The News

DR Congo’s leading mobile operators are in talks with Elon Musk’s Starlink to expand connectivity in hard-to-reach regions of the central African country, executives told Semafor.

Africell DR Congo CEO Kory Webster told Semafor the US-backed operator was in “active conversation” with Starlink for an operational partnership. An executive from Vodacom, speaking on condition of anonymity, said the market leader was also exploring satellite collaboration with Starlink in DR Congo, calling it a “complementary” service “to extend coverage in hard-to-reach areas.”

The potential partnership comes as Kinshasa leans on satellites to close yawning coverage gaps amid slow broadband fiber rollout: It granted Starlink a license in May 2025, reversing an earlier ban on the company, and the government has backed a separate $400 million national satellite plan. Around 30% of the population used the internet in DR Congo in 2023, according to the International Telecommunication Union.

Airtel, for its part, announced a group-level agreement with SpaceX in May to integrate Starlink across its footprint. Alongside satellite options, operators are extending their reach via a new Vodacom–Orange rural tower joint venture to build and operate solar-powered sites for underserved areas.

In this article:

Know More

Africell plans to “accelerate” its multimillion-dollar investment in DR Congo, Webster told Semafor, having paid back a $100 million loan from the US Development Finance Corporation (then OPIC) three years ahead of schedule in 2024. The company is also playing a “critical lead role” in the US-backed Lobito Corridor rail project, said Webster, laying fiber and telecom links between Angola, DR Congo, and Zambia.

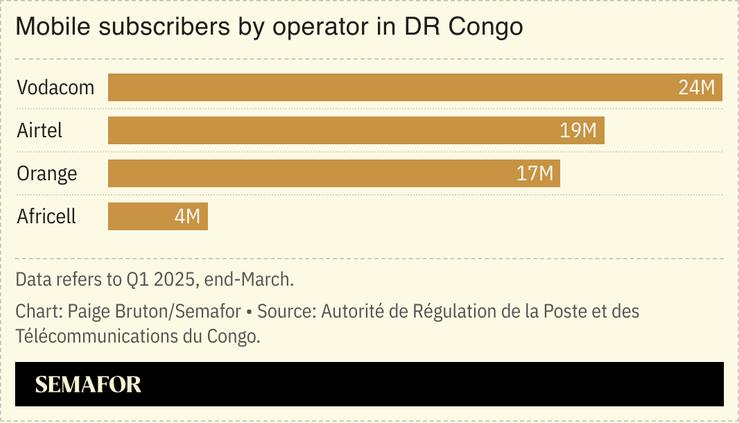

The operator, which currently holds just 6% of DR Congo’s mobile market, is also busy pushing for regulatory reforms to boost competition. “It’s important for the regulator to implement national roaming and number portability,” Webster told Semafor, arguing current rules lock customers to incumbent operators.

Vodacom, the biggest mobile operator in DR Congo, is not as supportive of introducing number portability, according to the executive who spoke to Semafor. Separately, industry experts point to fundamental technical hurdles. “Number portability means you need a common database of all numbers from all operators in one place. Who has this database? Nobody,” an industry expert told Semafor. The regulator’s chair reiterated portability as a priority in a March 2025 address, without giving a timeline.

Room for Disagreement

Experts have questioned Starlink’s impact on connectivity in DR Congo to date as well as the country’s readiness for satellite technology. “Nothing has changed since Starlink’s arrival,” Albert Kabeya, a telecoms analyst in DR Congo, told Semafor, noting the company relies on grey-market distribution through a single official distributor and unofficial operators.

On satellite technology’s capabilities, Kabeya was dismissive: “Starlink isn’t a core telecom operator. It’s a cosmetic operator.” He argued that satellite bandwidth remains too expensive for mainstream use, noting “you can’t transport Kinshasa’s data volume with Starlink — it’s impossible, too bulky,” suggesting the technology serves mainly as backup rather than primary infrastructure.

Ruben’s view

Starlink’s promise to connect rural DR Congo with the internet faces a fundamental mismatch: The satellite service requires smartphones or computers, while most Congolese rely on basic 2G phones that can’t access it. This explains why mobile operators see Starlink as a backhaul partner rather than a direct competitor — the satellite service ultimately depends on their infrastructure to reach end users.

The mobile industry trade body GSMA’s finding that 51% of Congolese live within mobile coverage but remain offline reveals the real bottleneck: smartphone affordability. At $305, DR Congo’s average smartphone price far exceeds the African average of $201, putting internet-capable devices out of reach for most in a country where the average person earns $640 a year, according to the World Bank.

Even DR Congo Airtel CEO Thierry Diasonama argued in September for “the suppression of customs duties for telephones and computer equipment,” noting that Chad’s removal of such taxes had significantly increased technology access. For all its technological sophistication, Starlink cannot bypass DR Congo’s device affordability challenge, making mobile operators essential partners in any meaningful digital inclusion strategy.

Notable

- How Starlink is stitching together a pan-African strategy in small bytes. It’s aggregating small, high-value pockets across the continent.