| In today’s edition, we look at the return of Ryan Cohen at GameStop, U.S. mortgage rates on the rise͏ ͏ ͏ ͏ ͏ ͏ |

| Liz Hoffman |

|

Welcome back to Semafor Business, where the harbors are safe.

I got some grumbling emails from some of you after my story earlier this month about the deal slump that has hung over Wall Street for a lot of this year. It’s possible I might have bottom-ticked things, and permission granted for an Inverse Liz Hoffman index.

But with the exception of Cisco’s big deal for Splunk, which should move a maker of ubiquitous office hardware further into AI and software, most have been rivals trying to find savings and improve margins. And it’s worth noting that investors — who generally, but especially during periods of economic uncertainty, prefer cold, hard cost cuts over rosy revenue promises — promptly cut $10 billion off of Cisco’s market value.

These deals will keep bankers busy, but they’re not the kind that reflect the stirring of any animal spirits. And they come too late to do anything for a Wall Street bonus season that’s shaping up to be just dismal.

With that happy thought, a programming note: Next week’s usual Tuesday missive will come out on Wednesday, wrapping in highlights and takeaways from our inaugural Semafor Business Summit at Genesis House. Semafor’s editor-in-chief, Ben Smith and I are hosting Mayor Eric Adams, former NEC Director Gary Cohn; BlackRock senior managing director Mark Wiedman, NYSE President Lynn Martin, RXR chief Scott Rechler, WSJ’s new editor-in-chief, Emma Tucker. Follow along at semafor.com or @semafor for live updates.

Reuters/Andrew Kelly Reuters/Andrew Kelly➚ BUY: BFD: Wall Street is buzzing after deals for Splunk ($28 billion), fashion house Capri ($8.5 billion) and WestRock ($11 billion.) Still, $10 billion-plus mergers are on track for their slowest year in a decade, according to S&P Capital IQ. ➘ SELL: LFG. Memelord Ryan Cohen is back running GameStop and his once-loyal army of retail investors responded by selling. Shares were down 2% this morning. Cohen’s handpicked CEO, Matthew Furlong, was fired in June after the company’s e-commerce ambitions flopped. |

|

Average U.S. mortgage 30-year rate last week, the highest in nearly 23 years, according to the Mortgage Bankers’ Association. The Fed’s “higher for longer” pivot has pushed Treasury yields up half a percentage point in September, dragging loan rates with them. |

|

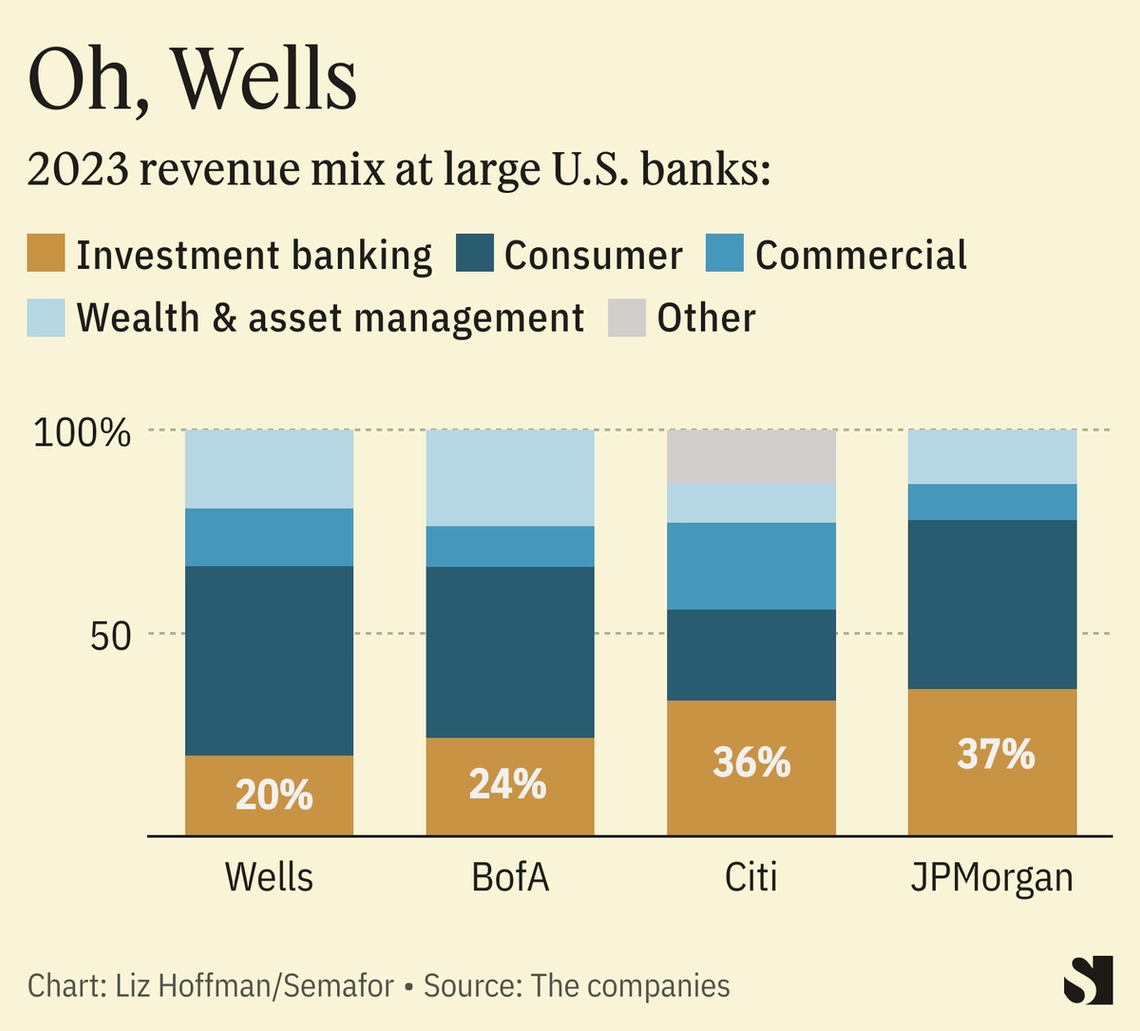

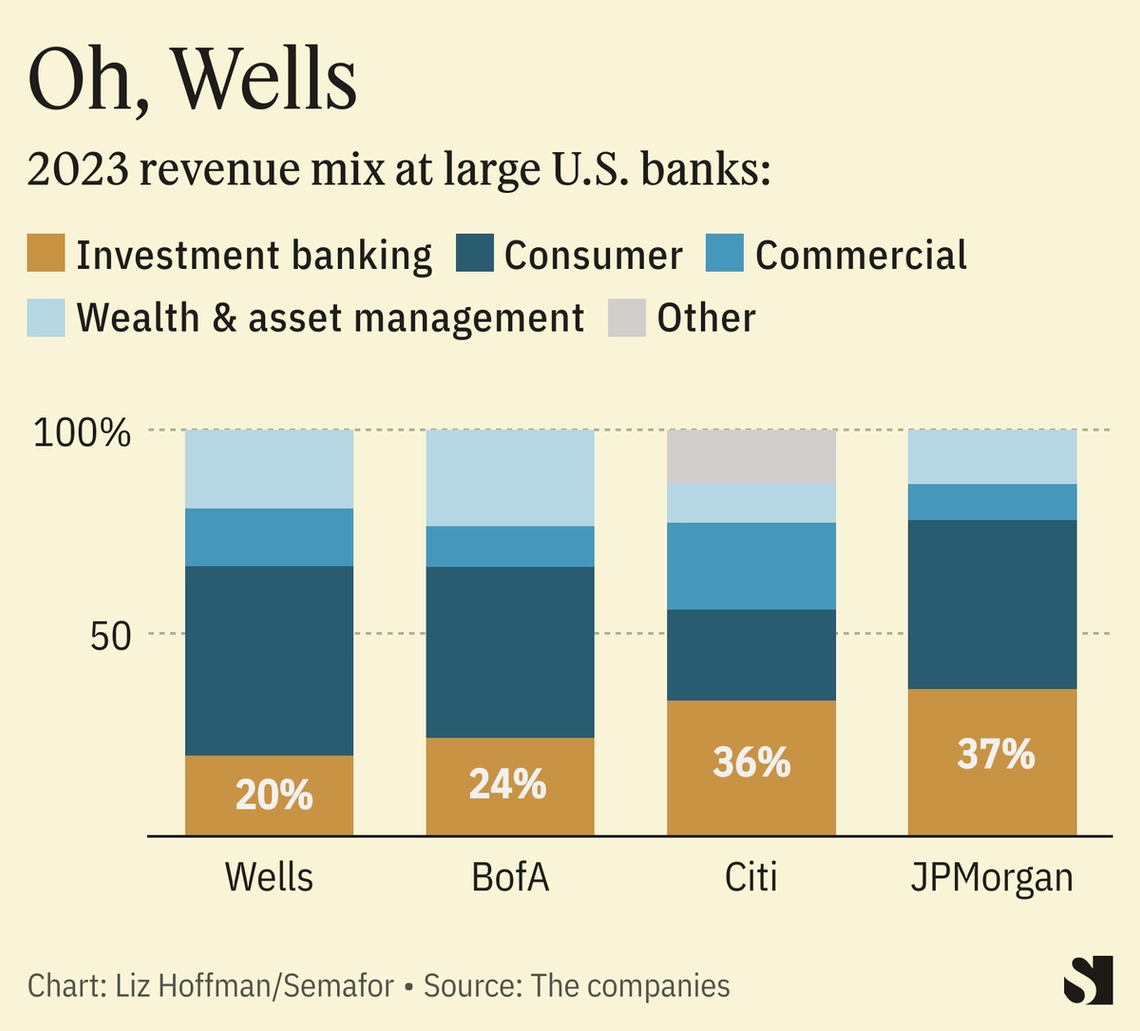

Sign of the climb? Wells Fargo will will pay $550 million to more than double its space in Hudson Yards, which houses its Wall Street businesses. It first moved into the west-side complex in a 2015 deal that then-CEO Tim Sloan said “reinforces our continued commitment to our investment banking and securities business.” Wells has tried before to break into the dealmaking big leagues. JPMorgan, Goldman Sachs, and Morgan Stanley’s grip has only tightened, and the market share coughed up by retreating European firms went mostly to boutiques.  This time, the bank hired Jeff Hogan, a star Morgan Stanley banker, to run its M&A group, and added Credit Suisse’s Malcolm Price to court private-equity clients. And Wall Street’s and Washington’s man-about-town, Tom Nides, plucked on the way out of his Israeli ambassadorship, will be out schmoozing clients. |

|

Reuters/Brian Snyder Reuters/Brian Snyder- The judge overseeing the U.S. government’s antitrust case against Google is under fire for letting company executives testify behind closed doors. (He blames the prosecutors.) Notably, the same judge has already found Google to be less than transparent in its legal dealings: Executives’ habit of routinely CC’ing in-house lawyers on documents they wanted to keep secret was “eyebrow-raising,” he said last year in an unrelated case.

- Sam Bankman-Fried’s trial starts on Tuesday and it’s likely to be feisty. SBF’s ex-girlfriend, who pleaded guilty to fraud, is set to testify against him. SBF’s lawyers won the right to question former FTX executives about their drug use.

- The SEC is nearing a settlement with big Wall Street firms over their employees’ use of personal phones, Reuters reports. The investigation — which has already squeezed $2 billion in fines out of a dozen firms — may wrap up ahead of the agency’s Sept. 30 fiscal-year-end; last-minute enforcement actions have been pouring in all week.

|

|

There are some 10,000 banks and credit unions in the U.S. Last quarter, federal data shows, just 812 of them were serving marijuana companies, leaving the cash-heavy businesses vulnerable to theft and violence. A bill to fix that by offering a safe harbor for lenders to work with legal cannabis companies cleared a big hurdle in the Senate this week. Seth Goldberg is a partner at law firm Duane Morris and advises cannabis companies.  |

|

- Democrats say it’s time for Menendez to go. Republicans say not so fast.

- The world’s biggest climate fund wants to get bigger. But even more is needed to help developing economies decarbonize.

- Fox slashed ad prices for the second Republican debate. One ad buyer told Semafor the race “has become a snoozer.”

|

|