The News

Botswana’s acquisition of a 24% stake in a Belgian diamond company is one of the most ambitious attempts by an African country to move beyond extracting minerals to adding more value.

The three-year old HB Antwerp is worth “hundreds of millions” of dollars, co-founder Rafael Papismedov told Semafor Africa. The investment will help the company open a new facility in Botswana and hire about 350 more people by 2026.

“Diamonds remain the mainstay of our economy,” said Botswana’s Minister of Minerals and Energy Lefoko Moagi, speaking during the announcement of the partnership in late March. “And indications are that they will remain so for the foreseeable future.”

The diamond sector accounts for some 20% of Botswana’s GDP and over 90% of its foreign export earnings and just over 30% of government revenue.

Botswana’s government is also keen for more transparency using HB’s proprietary platform to be able to trace diamonds from source to the consumer. “The legacy of the diamond industry is that everything is built on trust and a handshake,” Papismedov told Semafor Africa. “As disruptors we say don’t trust, verify.”

Yinka’s view

As the world’s second largest diamond producer, Botswana is already well-established within the global diamond supply chain but not just because it has some of the world’s highest quality gems. The government has a joint venture with the world’s second largest diamond manufacturer, De Beers and also owns a 15% stake in the company.

Botswana’s president, Mokgweetsi Masisi, has suggested he is prepared to upend a decades-long diamond mining arrangement with De Beers unless the industry giant improves its terms. The current 10-year license deal, which ends in June, entitles Botswana to buy up to 25% of the diamonds mined in their joint venture, Debswana. Industry insiders speculate that Botswana wants to push for closer to 50-50. Botswana earns around $4.5 billion per year in sales, taxes and royalties from its partnership with De Beers.

While the HB partnership is exciting and progressive in an industry not known for being exciting nor progressive, especially in Africa, it’s a relatively small deal in real terms. Paul Zimnisky, a diamond industry analyst, sees some elements of the HB Antwerp deal as “posturing” by Botswana to help push a better deal over the line with De Beers.

But Zimnisky agrees that Botswana is serious about improving transparency and moving down the value chain like more African countries are trying to do. Zimbabwe (lithium), DR Congo (cobalt, copper), and Zambia (copper) have all talked in recent months about more downstream processing taking place in their countries or even producing the electric vehicle batteries themselves in Africa.

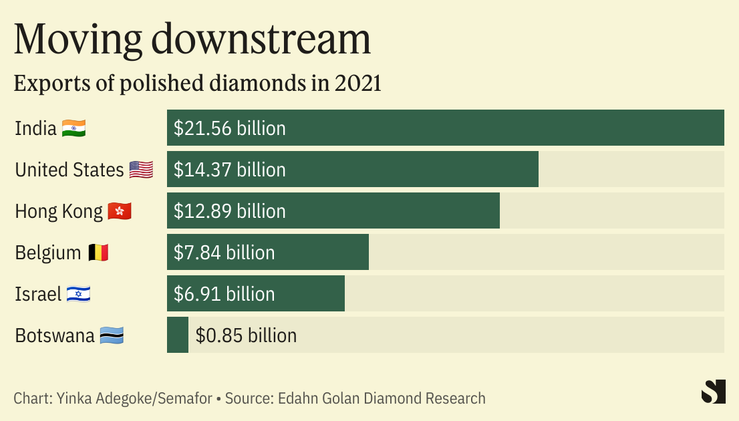

But it’s different with the diamond trade. India still controls about 95% of the rough diamond processing market. “Traditionally it’s been difficult to move down the supply chain to beat them on quality and price,” Zimnisky said.

Room for Disagreement

Botswana and other diamond miners have a limited amount of time to earn their maximum advantage. “At some point, more lab-grown diamonds will be sold than naturals,” said diamond analyst Edhan Golan in a research note published in March.

The View From Johannesburg

With the diamond industry dominated by De Beers and Russia’s Alrosa, smaller industry players have had to consider merging. “I think it’s healthy for an industry to have smaller and bigger players, but I think the multitude of single-asset companies is difficult,” one South African mining CEO told Reuters in February.

Notable

- “We now know how the diamond industry operates. We used to receive 10% of the stake, but now, under my leadership, we are receiving 25%.” Voice of America reports on how Botswana President Masisi is pushing for a better deal with De Beers.