The News

African banks need to take the lead in more effectively organizing and deploying the continent’s capital for investments that will boost growth, top bank executives said.

“Capital is available but it’s not being channeled into the opportunities that exist in Africa,” Aigboje Aig-Imoukhuede, chairman of Access Holdings which owns Nigeria’s largest bank, said at the African Financial Summit in Casablanca on Monday.

About $4 trillion is estimated to be available across various sovereign and private money stores in Africa, according to the Africa Finance Corporation. It is a level of capital that can be absorbed by African economies to attend to many development needs, the challenge being one of efficient allocation, industry leaders said.

“We need more pension funds, sovereign funds and others to invest in the capital of banks, for us to lend to small and medium enterprises and the productive sector,” said Jeremy Awori, chief executive officer of the Ecobank group that operates in 34 sub-Saharan African countries, at the same event. “We should not just be investing in sovereign paper,” he said, alluding to a perception that most African domestic financial assets flow towards short-term government securities.

In this article:

Know More

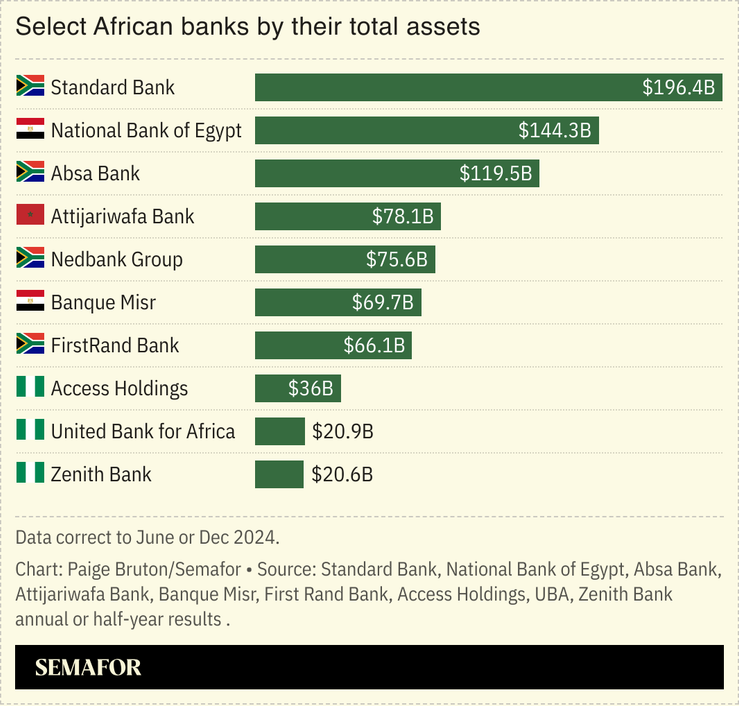

The top ranks of African banking are dominated by firms in northern Africa and South Africa whose assets range from tens to hundreds of billions dollars. South Africa’s Standard Bank is the largest with $196 billion in assets.

Relatively smaller bank groups like Access Holdings have embarked on an expansion drive over the past few years to build a pan-African network able to provide cross-border capital deployment services. It concluded a $110 million deal this month to acquire the National Bank of Kenya from the Nairobi-based KCB Group. Access Holdings’s total assets rose by 26% to $35.8 billion in the year to September, boosted by a near-50% increase in customer deposits.

The rise of fintech has driven up savings and payments volumes in Africa, but only 2% of about 700 million African bank accounts are applied towards investments, by Aig-Imoukhuede’s estimation. “We need the right policy context to get hundreds of millions of Africans investing at scale, not just saving,” he said. African fintech should diversify such that startups become “investment powerhouses,” partnering with traditional banks for the kind of scale that can produce transformative impact, he said.

Despite these ambitions, there is still an understanding that African banks operate in an economic environment with certain limitations that do not apply in developed markets or even other emerging markets.

While Asian banks, for example, operate in export-led economies that are parts of sophisticated regional trade networks, African banks are in economies whose health fluctuates to the tune of commodity prices and the landmark African free trade agreement has yet to fully take off, said Xavier Jopart, a financial services advisor at McKinsey. Compared to the liquid financial markets in places such as Tokyo, Hong Kong, Jakarta and Singapore, capital market activity in Africa remains nascent and even shallow, Jopart said.

“It doesn’t help our banking sector that only 15% of trade on the continent is within Africa,” said Afreximbank executive vice president Haytham El Maayergi, partly due to road and port infrastructure designed by former colonial powers to ship goods to Europe.

The View From DR Congo

Africa’s leading banking groups are targeting DR Congo, enticed by one of the continent’s fastest-growing economies and the promise of a lucrative mining sector, despite the ongoing conflict in the country’s east. Top banks from Kenya, Nigeria, Tanzania, and South Africa are among the newly arrived or expanding institutions over the past 18 months as their leaders eye a market that still produces higher than average banking profits. Local banks are starting to face more intense competition and, alongside earlier African entrants, are lobbying regulators and local politicians as tighter ownership caps rules are being considered.

Notable

- African banks are fighting against foreign currency challenges as shortages and volatile exchange rates choke trade flows across the continent but digital platforms are helping.