| In today’s edition, a look at how a more fractured, risky world gives business leaders opportunities͏ ͏ ͏ ͏ ͏ ͏ |

| Liz Hoffman |

|

Hi and welcome back to Semafor Business.

There’s a stat in sports called “value over replacement player,” which quantifies how much better a starter is than his substitute. For much of the last decade, the business world’s VORP was incredibly low. Nearly every investment asset went up. So did corporate profits. Cheap debt juiced both. The result was that genuine talent and pluck were rarely rewarded.

It infuriated people who are, or think they are, smarter. It also encouraged groupthink; the easiest thing to do was to go with the flow.

This was on my mind because I’m writing this from the global capital of groupthink: the World Economic Forum in Davos. It’s not just that headline topics are squishily easy to nod along to — this year it’s “rebuilding trust” and, sure, yes, great — but that the consensus hardens into an intellectual cement by the end of the week. And it’s almost always wrong.

But we’re heading out of the low-VORP era in business. The past few years have brought real challenges for CEOs — remote work, hard money, reconstructed supply chains, and political controversies everywhere. I think we’ll start to see the pull of groupthink become a little weaker, and contrarianism start to pay off. Sure, the true gold rushes will still draw everyone (weight-loss drugs, for example) but a world that’s more fractured, risky, and dynamic affords leaders opportunities to zig instead of zag.

Just don’t expect them to start this week in the Alps.

I promise not to flood you with Davos coverage this week. If you want that, sign up here for our pop-up newsletter. But if you’re silently judging all of us from afar, here’s a story from Ben Smith and me that will get your blood boiling.

Reuters/Mario Anzuoni Reuters/Mario Anzuoni➚ BUY: Succession. A record number of CEOs left their jobs in 2023 — more than 1,500, according to Challenger, Gray & Christmas, which bills itself as an “executive offboarding” firm. Plus, the HBO drama ends its run with another Best Drama Emmy. ➘ SELL: Recession. The odds of a U.S. downturn are shrinking but haven’t vanished. The yield curve is still inverted — i.e. investors are charging more for short-term loans than long-term ones, historically a very bad sign — and new data shows Europe has probably been in a recession for weeks already. |

|

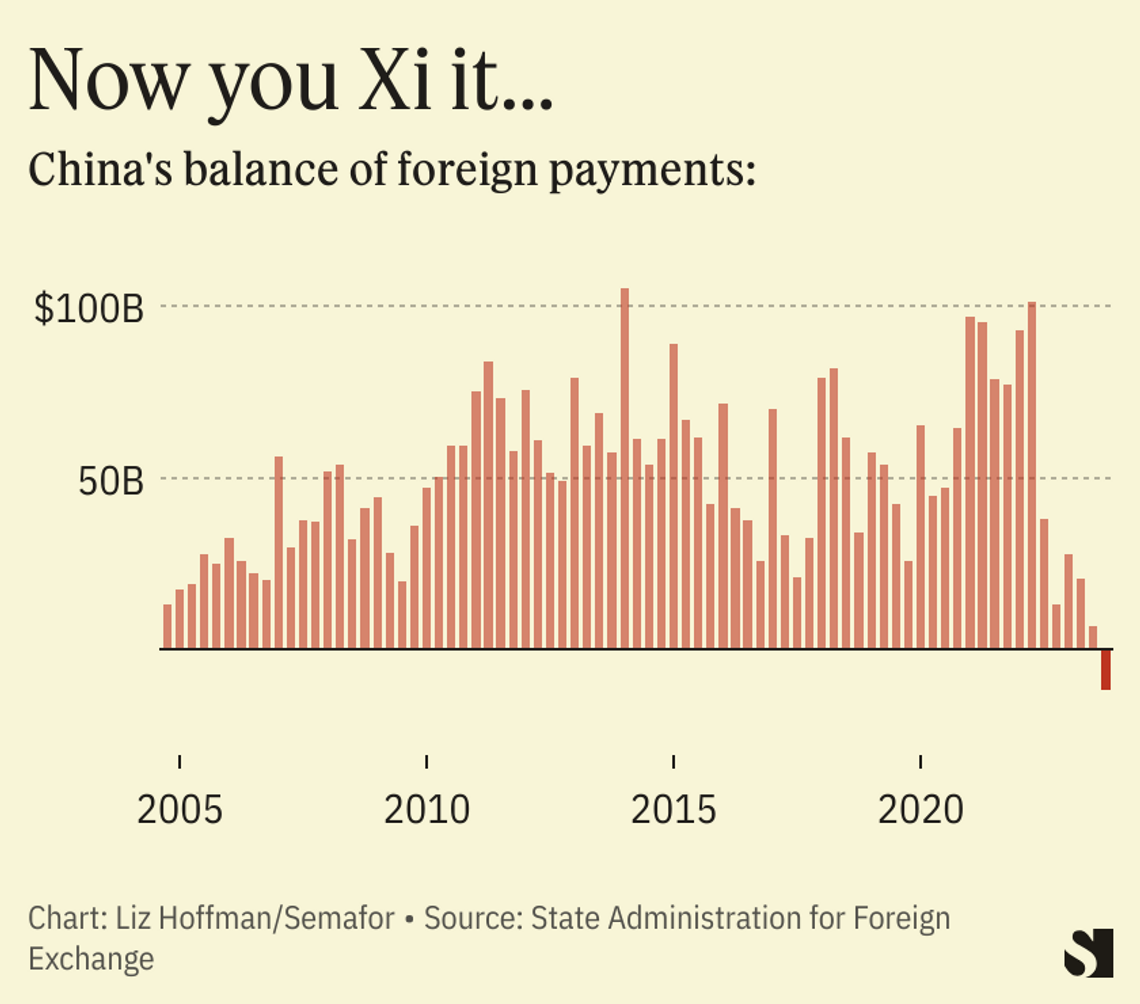

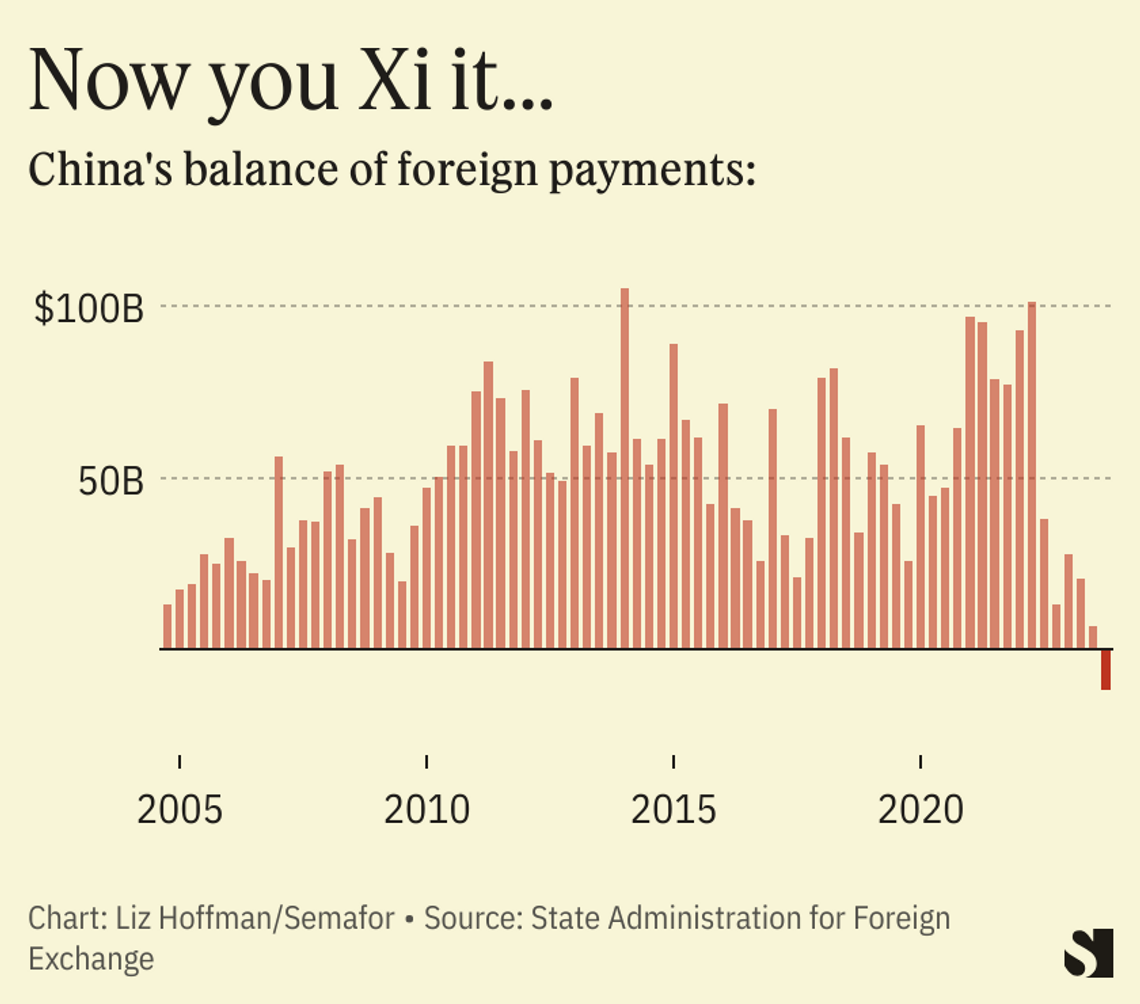

China sent its largest delegation to Davos since 2017, when Xi Jinping came. The mission: to woo back companies that have deemed the country “uninvestable,” rattled by Xi’s raids on private businesses, unpredictable lockdowns, and increasing economic protectionism and military projection. Premier Li Qiang, speaking Tuesday morning, said China was “firmly committed” to opening up its economy and would create “favorable conditions” — a promise that seems firmly at odds with Xi’s crackdowns. “Choosing investment in the Chinese market is not a risk, but an opportunity,” Li said. He was speaking from a position of weakness. China’s economy is slowing, it’s facing its own 2008-style property bust, and decades of one-child policies have set up a demographic doomsday that will need serious foreign investment to counteract it. Instead, foreign investors are fleeing: In the third quarter of 2023, they withdrew $12 billion from the country, the first net outflows in a generation. “The data are undeniably grim,” Chatham House’s David Lubin writes. “Chinese firms are investing more abroad than foreign firms are investing in China, and foreign firms now seem unwilling to invest in China at all.”  |

|

Morgan Stanley agreed last week to pay $249 million to federal regulators and prosecutors to settle a long-running probe into its business of executing big stock trades for investor clients. That’s not a lot of money. Penalty math is always fuzzy but banks have paid far more for relatively minor sins, and the government was prepared to seek more than $500 million just a few months ago. A lot of financial investigations end with the government finding process problems but no substance problem. Consider the WhatsApp settlements last year, more than $2.5 billion across two dozen banks: Bankers were using their personal cellphones to communicate in violation of their firms’ record-retention policies, but regulators found little scandal in what they were saying to each other. The Morgan Stanley situation is the opposite. When I was at WSJ, we analyzed 400 block trades and found that information that’s supposed to be private routinely leaks out — and that Morgan Stanley was by far the worst offender. Clearly bad things happened on the equity desk at 1585 Broadway, but the government was unable or unwilling to find underlying process problems that would turn them into an institutional failing befitting a hefty fine. Morgan Stanley, once the leader in block trades, had hung back while the government investigated. I’m told they were calling clients on Friday, pitching their services. |

|

Unsplash/Mirko Fabian Unsplash/Mirko FabianWhirled Peas: The board of Ben & Jerry’s called for a ceasefire in Gaza, declaring “peace” to be a “core value” of the company known for its core values. To rewind: When Unilever bought the company in 2000, it promised not to meddle in the creamery’s tendency to speak out on social issues. In 2021, Ben & Jerry’s tried to yank its ice cream from stores in the West Bank to protest Israeli control. Unilever instead sold the local rights to a local distributor. Round two will happen in a business world that’s only grown more fraught. These aren’t the Droids you’re looking for: Apple has outfoxed U.S. customs, at least for now. A tweak to the design of its latest watch bypasses an import ban stemming from its patent infringement dispute with a medical-monitoring technology company. Apple hasn’t publicly described the redesign, which will allow the company to bring its watches from factories in China. |

|