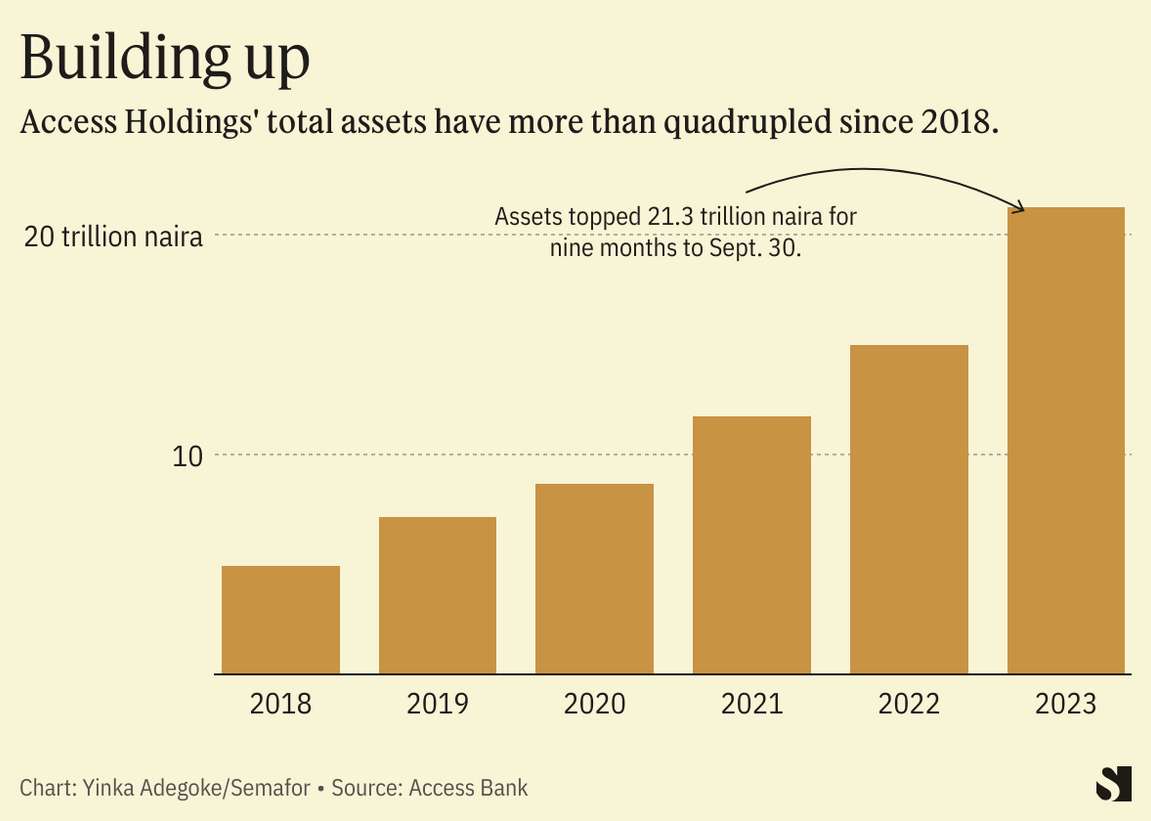

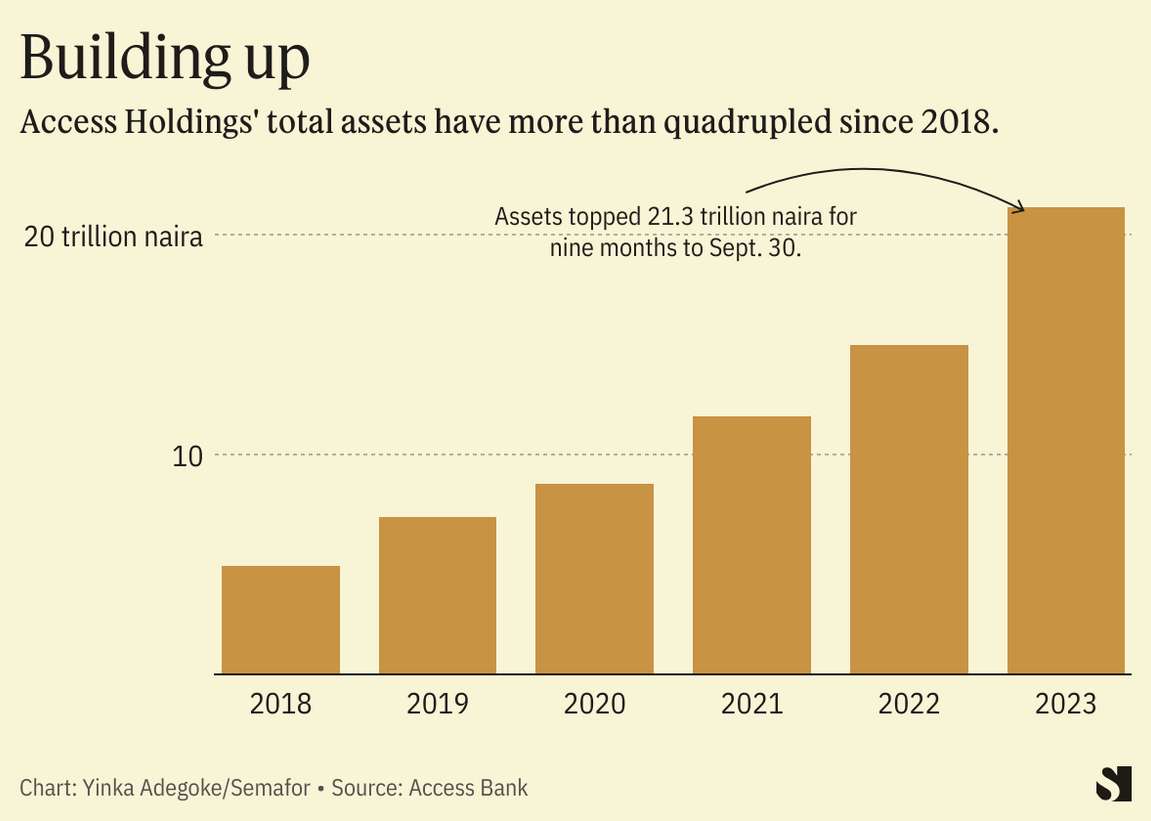

Andrew Esiebo/Getty Images for Global Citizen Andrew Esiebo/Getty Images for Global CitizenTHE SCOOP LOME, Togo — Lagos-based Access Bank, one of Africa’s biggest banks, is close to finalizing a regulatory process to launch its first full banking service in Asia in the first quarter of 2024, the chief executive of its holding company told Semafor Africa. The Asian bank plan is part of a wider global expansion target which includes a strategy to expand more deeply into Francophone Africa, build closer ties with North Africa, and across Europe where it already has wholesale banking operations in London and Paris, which opened in May. Herbert Wigwe, chief executive of Access Holdings, parent company of Access Bank, said he and his team expect to receive approval from monetary authorities “by this side of Christmas.” Wigwe declined to confirm the country in which the bank would launch in order to avoid preempting local regulators, but he added: “We will definitely be in Asia by the first quarter of next year.” Access has used a wholesale banking model outside of Africa, which is a corporate to corporate approach rather than retail banking with individuals. KNOW MORE Wigwe and his team have built Access from a small Nigerian operator into the largest banking group in the country through an aggressive and ambitious acquisitive approach. The lender accounts for 16% of the banking system’s assets at the end of 2022, according to ratings agency Fitch. It has also expanded rapidly across the continent over the last half decade. Most recently, it snapped up the banking operations of Standard Chartered in Angola, Cameroon, The Gambia, Sierra Leone, and Tanzania. Access, which had 21.3 trillion naira ($26.5 billion) in total assets on its balance sheet at the end of September, has seen its share price double on the Lagos stock exchange since the start of the year to give it a market capitalization of around 614 billion naira ($762 million).  YINKA’S VIEW The rise of Access Bank since it was taken over in 2002 by Herbert Wigwe and his partner Aigboje Aig-Imoukhuede has been remarkable. But it’s the ambition of their strategy that is worth paying more attention to because it makes an unabashed and long-term bet on Africa and African businesses on the global stage. Wigwe explains the move for Asia as serving their customers who operate in those regions. “The big advantage is we gain access to capital and trade; these are trade hubs where people come from across the continent, set up businesses, and trade from there — so we’re following that chain of trade,” he told me. He sees an Asia bank “supporting overall network effects” in terms of what customers already do in the region. But, most importantly, he emphasized the ability to access “huge pools of capital” which would typically be unavailable in African markets. “So by being present in these markets, there is a brand recognition and a real business supporting trade.” |