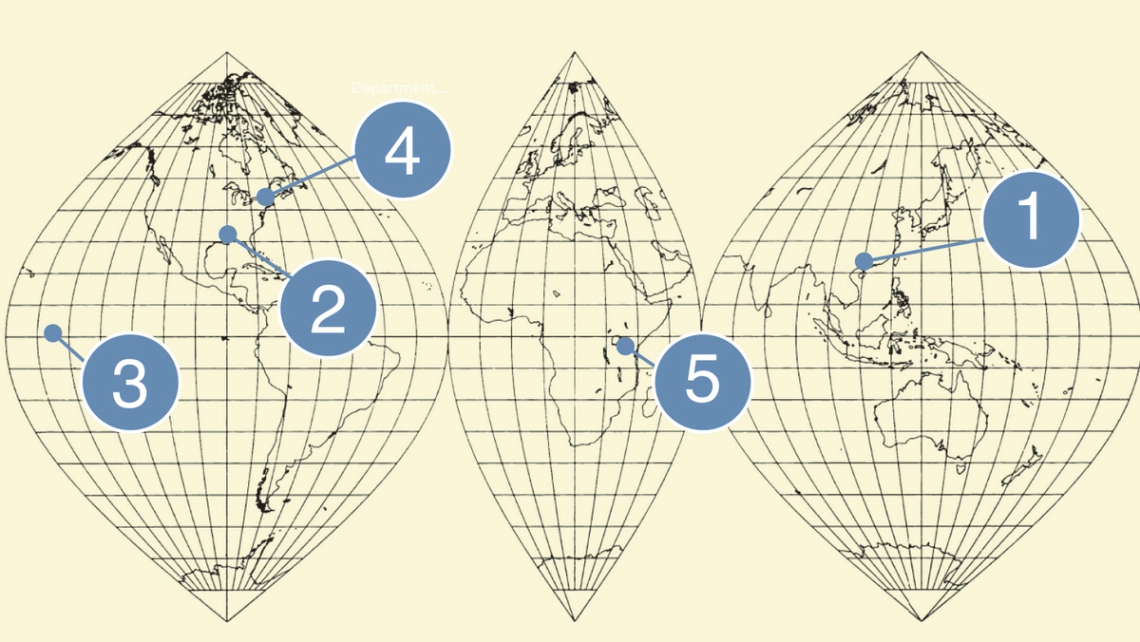

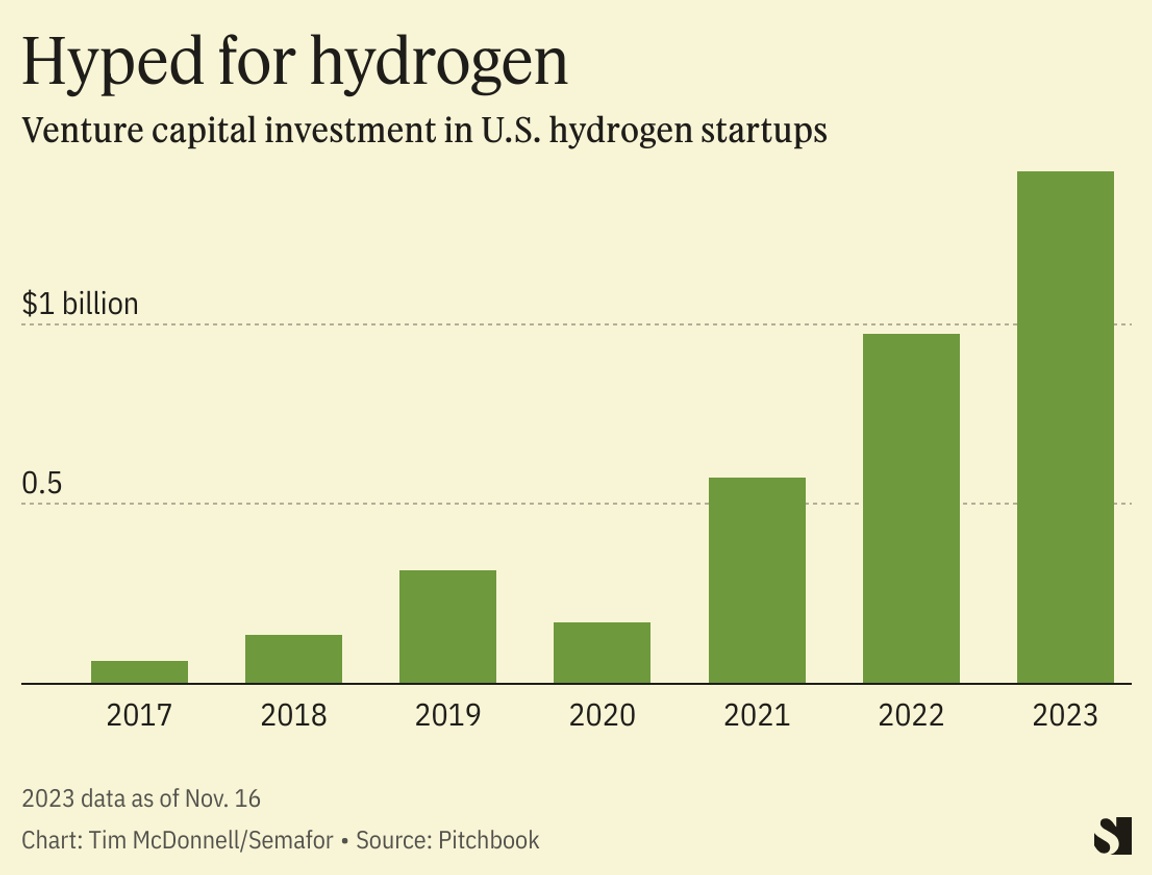

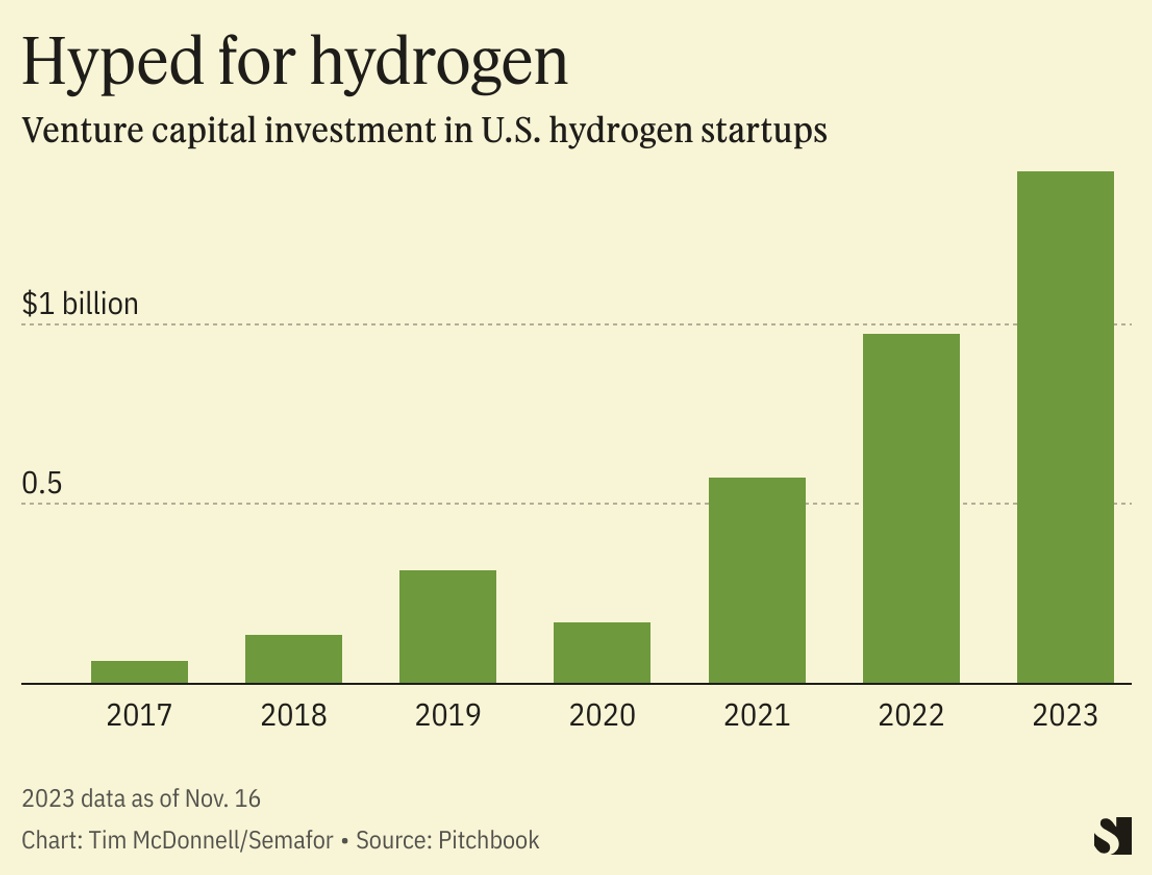

Courtesy Talus Renewables Courtesy Talus RenewablesA new generation of green-hydrogen startups is lining up to take advantage of a lucrative new U.S. tax credit. At the end of December, Treasury Department officials proposed long-awaited rules for what types of green hydrogen — which, when made by using renewable electricity to strip hydrogen out of water, can be used to cut fossil fuels out of shipping, steel and fertilizer production, and other emissions-intensive industries — can qualify for a credit of $3 per kilogram. The proposal sets stricter limits for how renewable energy gets used than what many in the oil and gas industry, which is poised to invest billions in hydrogen infrastructure, had hoped to see, raising cries from some lobbyists that the Biden administration was effectively strangling the nascent technology in its crib. But Hiro Iwanaga, the founder of Talus Renewables, is hyped: “Our systems were designed to work under the strictest interpretations of 45V [the tax credit]. So we’re excited about where it’s going.” Talus closed a $22 million series A fundraising round in November to build modular systems powered by adjacent renewable energy to produce green hydrogen and turn it into ammonia, a key ingredient for fertilizer. Talus was originally focused on installing its systems on farms in sub-Saharan Africa, where fertilizer costs are among the world’s highest, and built its first last year on a nut farm in Kenya. Unsubsidized, the company’s product isn’t cost-competitive with traditional fertilizer in the United States. But with the green-hydrogen tax credit, Iwanaga thinks it will be.  Talus is working on deals with commercial farms in the U.S., as well as mining companies that have their own uses for ammonia and are under pressure from investors and regulators to cut their carbon emissions. Talus is not alone; according to Pitchbook, venture capital investment in hydrogen startups hit nearly $1.5 billion in 2023, and will likely surge higher into companies that qualify for the tax credit now that the rules for it are more clear. |