Gold and silver hit record highs as investors seek safe havens in a world with few of them. Bullion neared $4,500 an ounce Tuesday, more than double since 2022 — a year when both Russia’s invasion of Ukraine shattered a period of relative geopolitical calm and the onset of inflation eroded investors’ trust in government currencies. “It’s a little bit of a spicy time right now,” Anduril’s CEO told Semafor in a recent interview, and periods of unease are metals’ time to shine.

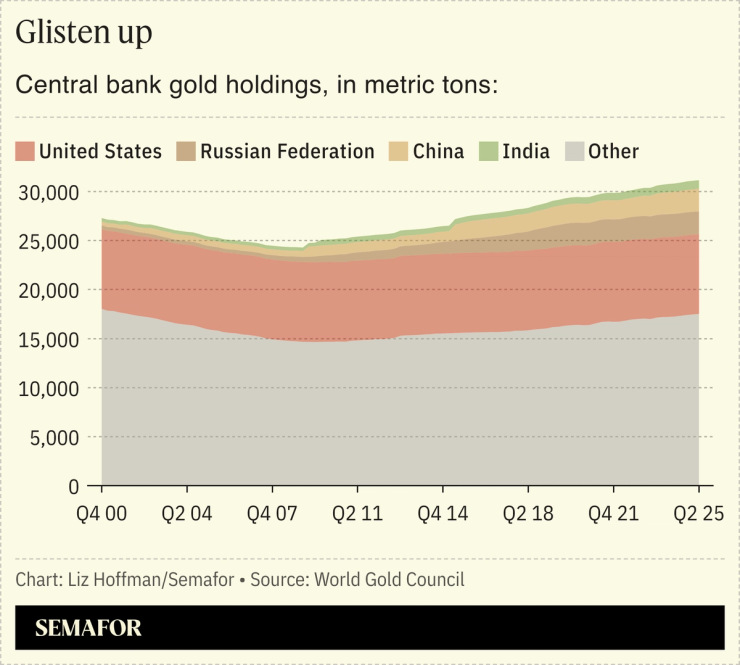

In addition to retail boosters — you can buy gold bars at Costco, where sales jumped double digits last quarter — central banks have turned to gold as a replacement for US dollars. Russia, India, and China are among the biggest buyers, and globally, central banks now hold more gold than US Treasury bonds. The prospect of lower interest rates also helps by reducing the opportunity costs of holding non-yielding assets like bullion.