The News

Morgan Stanley chose trading executive Ted Pick to succeed CEO James Gorman, ending a succession battle that Gorman once compared to Succession, but which in the end had little drama.

Gorman said in May that he would retire within a year, and the job was widely considered Pick’s to lose. He beat out two contenders: Andy Saperstein, who runs the firm’s retail brokerage arm, and Dan Simkowitz, who runs its asset-management business catering to institutional investors, will both stay on as co-presidents.

Blunt and, at least in his younger days, famously profane, Pick is a Morgan Stanley lifer with a contrarian streak. He revived its trading arm after the 2008 crash and wooed back clients who had dropped the firm, worried it wouldn’t survive.

Morgan Stanley today, which Pick will lead starting Jan. 1, bears little resemblance to the firm that limped out of that crisis. Gorman, CEO since 2010, tilted it toward managing money for clients rather than taking risky swings with its own capital. He drafted a deliberately boring blueprint that’s been copied across the industry, where ego has been checked and small, steady profits are prized.

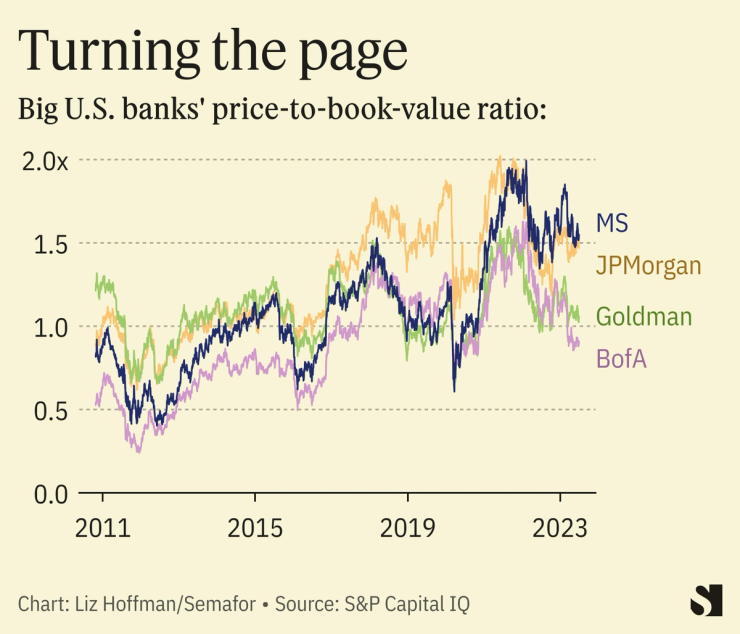

The bank has been healthy enough to strike big deals, buying E*Trade and Eaton Vance for a combined $20 billion, while competitors were sidelined by missteps. Depending on the day, only JPMorgan’s stock is more richly valued by investors.

“Remembering how close we came to the abyss, we have our strategy now,” Pick said in an interview. “We have a wealth and asset-management machine that we’ll continue to feed. And a premier investment bank — one with higher lows and maybe lower highs, but plenty of running room.”

Addressing top executives this morning, Pick said “it’s impossible to fill” Gorman’s shoes. His boss chimed in: “There are lots of shoes in the store that will do just great.”

In this article:

Know More

Pick is a rarity among today’s Wall Street CEOs: A true Wall Streeter. He started out doing corporate stock deals and later ran the trading floor — a contrast to the commercial bankers, consultants, and former lawyers who mostly run big banks today.

But rising interest rates have put market risk back in the spotlight and threaten to punch holes in banks’ books. Morgan Stanley still has a $1.1 trillion balance sheet, most of it in the Wall Street arm Pick ran.

Jay Clayton, who’s worked with and opposite Pick for 20 years, including as chair of the Securities and Exchange Commission, called him a “markets and risk expert,” adding: “He never wastes my time.”

Liz’s view

Gorman, 65, wanted to avoid the drama that’s attended every CEO transition at Morgan Stanley since 1997, and he’s done so. The firm’s merger that year with Dean Witter brought in Phil Purcell, who was ousted in a 2005 mutiny that brought back former executive John Mack.

Mack lasted five years, and saw Morgan Stanley through the crisis, but his career never recovered. The old guard for years remained suspicious of Gorman, a former McKinsey consultant turned Merrill Lynch executive, especially as he axed trading desks and doubled down on retail brokerage with the acquisition of Smith Barney.

In the years I covered the firm, Gorman constantly bristled at the idea that the feeling was mutual. He would insist that he hadn’t pivoted Morgan Stanley away from its Wall Street roots so much as grafted on a steadier Main Street business. Investment banking was the “engine” of the firm, he often said, and wealth and asset-management provided the “ballast.”

Maybe so, but as the wealth businesses raked in profits — and did so with a fraction of the capital and drama of investment banking — the firm’s future seemed further from the trading floor. That focus sharpened when Morgan Stanley bought E*Trade in 2020 and fund manager Eaton Vance in 2021.

Choosing Pick ensures that Morgan Stanley stays more balanced, and gives the firm’s Wall Streeters a known ally.

Another factor: Gorman’s preference, shared by the board, was to keep all three executives around if possible, people familiar with the deliberations said in recent months.

Pick would almost certainly have quit had either of the other two gotten the job, say people who know him. Saperstein, an operator with a Wharton-Harvard-McKinsey resume but pool-and-patio vibes that hits with the brokers, and Simkowitz, a polished investment banker who’s been running asset management, were always more likely to stay in supporting roles — and are, at least for now.

A savvy bit of portfolio shuffling gives them both bigger jobs. Saperstein inherits Simkowitz’s asset-management business, now bulked up after the Eaton Vance acquisition and still on the hunt for deals. Simkowitz gets Pick’s old job overseeing the firm’s dealmakers and traders. Pick is younger than both of his new lieutenants, so if they do stick around long-term, it’s not with an eye on his job.

“This just doesn’t happen on Wall Street,” Gorman said in an interview.

Room for Disagreement

Pick isn’t entirely without baggage, having overseen the stock-trading desk that is now the focus of a federal investigation. Early in the succession deliberations, there was internal concern that the probe might ensnare him, people familiar with the process have said.