The News

A US startup that enables African immigrants to build credit profiles through their remittance transactions has raised $22 million to roll out its service in Europe and Canada.

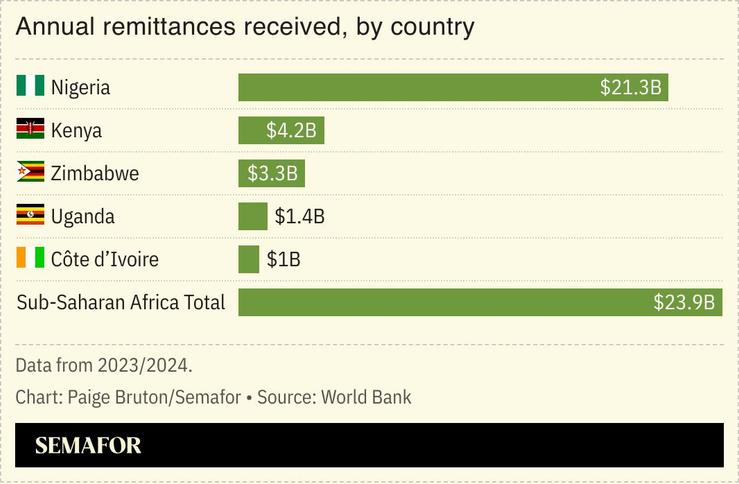

New York-headquartered Kredete, which was founded by Nigerian entrepreneur Adeola Adedewe in 2023, is one of a rising crop of startups serving Africans in the diaspora whose international money transfers are a sizable source of financial flows to Africa. In the US, Kredete enables users to build their credit history in the process of sending money to more than 30 African countries, thus allowing them to access other financial products which Kredete is rolling out. Other Africa-founded cross-border remittance providers, such as LemFi, are increasingly tapping into the market for providing credit access to migrants.

Like LemFi, Kredete is rolling out user bank accounts denominated in euros and dollars. It also plans to introduce a stablecoin credit card for users in 41 African countries.

Know More

Kredete is primarily targeting African migrants in the US, Adedewe told Semafor, estimating a target market of about 45 million people. In Africa, its focus is on 600 million “mobile-first users in Africa who serve as recipients of global remittances,” he said.

Less than 5% of people in Africa have access to credit cards. Kredete’s approach of using stablecoins ties into the growing interest in cryptocurrencies in Africa. Honeycoin, a startup backed by Visa Ventures and African venture capital firm TLcom Capital, raised $4.9 million in August for its stablecoin-based payments product that enables businesses to collect and disburse mobile money, card, and bank payments in 15 African markets, and in North America and Europe.

Notable

- Nigerian digital bank Moniepoint launched its UK to Africa remittance app in April, with an executive saying they “are not seeing that as the only need the diaspora has.”