The News

Nigerian fintech company Paga is betting that its decade-long operations in Africa’s payments ecosystem will give it an advantage over US digital banks in the race to provide financial services to the African diaspora.

The Lagos-headquartered company, founded in 2009, launched in the US in September through a partnership with Oklahoma-based Regent Bank. Users will get a dollar checking account insured by the US Federal Deposit Insurance Corporation at up to $250,000, with a physical debit card accessible on the Apple and Google Pay apps. Anyone with a verified US residential address can open and use the account, but Paga’s rollout is aimed primarily at the African diaspora with the Nigerian community as the initial adopters, Chief Executive Tayo Oviosu said.

African tech entrepreneurs are jostling to offer digital financial services to the millions of Africans who live outside the continent and frequently transfer money back home. At least two other African-founded startups, LemFi and Kredete, have raised up to $70 million from venture capital investors this year to offer remittances. Flutterwave, Moniepoint, and Kuda are other African startups in the space.

“The mental model is that we are building Revolut for Africa,” Oviosu told Semafor, referring to the British neobank that is also available in the US. Paga plans to compete with US digital banking incumbents not only on essential money transfer and savings capabilities available on generic checking accounts, but by enabling transactions to Africa “in a way that they just can’t,” owing to Paga’s access to local payment networks that its US competitors do not have, Oviosu said.

Know More

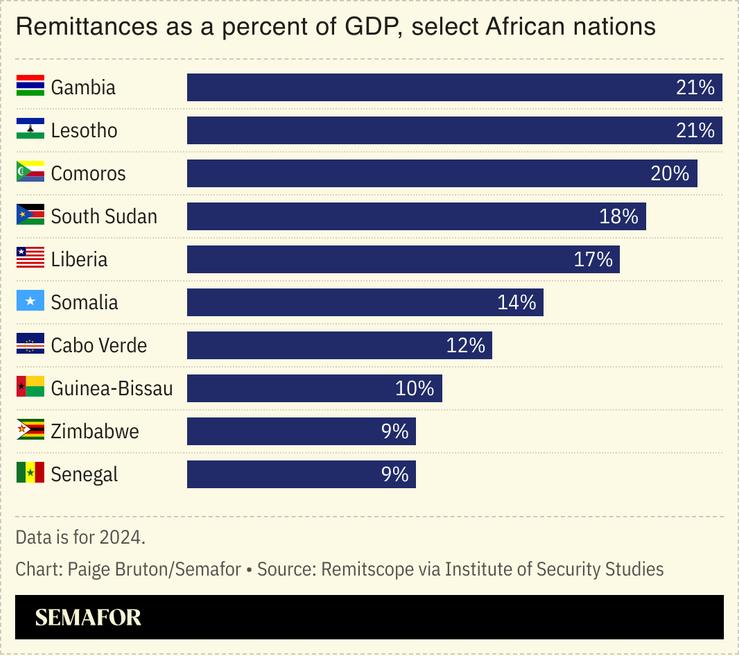

Remittances to Africa grew by nearly 80% between 2010 and last year to $95 billion, a mark that has been surpassed so far this year according to RemitScope, a UN-affiliated remittance data provider. Foreign direct investment inflows into Africa last year stood at $97 billion, by comparison.

African companies’ interest in providing money transfers from the US to Africa has risen alongside growing African migration to Europe and North America in recent years. But Paga’s US launch comes in the midst of anti-immigration policies that have seen the US government engineer deportations to multiple African countries and move to tighten visa requirements.

The Trump administration will begin enforcing a remittance tax from January 2026, charging a 1% fee on some money transfers sent from the US. The tax could lead to a $168 million drop in remittances to Nigeria, estimates the Center for Global Development think tank.

But the dollar’s position as the currency of international trade still makes operating a US-Africa remittance corridor crucial for business growth, said Oviosu. The company began work on the US rollout months before last year’s presidential elections, he said.

“If we want to give Africans access to global financial rails, we have to give access to the US market. But we will, for sure, open accounts in other currencies over time,” Oviosu said.

Notable

- Fintech startups accounted for 45% of African tech fundraising in the first half of this year, drawing $640 million.