| In today’s edition, does the US need a sovereign wealth fund? And the next generation of “Trump trad͏ ͏ ͏ ͏ ͏ ͏ |

| Liz Hoffman |

|

Hi, and welcome back to Semafor Business.

It took Mexico’s president one phone call to change Donald Trump’s mind. It took Canada’s Justin Trudeau just two. Both offered mild or already-planned actions in exchange for staving off costly tariffs. Even the tariffs announced on Chinese goods are smaller than Trump had previously threatened, and Beijing’s response to them is muted, a sign that Xi Jinping knows his weakened economy can’t afford a full trade war.

Even as Trump’s broligarchs bulldoze the machinery of government, other parts of the MAGA movement are being tempered by economic realities. American energy companies, mindful of the financial ruin of the 2010s fracking boom, don’t want to drill more. Unions, a historically Democratic bloc that Trump had some success in converting, are criticizing his trade policy. (The USW’s pushback is particularly notable, as it needs Trump to hold the line on blocking US Steel’s sale to a Japanese company.) The stock market is wobbling in the face of tariffs, only keeping its cool because, as Morgan Stanley analysts write, it doesn’t think Trump will follow through.

The next few months will reflect that push-and-pull. Key appointees this week included both MAGA zealots and Republican normies. Elon Musk’s band of 20-something engineers is inside the US Treasury’s payments system, but Congressional Republicans have drawn up a list of tax-cut pay-fors that look positively conventional.

The business community still believes that Trump cares enough about the stock market to tone down his more aggressive policies. His support for the Fed’s decision to hold interest rates steady offers some support for this theory, though his tepid response to the DeepSeek freakout last week casts doubt. As Nasdaq President Tal Cohen told me recently, “the last voice in the room is the most impactful” on the president, which explains both seemingly contradictory moves — and why corporate executives are spending so much time in the room.

In today’s newsletter: Why a US sovereign wealth fund may be a solution in search of a problem and a Wall Street rainmaker scoop. Plus, the next wave of Trump trades are here.

➚ BUY: Texas. Delaware’s status as legal home to corporate America is in danger. Meta may follow Elon Musk’s Tesla and reincorporate in Texas, which is seen as friendlier to conservatives, The Wall Street Journal reported. “There may be some things we need to change,” said the governor of Delaware, which gets a quarter of its revenue from incorporation fees. ➘ SELL: Taxes. Workplace perks like free meals, massages, and gyms may be taxed as Congress looks for ways to pay for a $4 trillion extension of Trump’s 2017 tax cut. Companies have used freebies to lure employees back to the office, and House Republicans think closing those loophole would raise $157 billion over 10 years. |

|

Michigan State University Michigan State UniversityTech CEOs are embracing Donald Trump, but his appointments to key roles suggest their enthusiasm may not have converted a political movement that’s profoundly skeptical of their power. Semafor scoops the latest: Adam Candeub, a leading critic of Big Tech, will be general counsel of the Federal Communications Commission. He has pushed the FCC to force tech companies to be neutral on political speech or lose legal protections under Section 230 of the 1996 Communications Decency Act. Mark Zuckerberg may be happy to get out of the fact-checking business, but any threat to the Section 230 exemption would expose companies like Meta to huge risks. |

|

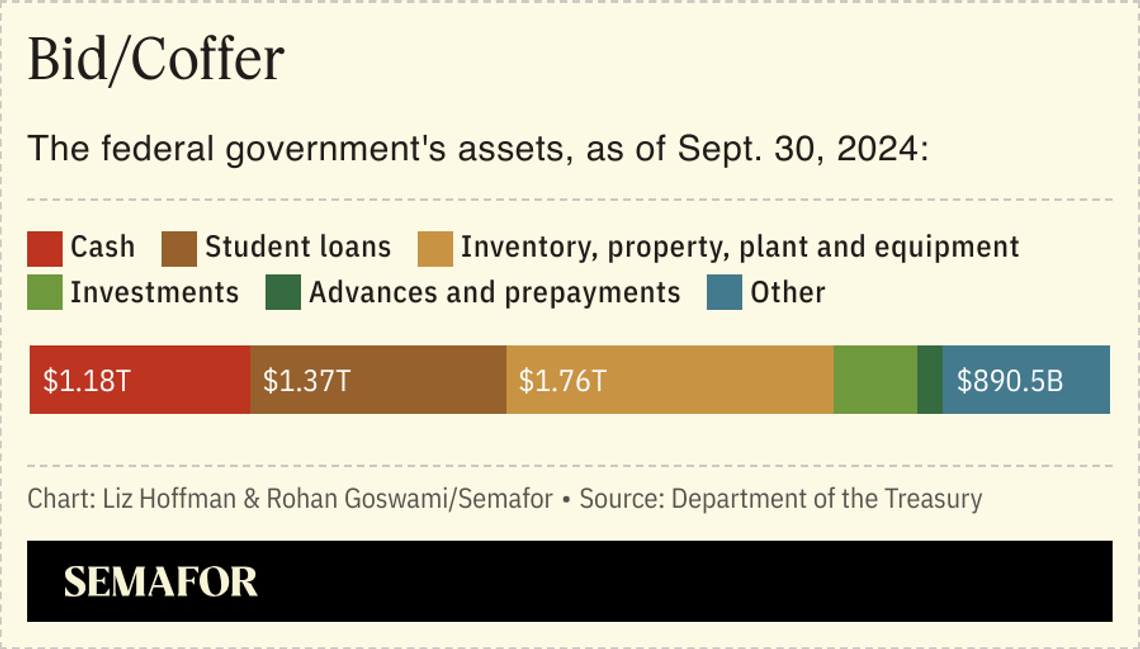

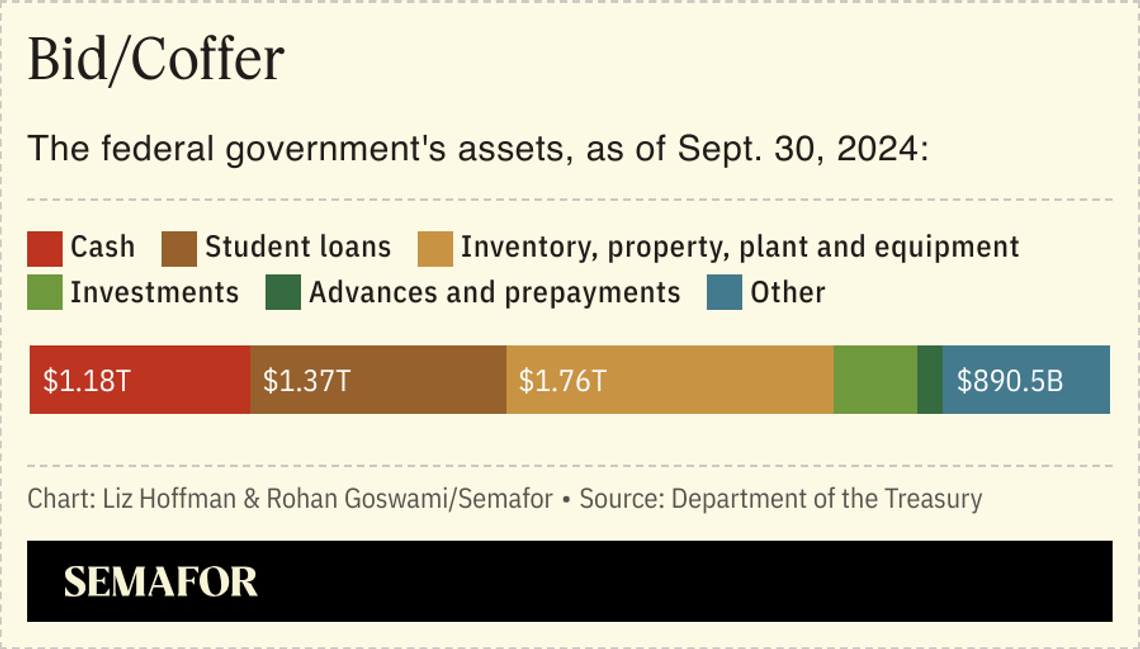

Donald Trump ordered the creation of a US sovereign wealth fund and said it could be used to buy TikTok. Sovereign wealth funds are common in countries with state-owned oil assets, budget surpluses, and weak private sectors. None of those apply to the US, where most assets are privately held, and the public gets its share by collecting taxes that provide services. Economists have warned that a US sovereign wealth fund could crowd out private investment. It would put Washington in the politically unpopular business of choosing winners and losers (remember Solyndra?). The proposal likely needs approval from Congress, which may not embrace a fund that would undermine its own power to set federal spending, and the campaign donations that power commands. The Economist called the idea “a risky solution to a problem that does not truly exist.” “We’re going to monetize the asset side of the US balance sheet for the American people,” Treasury Secretary Scott Bessent said. The US has about $5.6 trillion of assets, mostly student loans and real estate — national parks would make a nice trophy for the billionaire set — but owes trillions more to creditors, employees, and benefits recipients.  There are other levers the US could pull. Opening up new federal lands for oil drilling could unlock national wealth, though the Trump administration is already struggling to coax America’s energy companies to drill more. A focus on Wall Street-style investing could speed up plans to take Fannie Mae and Freddie Mac public. The government’s stake in the mortgage giants was most recently valued at $310 billion, enough to pay every American a $1,000 dividend. |

|

Noam Galai/Getty Images for Global Citizen Noam Galai/Getty Images for Global CitizenDeclan Kelly’s merchant bank is losing its star banker. Mark Shafir, a Wall Street veteran who joined Consello in 2023 with a mandate to turn it into a dealmaking powerhouse, is exploring other job options, people familiar with the matter said. Shafir ran M&A at Citi and came to Consello to turn Kelly’s rolodex of CEOs into an investment-banking business. It worked on General Electric’s aerospace spinoff and Cisco’s acquisition of Splunk, but the steady flow of deals hasn’t materialized. Consello invested in Tidal Partners, the tech-focused investment bank, but has since sold its stake back to the firm. Shafir and Kelly did not return requests for comment. |

|

Bob Strong/File Photo/Reuters Bob Strong/File Photo/ReutersThe next round of Trump trades are here, and they’re certainly creative. Early MAGA-adjacent bets like buying bitcoin and shares of gun makers are getting crowded, pushing hedge funds toward bank-shot ideas. Among the theses gathered by Semafor in recent days: - Mass detentions of immigrants will increase demand for temporary structures to house them. Some of the bidders circling Willscot see its mobile structures as key to Trump’s plan to detain up to 30,000 immigrants at Guantánamo Bay.

- RFK Jr.’s plan to defluorinate water will boost dental stocks. Buy Henry Schein.

- DOGE will replace the IRS with software, which is bad news for tax-prep companies. Market bets against shares of H&R Block have risen since Elon Musk called for simplifying the tax code and reportedly suggested creating a mobile app.

- Trump’s warm relationship with Madison Square Garden owner Jimmy Dolan will break a logjam between MSG, developers, and city officials over a deal that could bring a billion-dollar windfall to the company.

|

|

Thomas Arnoux/ABACAPRESS.COM Thomas Arnoux/ABACAPRESS.COMGiant defense contractor RTX has quietly scrubbed its workplace diversity policy from its website, scrambling to avoid a Pentagon blacklist. Plenty of companies are backing away from diversity commitments under pressure from the Trump administration and a broader shift in public support. But concerns are acute at companies like Raytheon parent RTX that rely on government contracts; see terse statements from Lockheed Martin and Boeing. Trump’s executive order last month required federal agencies to identify up to nine companies or nonprofits under their purview with DEI programs. |

|

Todd Korol/Reuters Todd Korol/ReutersDonald Trump’s tariff threats revealed just how difficult it would be for the country to function as an energy island, Semafor’s Tim McDonnell writes. Energy, more so than other products, is bound by physical constraints that can’t be reengineered, making Trump’s trade aggression antithetical to his key campaign promises. Natural resources are in the ground where they are, and trade between countries is a prerequisite to have reliable, affordable access to energy, Tim writes. |

|