The Scene

Top corporate advisers have built a lucrative business around fending off hostile takeover attempts and vocal activist investors. Now, their clients want them to apply those same skills to contain America’s most potent investor: President Donald Trump.

The Trump administration’s $1.6 billion investment in an American rare-earths miner is the latest private investment ruction highlighting the need for CEO whisperers and takeover defense experts who had already begun to include “the president wants to own a bit of us” in their quarterly “what-if” scenario planning, one advisor told Semafor.

“There’s really only one answer when the president comes knocking,” so you’ve got to be prepared, another takeover defense advisor said.

And whether companies are trying to fend off a federal investment — or court one, betting on a stock price pop — the strategy is the same: an aggressive DC ground game. Avoidance is not a strategy, said Jack Kelleher, managing director at activist-defense specialist Collected Strategies.

“It’s always clear who got caught flat footed, and what was out of your control can become your Achilles’ heel down the road,” he said.

There are also ways to find creative solutions. L3Harris alighted on some middle ground that may give CEOs a model: rather than offer the administration shares in the (more valuable) main company, it offered up a $1 billion stake in a business L3Harris plans to spin off.

“I guarantee every banker in America is calling every other company in this industry saying, ‘hey, I did a sum-of-the-parts this morning and have an idea,’” L3Harris’ CEO told Semafor the day the deal was announced.

L3Harris also benefited from moves it made before the Trump presidency — husbanding cash for acquisitions, rather than share buybacks — and moving to differentiate itself from competitors. By contrast, the president has not let up on Raytheon, taking aim at the defense company’s stock buybacks and threatening to cut contracts if they don’t invest more in the US.

In this article:

Rohan’s view

Proximity to the president is seen by some advisors as the surest inoculation — preemptive compliance (see Apple or Chevron) can forestall an abrupt reaction from the administration. But even that has its limits: CBS News has continued to cause problems for the Ellison family, which has tried to lean on its relationship with the president with mixed results.

Other executives — especially those whose companies are struggling — may actively encourage the administration to take stakes in their firms, trading the dilution of existing shareholders for the stock bump that usually follows the news.

Months before the US government inked its deal with USA Rare Earth, its CEO shot up a flare on stage with Semafor, saying that “the fact that the US government will get involved… allows others to say, ‘Yeah, this is worthy of investment.’”

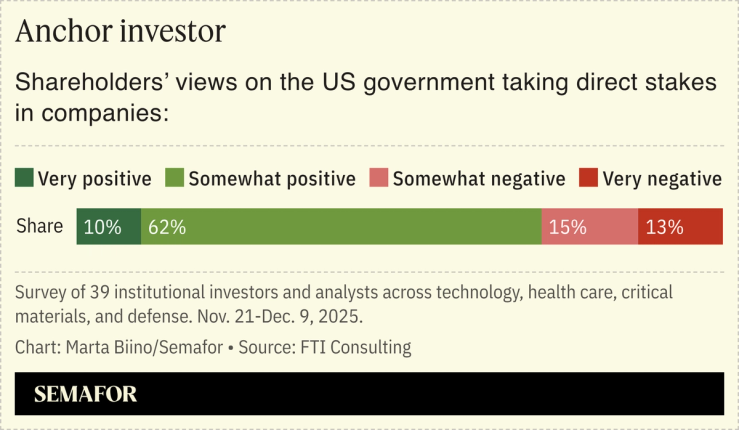

Nearly three quarters of institutional investors in key sectors — technology, health care, critical minerals, and aerospace and defense — saw the government taking an equity stake in a publicly traded company as a positive, according to an FTI Consulting survey of nearly 40 investors late last year shared exclusively with Semafor. Still, roughly the same amount of investors said the US government taking stakes in publicly traded companies will also create more risk in the market, according to the survey, with investment priorities impacted as a result of the government investment.

Room for Disagreement

The Trump bump doesn’t necessarily sustain. Shares in USA Rare Earth are down about 30% since CEO Barbara Humpton praised the Trump administration’s state capitalism efforts. For its part, Intel shares shot up 168% on the back of the government’s 10% stake and follow-on deals, until the company’s earnings showed its next-generation chip technology’s yield — which directly correlates to profitability — was subpar.

Notable

- Deputy Secretary of Defense Stephen Feinberg — a former Cerberus executive — has already emerged as a key point of influence over government dollars, Semafor’s Ben Smith reported months ago.