| In today’s edition, the firestorm over content moderation on social media re-erupts, this time fed b͏ ͏ ͏ ͏ ͏ ͏ |

| Liz Hoffman |

|

Welcome back to Semafor Business, and a big thanks to Editor-in-Chief Ben Smith for filling in last week with this telling story on Kamala Harris and the subtler role that at least one billionaire is playing in today’s politics. Bill Ackman has his billions; Laurene Powell Jobs has her bestie.

But with the US election settling into a more recognizable campaign rhythm, the big story in business right now is, once again, social media. We have two developments to thank for that this week: Mark Zuckerberg’s revelations that the Biden White House pressured Meta to censor Covid-related posts, and the arrest of Telegram CEO Pavel Durov in France for allegedly failing to curb criminal activity on the messaging service.

As Ben wrote on Sunday: “National governments have been increasingly confident imposing a patchwork of regulations that threaten the concept — and the business — of global social media.” These companies spent a decade creating their own set of universal, self-styled utopian values, protected by a legal system unequipped to deal with them and regulators who were slow to see the need.

Policymakers are catching up, messily, and the industry is hitting back, emboldened by a free-speech movement that’s politically ascendant right now. Conservative critics seized on vice presidential candidate Tim Walz’s recent comments about the limits of free speech, and the US Supreme Court has now repeatedly punted on the question of where tech platforms’ responsibilities end. Expect more debate ahead: Entire business models are at stake.

Brendan McDermid/File Photo/Reuters Brendan McDermid/File Photo/Reuters➚ BUY: Skinny jeans. Eli Lilly announced a cheaper, single-use version of its slimdown drug Zepbound, delivered in a self-serve vial instead of the injectable pens that are in short supply as drugmakers struggle to keep up with demand. ➘ SELL: Fast fashion. Shares of Temu’s owner cratered after a gloomy sales outlook that shows one of the last remaining bright spots in China’s consumer economy — demand for cheap, ultrafast clothing and other goods — is fading. Its founder spent just 18 days as the world’s richest person. ⇌ HOLD: Chips. Investors are on edge awaiting Nvidia’s earnings tomorrow, after shaky results from some other tech giants. Options traders are betting big on a swing of up to 10% in either direction for “the world’s most important stock.” |

|

Join me on September 16 for a discussion with Jonathan Kanter, the Justice Department’s top antitrust cop, part of Semafor’s Watchdogs of Wall Street series. I’m bringing together a small group of folks for an evening conversation about corporate power and consolidation, turbocharged by election-year politics. Space is limited, and you can request an invitation by replying to this email. |

|

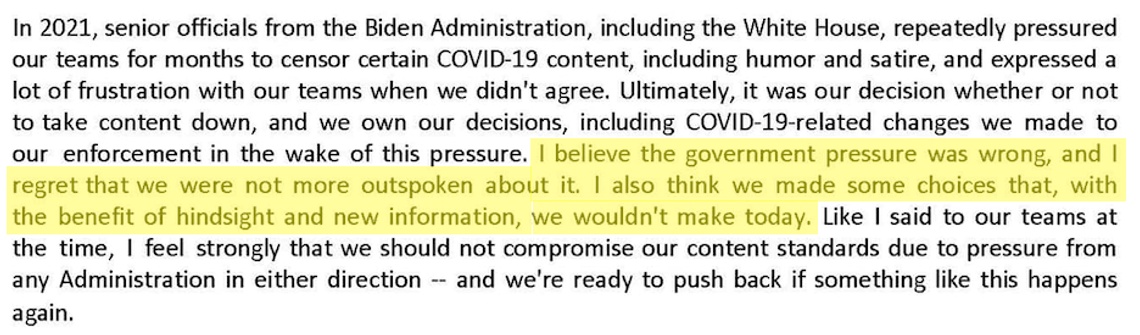

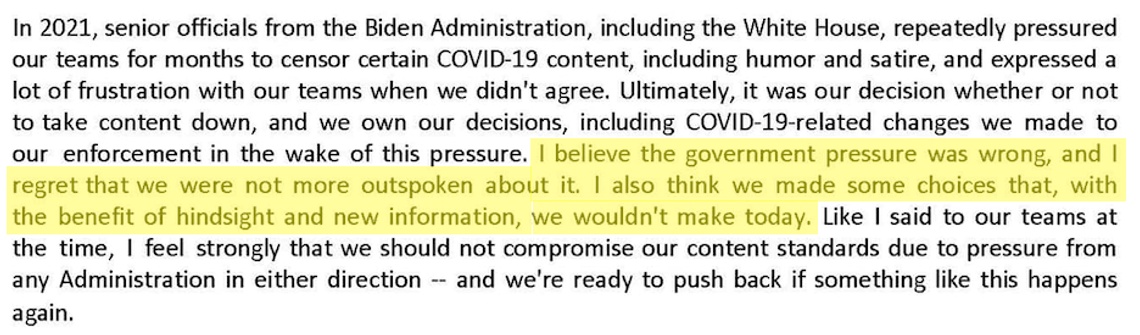

That’s from Mark Zuckerberg’s letter to the US House Judiciary Committee, part mea culpa and part criticism of the Biden administration, which he said pressured Meta to censor Covid-related content. Zuckerberg said it was a mistake to comply with those requests and to demote stories about Hunter Biden’s laptop. Judiciary Chairman Jim Jordan, a Republican who has spearheaded investigations of tech giants over their content-moderation policies, called it a “big win for free speech.” |

|

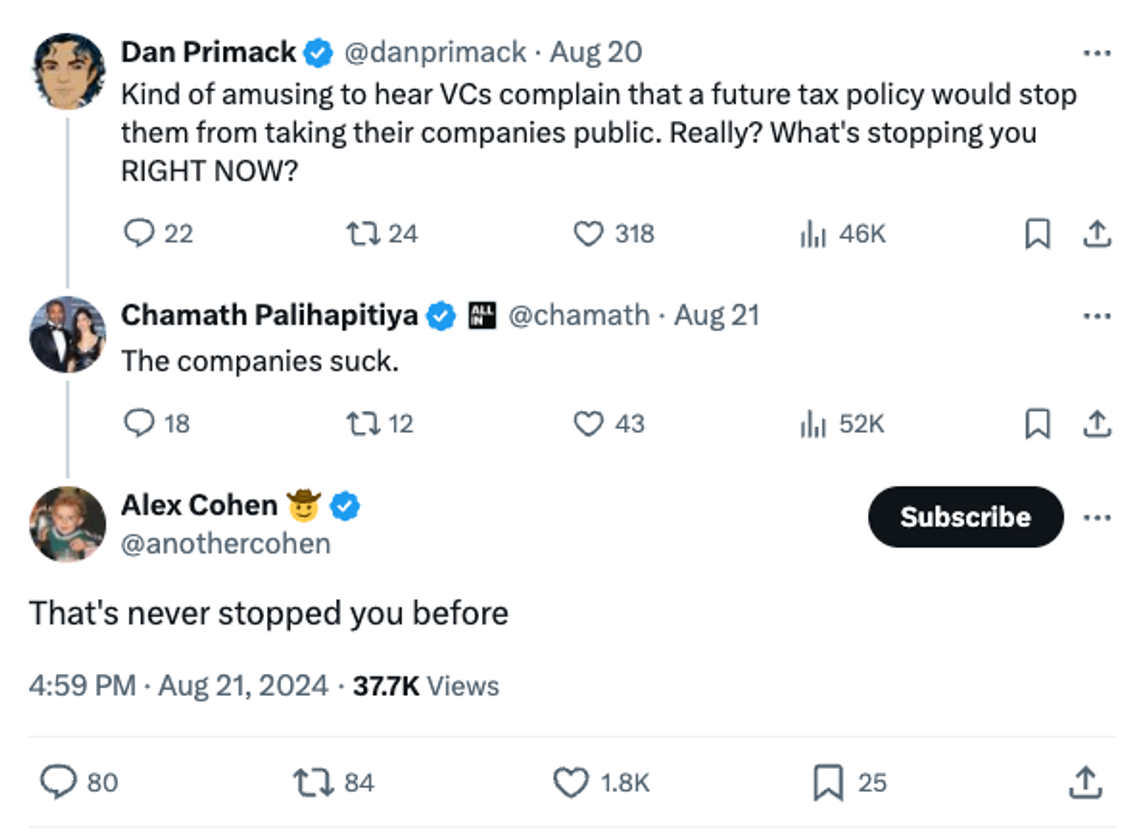

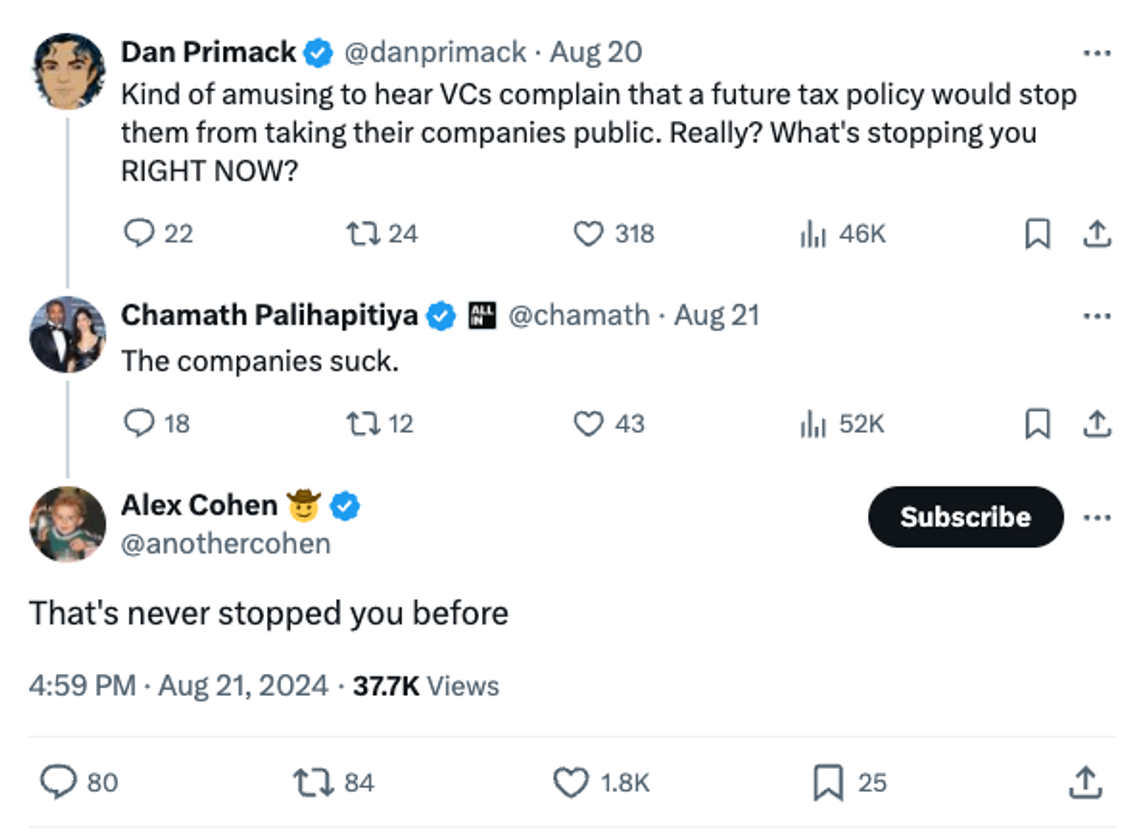

Stefan Rousseau/Pool via Reuters Stefan Rousseau/Pool via ReutersBecause this has never been a problem before: UK Prime Minister Keir Starmer warned that the autumn budget is “going to be painful,” hinting at tax increases he said are needed to cover big pay raises for government workers and to otherwise fill a financial “black hole” left by the departing Conservatives. The prospect of a fiscal surprise harkens uncomfortably back to Liz Truss’s budgetary gamble in September 2022, which crashed markets and gave British tabloids their own Scaramucci clock. Big food fights back: Kroger and Albertsons are defending their $25 billion deal against the Federal Trade Commission’s antitrust cops in an Oregon courthouse this week. The timing for the companies could hardly be worse, with the Harris campaign making food prices and corporate consolidation the centerpieces of her stump speech. The companies say the government is defining the grocery market too narrowly and ignoring the rise of new competitors. (“We are really, really focused on Walmart,” Kroger’s attorney said.) But that defense recently failed Google, which argued in its monopoly trial that TikTok and Amazon were emerging destinations for online search. Green shoots, cold feet: Companies trying to go public have a choice to make and not much time. They can hustle to catch markets that are still at all-time highs before November, or wait until 2025, when interest rates and politics are more settled. There’s plenty of cash ready to back quality businesses, but few of those on offer; it’s a “supply problem,” Morgan Stanley’s Arnaud Blanchard told Bloomberg. Put another way, newly sober investors are no longer prepared to back the money-losing companies they once were. Chalk one up for Jay Powell.  |

|