The News

The Pentagon is taking a $1 billion stake in a new spinoff from defense contractor L3Harris, a deal the company’s CEO sees as the first step to injecting some competition into the industry.

The Pentagon’s proposed investment will separate L3Harris’ rocket business and give it new shareholder money to speed up replenishment of national missile reserves that have been depleted by transfers to Israel and Ukraine. The move follows Trump’s criticism of defense contractors for slow production and stock buybacks. “Instead of buying back our stock, we bought Aerojet Rocketdyne,” L3Harris CEO Chris Kubasik told Semafor, referring to the 2023 acquisition that formed the basis of the rocket business.

Know More

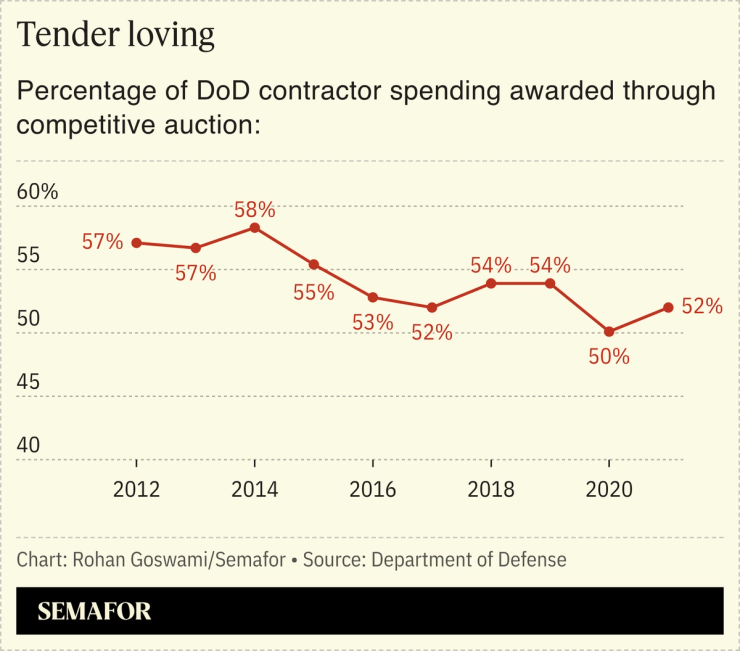

Kubasik sees this as the first step toward shaking up an industry long plagued by oligopolistic hangovers and kicking off a new wave of dealmaking. Fifty-one contractors in the 1990s consolidated into five at the urging of the Clinton administration, which was keen to move on from the Cold War. “It all goes back to the Last Supper in ’93,” he said, referring to the Pentagon dinner that set off a wave of mergers. “The consolidation went too far.”

L3Harris, itself formed by a 2019 merger, “makes six — maybe five and a half” defense contractors, given its smaller footprint and lack of a signature program like a fighter jet, Kubasik said, “and we’re creating another new one [with this spinoff]. You’ve got your Andurils and your Palantirs and maybe we get up to 12. This could be the first step of deconsolidating the defense-industrial base.”

“I guarantee every banker in America is calling every other company in this industry saying, ‘hey, I did a sum-of-the-parts this morning and have an idea.’”