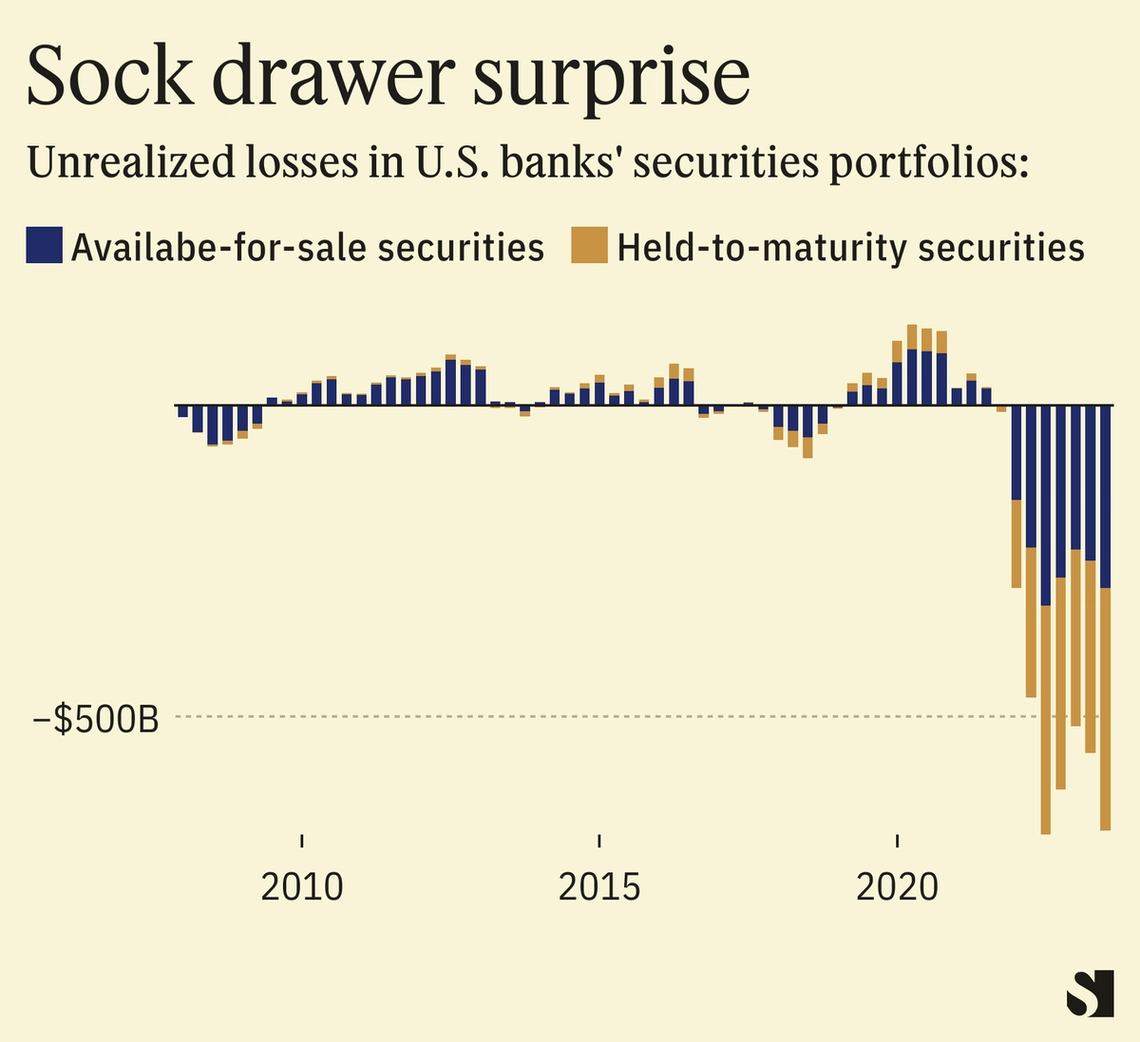

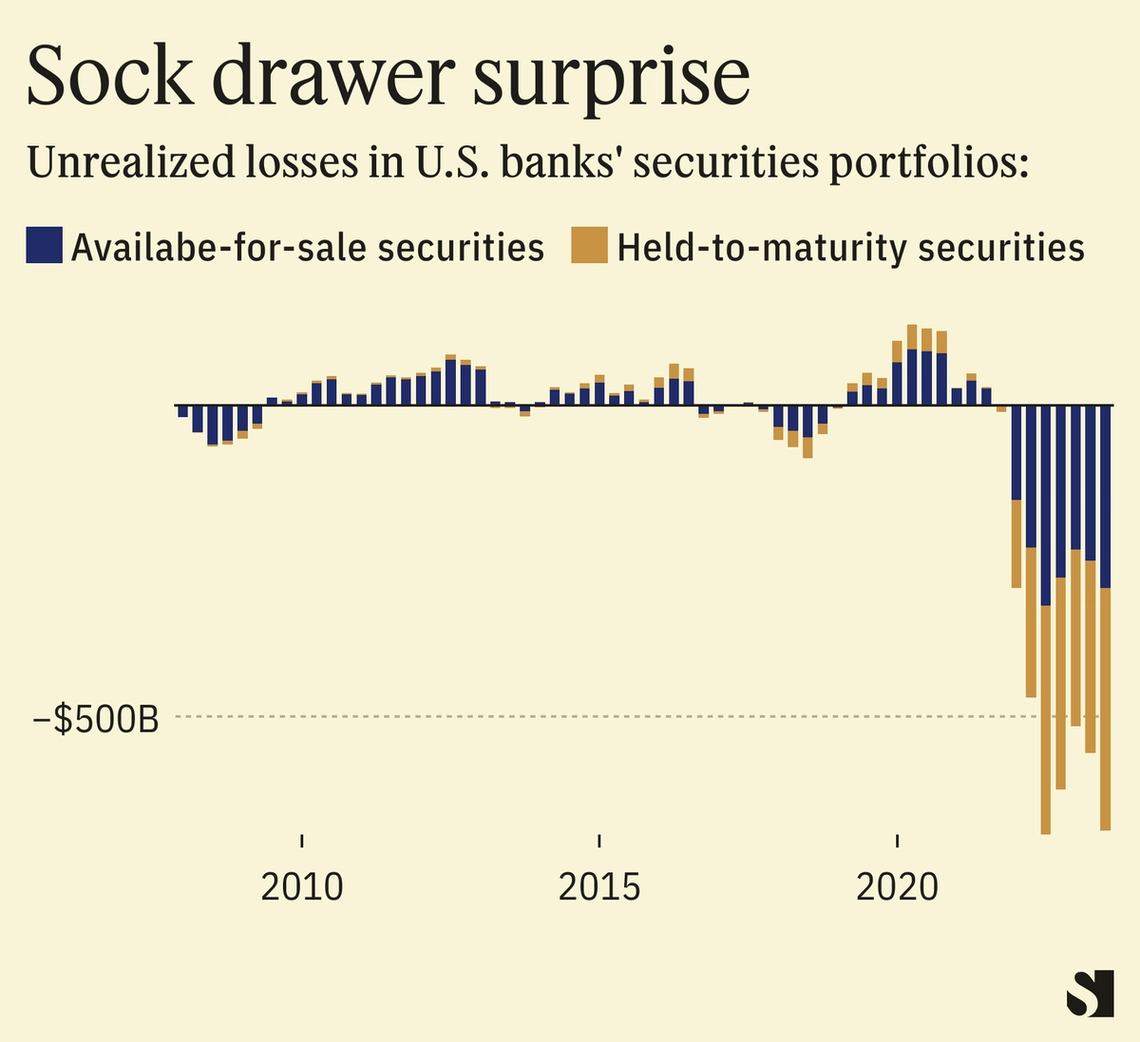

Bank shots: The dynamics that took down three regional banks this spring are still here, and will be for a while. Interest rates will come down more slowly than they went up, and banks are currently sitting on more than $300 billion of paper losses on pre-2022 loans. We’ve moved from an acute crisis to a slower-moving one, where unprofitable banks with shaky funding limp along. They should merge, but they won’t be allowed to, unless it’s via a government auction. — Liz  A restruXuring: Elon Musk willed a financially illogical deal into existence, then ran into the buzzsaw of basic financial math. X’s advertising revenue has plummeted and its borrowing costs have risen alongside interest rates. Its lenders, meanwhile, are nursing their own losses and eager to get the debt off their books. A takeover that began with fireworks will end in the lamest way possible: an out-of-court debt swap. — Liz  Reuters/Gonzalo Fuentes Reuters/Gonzalo FuentesStill Xi persists: The Chinese leader will take a harder line on Taiwan after the island’s Jan. 13 elections, in which the Beijing-friendly Kuomintang party is polling competitively. More military maneuvers and political crackdowns will spur more U.S. trade blacklists and sanctions, which Xi is willing to bear, the slowing Chinese economy be damned. In his New Year’s Eve speech, he told Chinese citizens to expect “winds and rains” this year. — Gina Chon Media matters: We’ve been calling the 2024 U.S. campaign the Fragmentation Election and one thing that means is that an array of unexpected, medium-sized media figures — podcasters, influencers — will have their 15 minutes of presidential campaign glory. Successful media companies have been built on less! — Ben Smith Green’s back: This could be a turnaround year for ESG investing, which saw some outflows in 2023. The backlash from Republicans will intensify as the U.S. election heats up, but smart investors will tune that out — cooling inflation will boost renewable energy companies, and the long-overdue arrival of climate disclosure rules from the SEC will make it easier to tell leaders from laggards. There’s still plenty of money to make from fossil fuels, but COP28 made the green trajectory of the global economy undeniable. — Tim McDonnell |