Liz’s view

Another day, another $100 billion AI investment. Gargantuan spending on data centers, chips, and new models has prompted wary comparisons to past capital-spending booms, from railroads to fiber-optic cables, that built magical and ultimately useful things but ended in tears for those writing the checks.

Is this time different?

Let’s assume that AI is as much of an economic game changer as the railroads and the internet, and then look at the money.

Analysts expect big tech companies to spend some $300 billion on AI this year, a bit more than telecom companies spent laying cable in 2000. AI would account for 2% to 3% of all US capex, versus estimates of as little as 6% and as much as 20% for railroads in the 1840s, though we’re likely nowhere near peak spending for AI.

But the question isn’t whether the investment is massive — it’s where the money comes from. The robber barons and telecom wildcatters borrowed to build their empires, and dragged their financiers down with them when the music stopped. We got the Panic of 1893 and the dot-com crash. Fracking companies spent twice their free cash flow in 2016, raising the rest from shareholders left with little to show when the shale boom ran out of steam.

Most of the AI investment is coming from tech giants spending the profits produced by their dominant businesses in advertising (Google and Meta), software (Microsoft), and cloud computing (Microsoft and Amazon). Those cash cows aren’t quite created equal — AI lifts cloud businesses and threatens to totally upend advertising — but all are healthy enough to back the checks their owners are writing. “It’s an epic amount of money,” Vlad Barbalat, who manages more than $100 billion as chief investment officer of insurer Liberty Mutual, told me recently, “but it’s real money.”

In economic terms, this boom is being funded, not financed. While some players like CoreWeave appear precariously leveraged, the big money in AI is coming from profits. These companies aren’t mortgaging the future; they’re spending current winnings. Bad funding choices can hurt, but they have smaller blast radii. Dumb financing decisions, at scale, tend to tug on threads that unravel in strange places, sparking systemic meltdowns.

Big caveat here: An AI stumble by the big tech companies, which make up a third of the S&P 500 by market cap, could uncover other people’s dumb financing choices. Steep slides in their stocks would trigger untold margin calls and, as we saw in the early days of the pandemic, force selling of whatever’s at hand — say, US Treasury bonds. That would be bad.

But for now, the big players aren’t betting money they don’t have. That makes this boom potentially more sustainable.

In this article:

Room for Disagreement

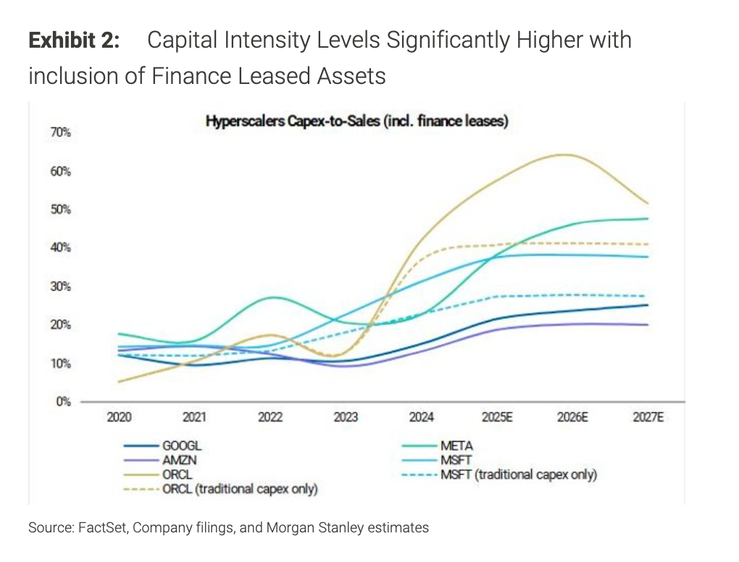

The ratio at hyperscalers like Google and Oracle of capital spending to sales has already passed that of the frackers in the 2010s and is nearing peak dot-com fiber territories, Morgan Stanley analysts point out in a note today. Take a closer look at data-center leases — which for technical reasons aren’t included in reported cap-ex figures — and the numbers get more lopsided.

Notable

- Xi Jinping is worried about a bubble, too. “Do all provinces in the country have to develop industries in these directions?” China’s president told a Communist planning panel in July, referring to AI and electric vehicles.

- Spending on building data centers has overtaken office construction, and “that’s not even counting the equipment that goes into them,” NYT reports.