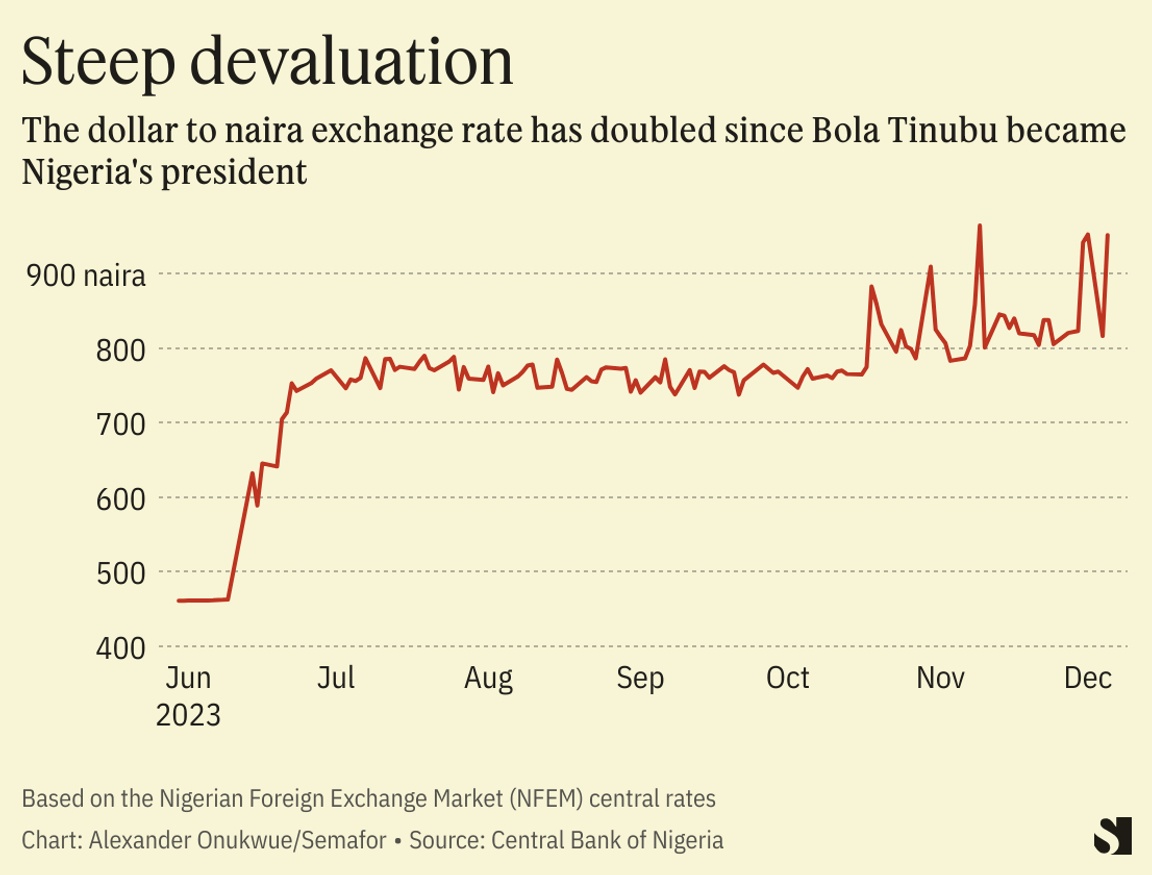

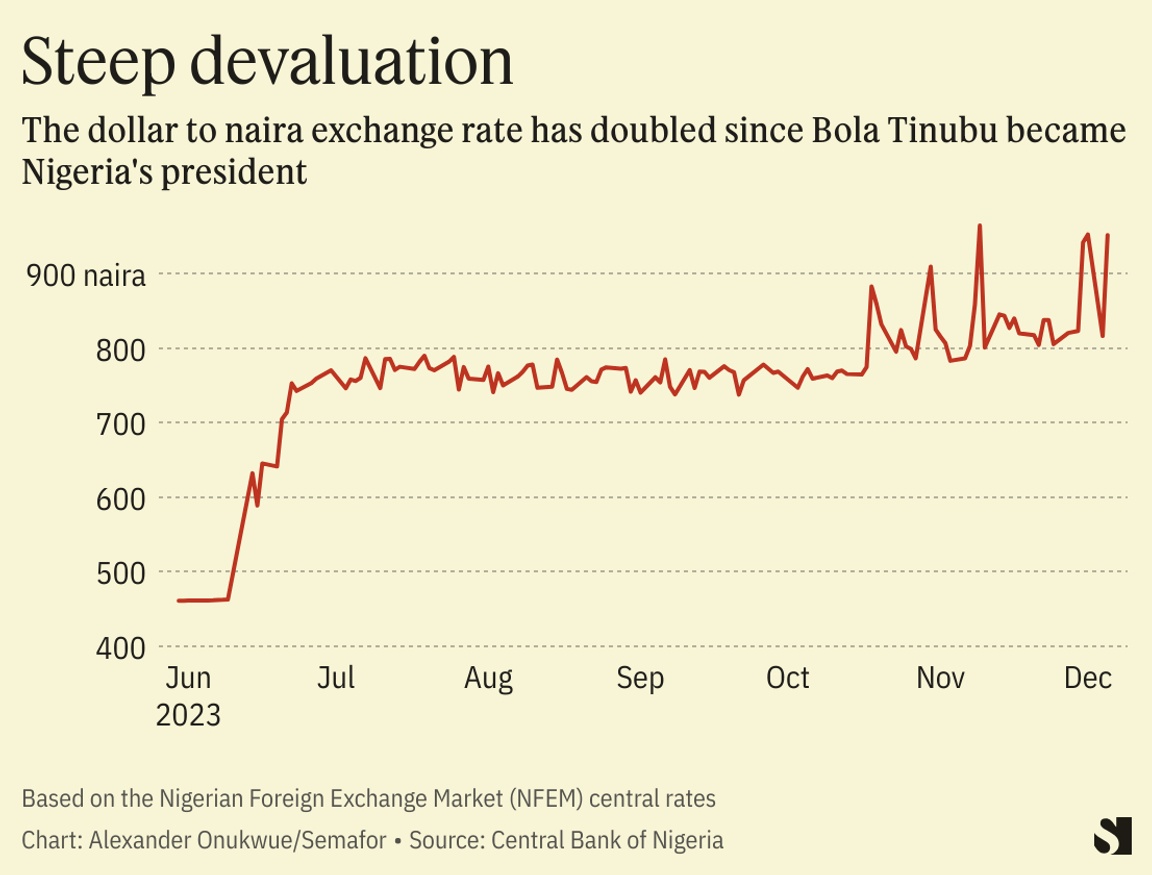

Emmanuel Osodi/Anadolu Agency via Getty Images Emmanuel Osodi/Anadolu Agency via Getty ImagesTHE NEWS LAGOS — Multinational companies are cutting back their presence in Nigeria or pulling out altogether as currency problems hamper their operations and hurt consumers. Procter & Gamble, an Ohio-based consumer goods giant, last week became the latest big company to scale down its operations. It said it will stop producing its care and hygiene products in the continent’s most populous country. P&G’s chief financial officer Andre Schuten said tough macroeconomic conditions, particularly the local naira currency’s weakness, is driving the shift. Nigeria is “very difficult for us as a U.S. dollar-denominated company to create value” in, Schuten said at Morgan Stanley’s Global Consumer and Retail Conference, an investor event in New York. British multinationals GSK and Unilever are two other high profile consumer goods companies to have announced changes to their Nigeria operations this year. Each signaled forex pressures as fueling decisions to shift to a third party distributor model (in GSK’s case) or retire the production of well-known products (as Unilever announced in March). In September, another British group, PZ Cussons, said “foreign exchange challenges” was causing it to delist from the Nigerian stock market. “Nigeria is a $50 million net sales business,” Schuten said, “a really small” market in the context of the company’s global net sales of $85 billion. P&G products, like diaper brand Pampers and laundry powder Ariel, will now be available in Nigeria on an import-only basis. KNOW MORE  Nigeria’s naira has weakened sharply against the dollar since President Bola Tinubu initiated reforms in June to cancel fixed exchange rates while inflation reached an 18-year high in July, rising to 27.33% in October. But even before Tinubu’s term, many of the largest companies in Nigeria, from cement producer Dangote to telecoms leader MTN, reported that the macroeconomic conditions had hit their earnings. New York-listed e-retailer Jumia and venture capital-funded startups that report earnings in dollars have noted similar challenges this year. P&G began doing business in Nigeria in 1992 with production centered in two plants located in towns close to Lagos. In 2017 it opened a multimillion-dollar baby care products manufacturing plant but it was shuttered a year later in a “restructuring” attempt aimed at efficiency and sustainability due to difficulties in sourcing inputs. Nigeria’s central bank governor, Yemi Cardoso, in a recent speech on his policy approach, said low forex inflows from declining oil revenues was a major cause of the country’s challenges, though he blamed the dollar’s strength and inflation in emerging markets on the effects of the war in Ukraine and the COVID-19 pandemic. He said the bank has taken actions over the past two months to achieve price stability, including a 108 billion naira ($136 million) sale of treasury bills. His response to industry concern around postponed monetary policy meetings was that the bank has fulfilled legal requirements to meet at least four times a year and was, in any case, reviewing the meetings’ value for efficiency. |