Alphabet’s $11.5 billion bond sale is notable for two things: Its debt is really cheap, and a chunk of it will outlive anyone who bought it.

Alphabet is paying less on the £1 billion, 100-year debt slug than the average American consumer is paying for a 30-year mortgage (compared to yields on government bonds.) The company’s century bond was set to be issued Tuesday at 1.2 percentage points above UK gilts, according to a person familiar with the matter.

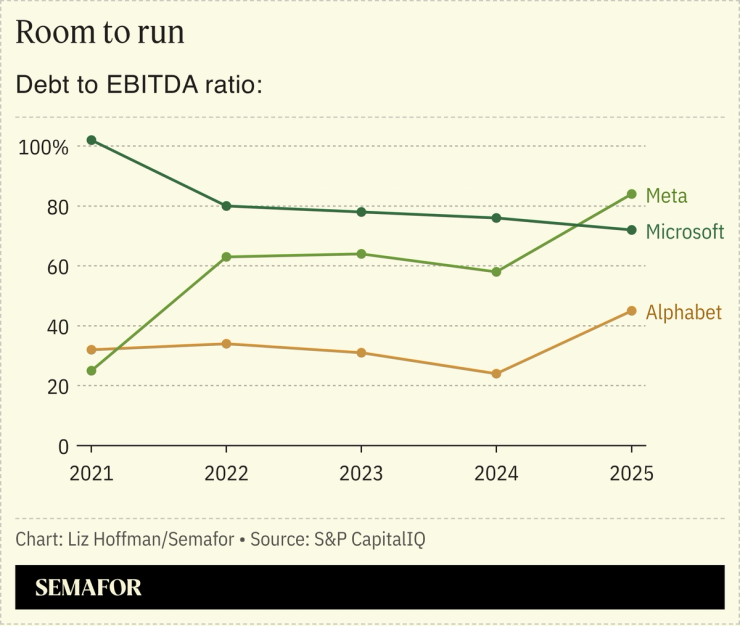

The foreign sales follow Alphabet’s $20 billion US dollar bond sale Monday, bringing its two-day haul to nearly $32 billion — a sign of just how expensive the AI buildout is getting. Alphabet has more borrowing capacity than some of its rivals.

Corporate century bonds are rare. The last one was in 2021 from French utility EDF, and the last one from a tech company was Motorola’s in 1997. They are more common from governments, which have forecastable 100-year expenses like pensions and defense. But as I previously noted, companies making centuries-long bets on AI now have centuries-long bills to pay.

One other note on Google’s cash grab: The roughly 3 billion Swiss franc portion appears to be the largest by a non-Swiss company, and could make that market more enticing to issuers — especially as global investors edge away from the US dollar.