The News

African fintech startups are betting on a raft of new services and geographical expansion to build on the momentum from an expected boom in customer demand.

In Nigeria, digital banking app PalmPay is evolving from merely providing quick money transfers between bank accounts to offering a health insurance feature that has enrolled one million people since its launch in 2024, with plans to add other types of insurance. Wave, a Senegal-headquartered mobile money unicorn, is exploring partnerships with banks in West Africa that would enable it to offer loans. MNT-Halan, an Egyptian digital lender that is also a unicorn, started allowing customers access to instant credit against investments made on the app in September.

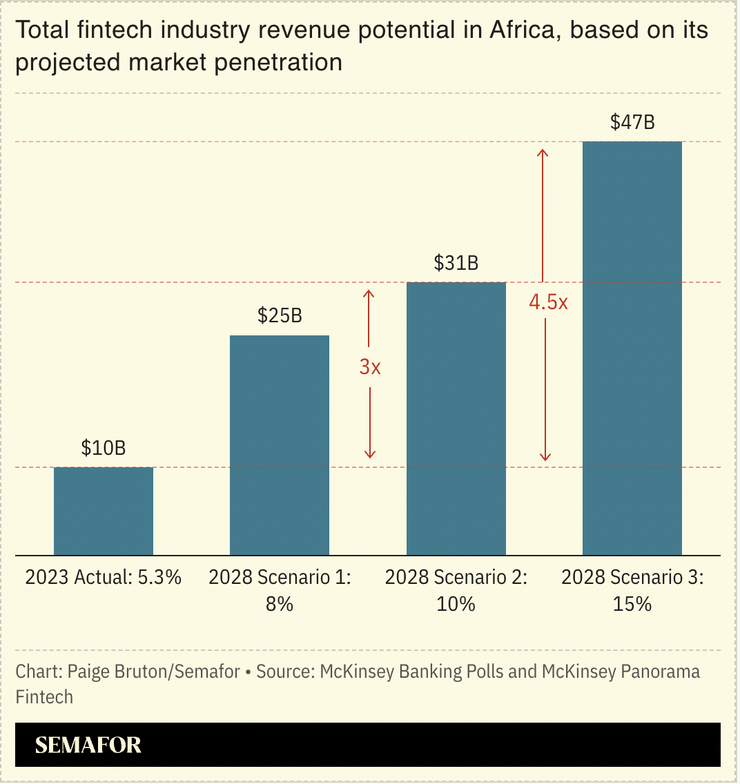

These are among a cohort of African fintech startups pushing to evolve into multifaceted, multinational companies, against the expectation that African fintech revenues could reach $47 billion in 2028, a near five-fold increase from 2023, according to McKinsey. The list includes older startups like Nigeria’s Paga which began offering dollar checking accounts for US users in September. Nepal’s central bank last week granted a remittance license to LemFi, a Nigerian-founded startup whose expansion this year saw it acquire a British card issuer.

PalmPay, whose main investors include Chinese companies Transsion and NetEase, has extended beyond Nigeria into Tanzania and Bangladesh this year and plans to set up shop in another East African country, chief marketing officer Sofia Zab told Semafor. Wave arrived in Cameroon in June, expanding its African footprint to nine countries. MNT-Halan has considered setting up in South Africa “because it is a mature, economically stable market,” but at present is focused on extending into the Gulf region over the next 18 months, CEO Mounir Nakhla told Semafor.

In this article:

Know More

Wave began offering peer to peer money transfers in 2018 but really took off two years later during the COVID-19 pandemic when demand for remote bill payments became intense, said Coura Carine Sene, the company’s West Africa regional director. It wants to serve the unbanked, offering “all the products someone can have with his bank,” hence its push into potentially offering loans to customers, Sene said.

A cash scarcity two years ago in Nigeria that resulted from a botched currency redesign “was the big event that transformed consumer attitudes” towards PalmPay, Zab said. The startup was one of a few local companies that had prepared to handle a massive rise in digital payments. PalmPay has since begun offering credit as a core service, and now plans to lead with smartphone financing as its main product rather than money transfers when entering new markets, she said.

Alexander’s view

Expansion moves are part of the usual expectations for startups that raise millions of dollars to grow quickly and produce returns for their backers. Fintech continues to attract the majority of investor capital in Africa, taking up a third of fundraising totals so far this year, according to deals tracker Africa: The Big Deal.

The number of African fintech companies tripled between 2020 and 2024, according to the European Investment Bank. Unsolved problems around access to financial services abound in Africa, creating a massive opportunity for players that can rise to the top.

“The scale of the potential is still so large,” said Mayowa Kuyoro, a McKinsey partner. Beyond bank accounts, African consumers have a far smaller range of financial products than people in developed countries, “so until the average person on the street has access to the financial system locally and internationally, African fintech cannot be seen as a crowded market,” she said.

Kola Aina, founding partner at Nigerian firm Ventures Platform that has backed a number of fintech companies, sees interesting opportunities in enabling intra-Africa trade and intra-Africa flows. The firm has raised $64 million so far for a new investment fund, targeting startups whose business models are fundamentally profitable in the near and short term. For startups in fintech and other sectors it hopes to back, “venture scale is really important,” he said, pointing to the need for startups to play in markets big enough to justify investor interest.

The View From UK

African startups succeed or fail in new markets according to the level of locally-relevant detail involved in their go-to-market strategies and not by following what is done in developed markets, said Victor Ekwealor, a UK-based African startup advisor and founder of Clarus.

“Go-to-market for fintech is less about awareness and more about trust and habit formation,” he said. Startups that effectively launch in new markets are not bothered about “a Silicon Valley-esque obsession with optics” but focus on designing their systems to communicate trust with a view towards market dominance, he said.

Notable

- Nigerian fintech unicorn Moniepoint raised $90 million in a recent round of funding, months after launching a remittance product for transfers from the UK to Africa.