| In today’s edition, a scoop about a $1 billion ‘conscious uncoupling’ in private credit and why ever͏ ͏ ͏ ͏ ͏ ͏ |

| Liz Hoffman |

|

Hi, and welcome back to Semafor Business, where we’ve been in “founder mode” for two years now.

It’s the phrase du jour in the business world, even beyond Silicon Valley, set off by a talk Airbnb founder Brian Chesky gave last week at Y Combinator that was amplified by venture capitalist Paul Graham. The idea, basically, is that micromanaging is underrated and that startup founders fell victim to the professional management theory taught in business schools.

This isn’t a new idea. It was raised in 2011, when Google co-founder Larry Page replaced as CEO the professional brought in to scale that company, Eric Schmidt. It was Mark Zuckerberg’s implicit argument when he complained about “managers managing managers, managing managers, managing managers, managing the people who are doing the work” and then fired tens of thousands of them. It got a boost when Twitter continued functioning after Elon Musk — not a founder but acting like one — laid off most of its staff and started personally reviewing code.

But it’s getting more traction now, maybe because “rawdogging” tech bros are on the offense in a way they haven’t been for a long time. Zuckerberg is punching back at the White House, Trump wants Musk’s help auditing (and cutting) federal programs, and the venture capitalists who have pushed more professional management styles on their startups are beginning to look dumb. The question is whether founders can turn their momentum into an organized front for their next big fight: Democrats’ plan to tax millionaires on their unrealized stock gains.

Elsewhere on Wall Street, a founder taking back his business is the subject of today’s scoop. This one, as you’ll read below, has more to do with the fast-changing landscape of private investing — in particular, private credit — but it’s a founder success story nonetheless.

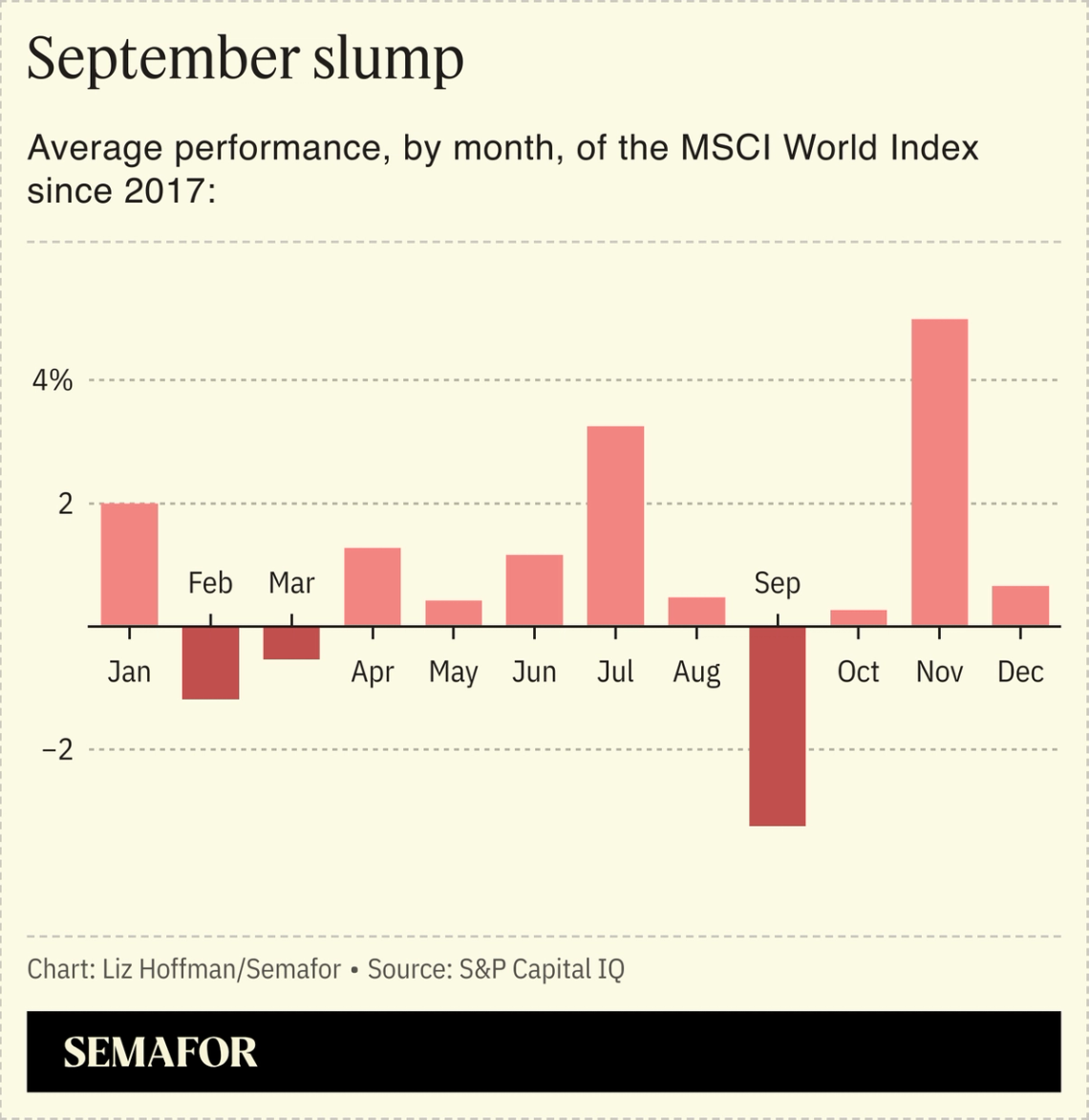

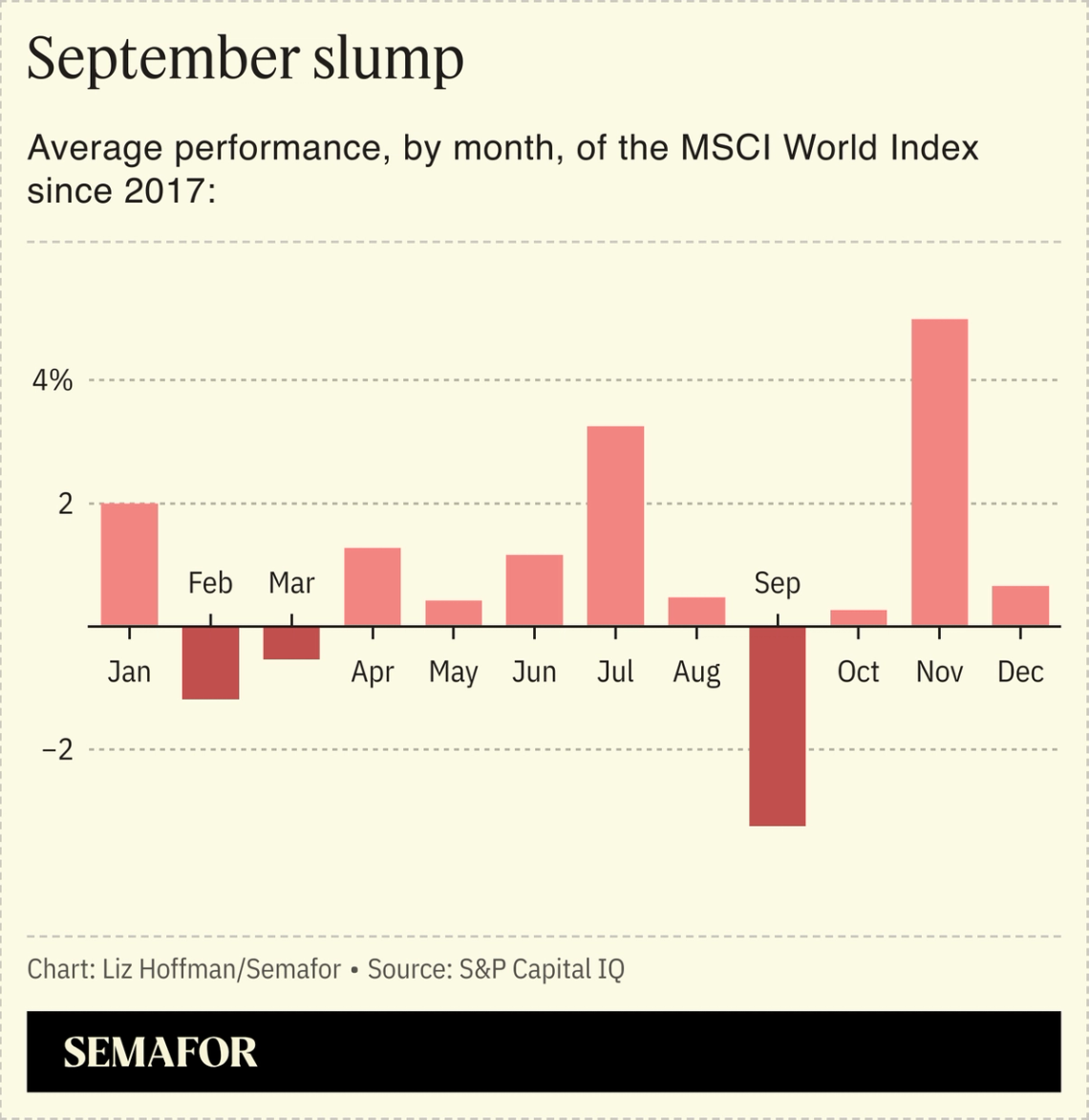

Plus, the September scaries are coming for the stock market.

➚ BUY: Budget. European low-cost carriers Ryanair and Wizz Air hit record passenger volumes in August, bucking the problems plaguing US budget airlines and winning the battle for “bums in seats.” ➘ SELL: Deficits. Democrats are likely to renew most of Donald Trump’s expiring tax cuts, continuing what The New York Times calls the “tax doom loop” of bad politics and ballooning budget shortfalls. |

|

Saudis keep borrowing to fund desert dreams… Volkswagen considers unthinkable German factory closures… Kamala Harris opposes Nippon-US Steel deal… Bond market backs new UK government… Bears target AI’s tagalong winners… Taiwan says China is poaching its tech talent… Britain to probe Oasis ticket pricing… |

|

A conscious uncoupling on Wall Street |

THE SCOOP TPG quietly sold its stake in its former credit arm, Sixth Street, back to that firm last month for more than $1 billion, people familiar with the matter said, bringing to a formal end one of Wall Street’s longest and most profitable partnerships. The deal valued Sixth Street at about $10 billion, a number agreed on last fall, after TPG’s takeover of Angelo Gordon brought it into direct competition with Sixth Street’s lending business and triggered negotiations, the people said. The separation, years in the making, leaves Sixth Street — which has already been touchy once about having a competitor as a part owner — freer to dabble in corporate buyouts. And TPG can focus on building its own lending business, where it lags far behind rivals like Blackstone and Apollo. Branching out is increasingly a survival requirement in today’s private-investment world. Sixth Street raised cash from outside sources to buy back the stake, but none of them were strategic investors along the lines of TPG, one of the people said. The windfall goes to TPG’s partners, not its public shareholders, as the Sixth Street stake wasn’t part of the firm’s 2022 IPO. |

|

Brace yourselves: Stocks almost always fall in September as traders, back from vacations, reassess their holdings and those ahead for the year start locking in gains (and their bonuses). This year’s markets are twitchier than usual, seen in last month’s overreaction to jobs data, with once-reliable Big Tech stocks leading the declines. The billions of dollars that moved out of stocks and into cash are staying put for now, even heading into this month’s expected cut in interest rates, which should boost share prices. Major indexes opened lower this morning. |

|

Mark Ein, Venture capitalist and investor in the Washington Commanders, and Lori Kalani, Chief Responsible Gaming Officer of DraftKings will join Semafor’s editors in Washington, D.C. on September 19 to discuss growth of the U.S. gaming industry and where it goes from here. RSVP for in-person or livestream.

|

|

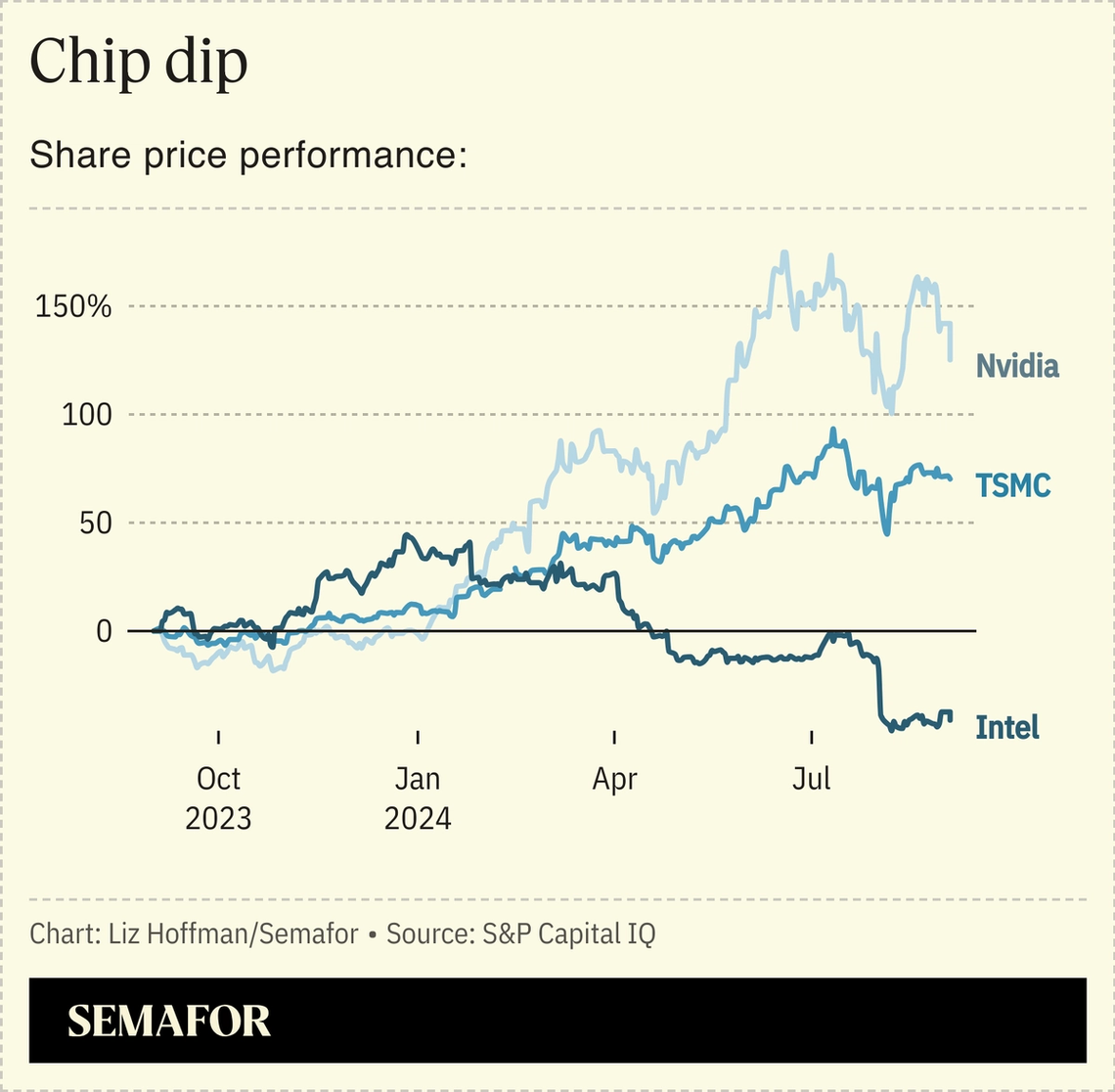

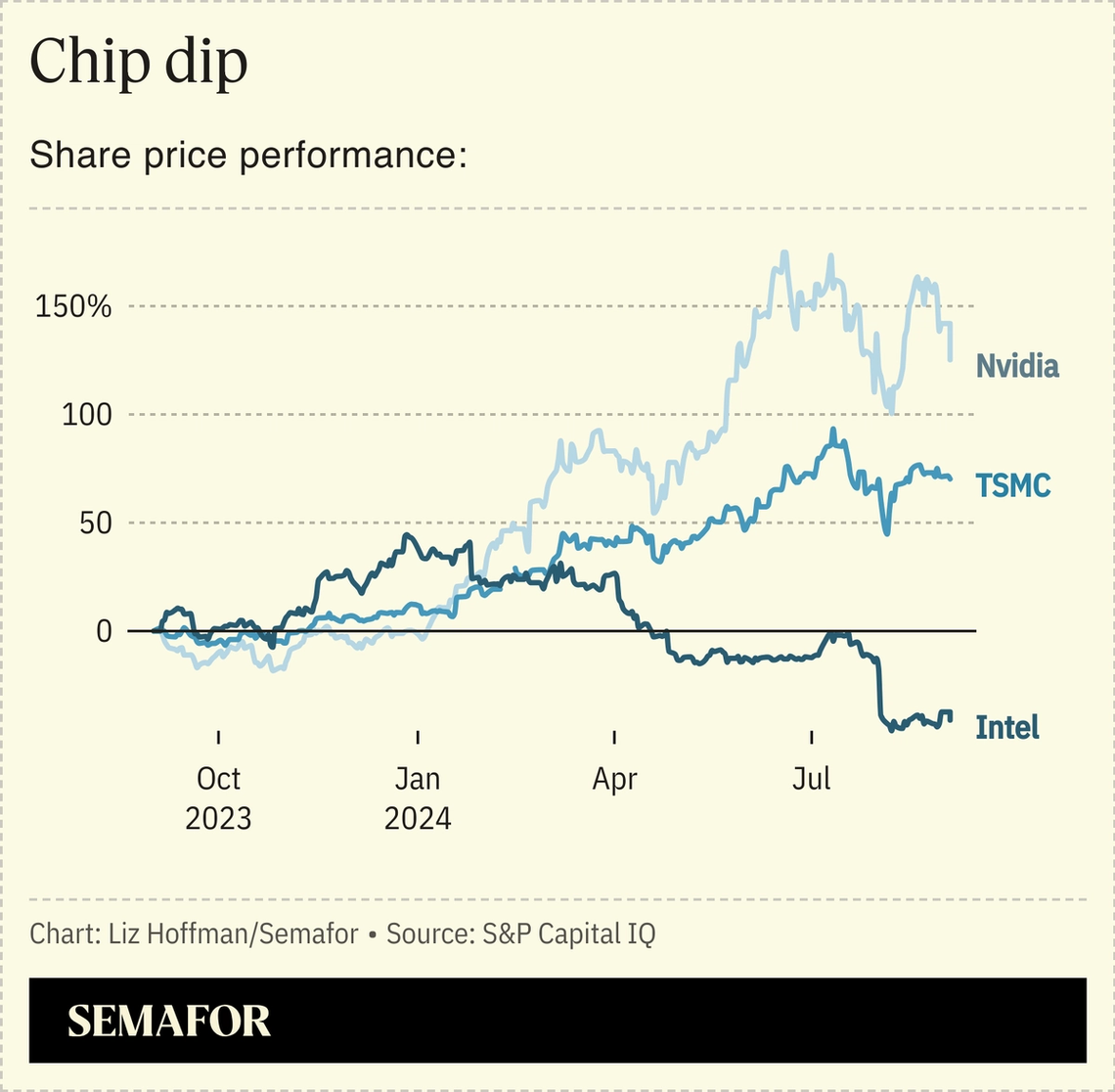

Intel signals: Intel may lose its place in the Dow Jones Industrial Average as its stock price continues to slide and it slips further behind rivals in key areas like AI, Reuters reports. After $2 billion in losses this year, the company announced a big layoff and is said to be considering various options, including asset sales and a major split, to correct course — though CEO Pat Gelsinger claims not to be a fan of the “90-day shot clock.” Key to his plan to return Intel to its former glory is positioning it as a national champion, a narrative rewarded with $20 billion of grants and loans from the Biden administration for new chip factories. Brussels pouts: A top European court ruled that the EU overstepped its mandate in blocking Illumina’s takeover of gene-testing startup Grail, a decision that could defang the continent’s antitrust regulators as it zeroes in on AI tie-ups. Brussels’ has ignored statutory revenue thresholds to examine “killer acquisitions” — takeovers of companies with promising technology but little revenue. AI certainly qualifies and the EU has its eye on partnerships like the one between Microsoft and OpenAI, which Europe’s antitrust chief said in June could “become a disguise for one partner getting a controlling influence over the other.” |

|