Big Tech giants have embraced borrowing to fund their AI buildouts. Amazon’s $15 billion bond offering Monday follows Alphabet ($25 billion), Meta ($30 billion), and Oracle ($18 billion) issuances, and has US corporate offerings on track for one of its busiest years ever.

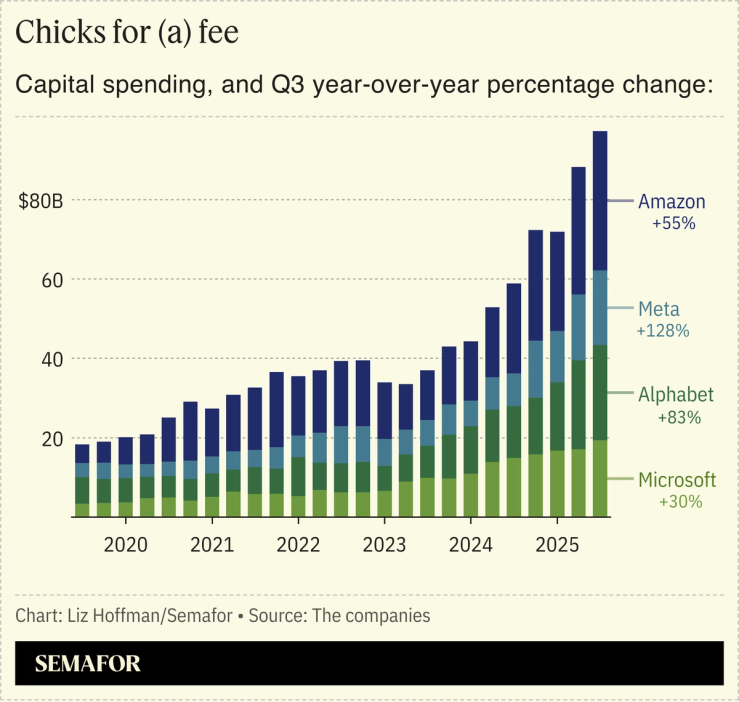

Early in the AI boom — the salad days of spring 2025 — calls for calm rested on the idea that big tech companies were cash-flow machines and funding their AI ambitions out of profits from prosaic advertising and software businesses. The speculative borrowing and equity offerings of past bubbles, in fiber and railroads, hadn’t materialized yet. (Liz may have top-ticked that argument.)

It has now: AI-related borrowing is pushing $200 billion this year, according to the Financial Times, and stealth debt is at work in less obvious ways, amplifying investment funds’ bets and hidden in off-balance-sheet leases. Some tech giants are “reaching the limit of what their free cash flow can fund,” 5C’s Michael Koester said at a Semafor event last week, noting that “Oracle is already levered.” Investors have noted that, too: Oracle’s bonds have slipped and its stock price is now below where it was before disclosing its big deal with OpenAI.