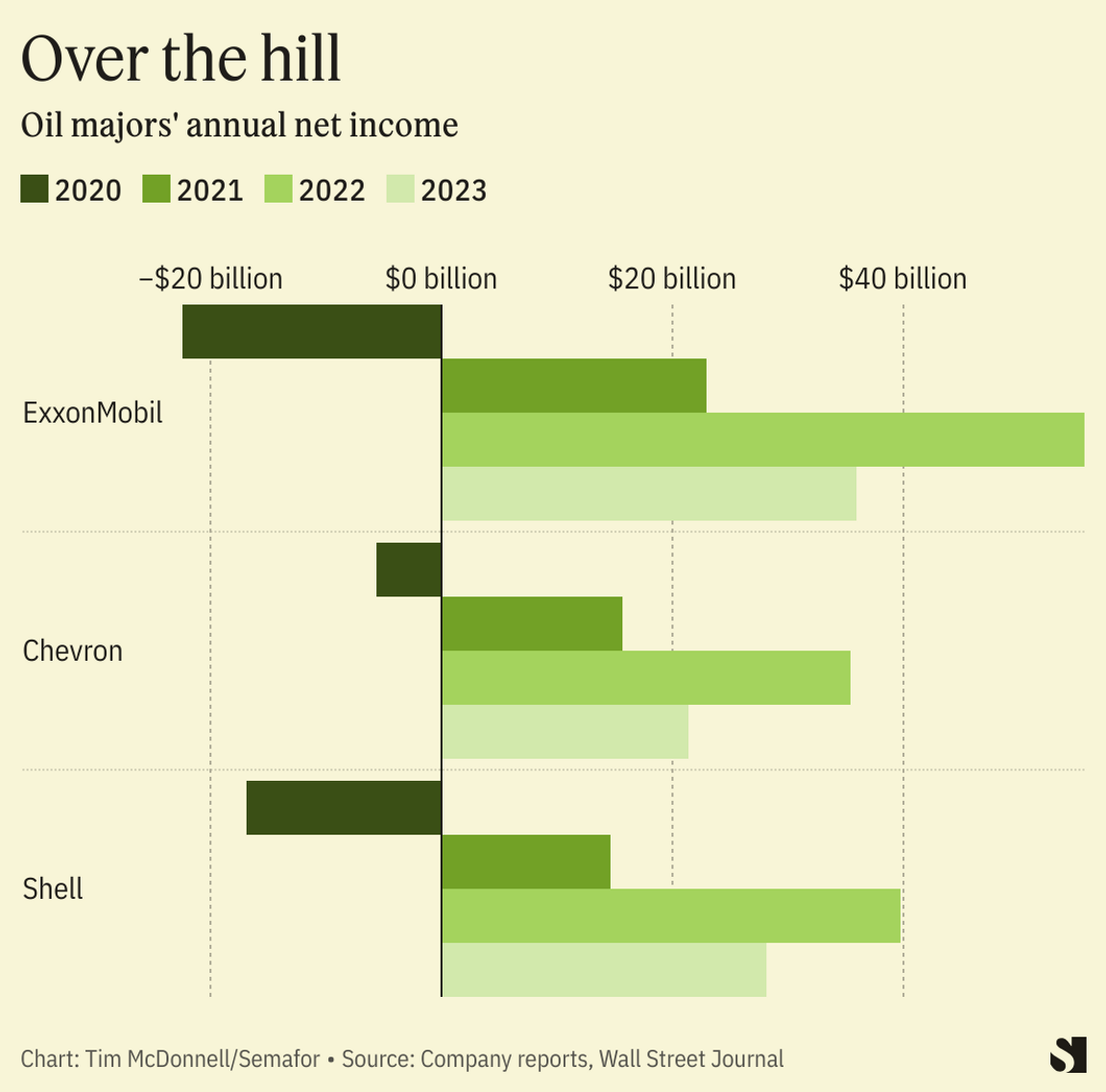

The top three oil and gas majors beat Wall Street’s 2023 earnings expectations, pulling in a combined $85.6 billion in profit.  That’s down 35% from 2022, dragged by lower oil and gas prices. But the trading desks of Shell, Chevron, and ExxonMobil have proven adept at capitalizing on commodity price jumps. The U.S. firms, each with fresh, massive acquisitions in the Permian shale basin, managed to push their drilling rates higher. Shell also reported that its pipeline of renewable energy projects under construction is shrinking, down to 4.1 gigawatts in the fourth quarter from 4.9 in the third. All three remain fixated on keeping their shareholders happy: Chevron bought back a record $14.9 billion in shares last year, and Shell plans to ramp up buybacks to $3.5 billion in the first quarter. |

|

| |  | Prashant Rao |

| |

REUTERS/Piroschka van de Wouw/File Photo REUTERS/Piroschka van de Wouw/File PhotoThe management consultancy BCG is sending all its staff monthly reports on the carbon emissions resulting from their flights. BCG staff — like those of other major consulting firms such as McKinsey and Bain — are famed for their prolific air travel and, because they typically travel business class, flights account for the vast majority of their carbon emissions. BCG’s Scope 3 emissions, which include business travel, accounted for 99.9% of its U.K. emissions in 2022. The firm’s employees now receive monthly auto-generated reports listing their total flights and the emissions resulting from that travel over the prior month, as well as how those figures compare to previous periods. While the data isn’t explicitly tied to employee performance, one BCG partner told Semafor the reports had helped spur them to change their flight patterns to reduce travel. |

|

China’s climate year ahead |

| |  | Xiaoying You |

| |

REUTERS/Carlos Barria/File Photo REUTERS/Carlos Barria/File Photo2024 is a critical year for China’s energy transition, when the country’s early investments in EV batteries, renewables, and other clean technologies could mean it has already passed its emissions peak. Even as it expands its coal fleet, China’s massive manufacturing capacity could potentially speed up the world’s energy transition: Solar panels, lithium-ion batteries, and electric vehicles, billed as the “new three” by Chinese officials, are now the country’s fast-growing exports. It’s hard to overstate China’s role in the energy transition. Beijing’s progress in cutting its emissions will have a huge impact on the world’s efforts to keep global heating within the Paris Agreement target of 1.5 degrees Celsius. |

|

Share of staff laid off this week at solar software startup Aurora Solar, out of about 500 employees. U.S. solar companies are hitting a rough patch: Interest rates remain high, and the biggest domestic market, California, drastically cut back on net-metering paybacks for rooftop solar customers. Many companies are also trapped in Wall Street-backed financing models that require them to grow quickly and burn through a lot of cash on customer acquisition. Last year, 100 U.S. residential solar companies declared bankruptcy. |

|

Battery recycling shortfall |

| |  | Diego Mendoza |

| |

Flickr FlickrChina’s EV boom is leading to an unwelcome environmental consequence: Its underdeveloped battery recycling program is unable to process thousands of used batteries teeming with potentially toxic chemicals. China is projected to reach its goal of having electric vehicles comprise half of all car sales by 2026, 10 years ahead of schedule. But the battery recycling vacuum has created a thriving gray market of smaller battery-recycling firms willing to pay higher prices for spent batteries, with China’s Electronic Energy Saving Association estimating that unregulated operators currently make up about a fifth of the market. These players “undermine the credibility of China’s recycled batteries” because they do not adhere to environmental regulations, lacking safety equipment needed to minimize explosions and the release of toxic chemicals, Bloomberg reported. The solution isn’t as easy as helping these companies meet regulatory requirements. So-called first-tier cities like Beijing and Shanghai have bans on new, high-emissions projects, and even regulated battery processing is still considered a highly-polluting industry, according to China’s Technical Committee on New Energy Battery Recycling. |

|

February 05 | Washington D.C.

Principals Live with Rep. Raja Krishnamoorthi

RSVP An exclusive 1:1 interview with Congressman Raja Krishnamoorthi on competing with China, the Democratic foreign policy argument, and the Select Committee’s focus for 2024. |

|

Personnel- U.S. President Joe Biden tapped his top climate advisor, John Podesta, to succeed John Kerry as the country’s global climate envoy. Podesta has previously focused on domestic climate policy, and will remain in the White House rather than moving to the State Department. “He will need to pick a few lanes for his priority engagement, as opposed to Kerry, who was across a lot of different moments and processes,” said Alden Meyer, senior associate at the think tank E3G.

New Energy - Wind farms in the U.K. may be overstating their power production potential, raising household bills and the country’s emissions. Some wind companies appear to be systematically embellishing output forecasts, Bloomberg reported, creating an illusory risk of grid overload, which can trigger utility operators to pay wind to shut down, and fire up gas-fired power plants instead.

Fossil Fuels- Canadian oil is getting a new door onto the global market, as a long-delayed pipeline to carry crude to Pacific coast ports nears completion. The pipe is bad news for U.S. drivers though — it will redirect some oil away from U.S. refineries, likely driving up gasoline prices in the Midwest.

Finance- Renewable energy companies will likely have to cope with several more months of high interest rates. The high cost of borrowing has become one of the biggest bottlenecks for high-capex clean energy projects. In comments this week, U.S. Federal Reserve chair Jerome Powell indicated rate cuts aren’t likely before June at the earliest.

Tech- Carbon accounting startup Watershed raised $100 million, pushing its valuation to $1.8 billion. The round is a testament to the growing demand for corporate climate accounting services as regulators and shareholders clamber for emissions data. The company’s clients include “four of the six biggest banks and six of the 10 biggest private equity firms,” Bloomberg reported.

- Google signed its biggest deal yet to buy power from offshore wind farms for its European data centers. New corporate anchor customers are key to resuscitating the battered offshore wind industry.

Enbridge/Handout via REUTERS Enbridge/Handout via REUTERS- U.S. regulators are about to start collecting data on the energy consumption of bitcoin mining operations. Crypto mining has become a major drain on grids around the country. Mandatory data collection could be a first step toward new regulations on the industry.

EVs- Ford is giving away free adapters to owners of its EVs so they can plug into Tesla charging stations. “Range anxiety” remains a major barrier to EV sales, and is something automakers are keen to assuage. Tesla has played this to its advantage well, essentially cornering the charging infrastructure market.

Food & Agriculture- Climate activists are teaming up with Republican senators and Big Beef to keep the world’s biggest meatpacking company off the stock exchange. Brazil-based JBS wants access to U.S. capital, but its U.S. rivals fear it gaining even more market share. Meanwhile, the company is battling allegations of corruption and illegal deforestation.

|

|

Semafor’s 2024 World Economy Summit, on April 17-18, will feature conversations with global policymakers and power brokers in Washington, against the backdrop of the IMF and World Bank meetings. Chaired by former U.S. Commerce Secretary Penny Pritzker and Carlyle Group co-founder David Rubenstein, and in partnership with BCG, the summit will feature 150 speakers across two days and three different stages, including the Gallup Great Hall. Join Semafor for conversations with the people shaping the global economy. |

|