Liz’s view

A big complaint about modern financial markets is that they have the foresight of a goldfish. This critique, popularized by such proletariat rabble-rousers as Larry Fink, says CEOs can’t focus on the future because they’re sweating the next 90 days and obsessing over their stock prices. So they buy back shares while their factories rot and their products slide into obsolescence.

But look at the engine of the global economy, Silicon Valley, and you’ll see something that looks suspiciously like the long-term stewardship Fink begged for back in 2015.

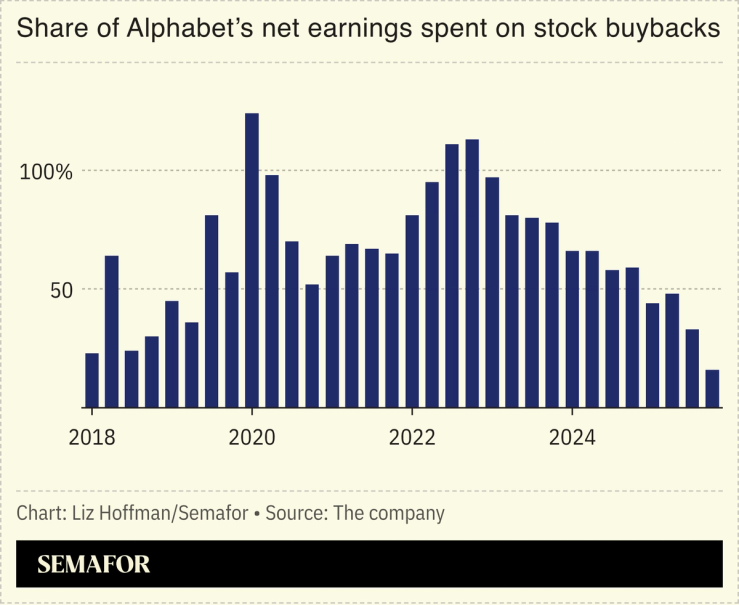

Elon Musk’s deepest desire is to fling enough data centers into space so that humanity can live there forever. Jeff Bezos is building a clock inside a mountain designed to tick once a year for the next 10,000. Alphabet is hawking the tech industry’s first century bond since the late 1990s — after a quarter in which it spent the smallest percentage of its profits buying back its own stock, just 16%, in eight years.

And the tech companies are plowing shareholders’ money into AI investments that will take years to pay off, if they ever do, because they believe that it’s the right bet. (Their personal obsession with human longevity may be a factor here: If you plan to live for 150 years, and your net worth is tied up in a company you control, you care less about the stock price tomorrow than you do about the stock price in 150 years.)

Of course, tech CEOs until now have been able to make these millennial bets without sacrificing short-term riches. The wilder the moonshot, the richer they got, on the backs of FOMO-seized investors.

But that immunity is already fading, as Oracle has learned over the past few months. The tradeoff that Fink lamented is likely to hit stronger players as the cost of the AI race grows. Even moonshots come with bills to pay.

Congrats, Larry, you got your long-termism. It comes with AI porn generated in space, but you got it.

Notable

- The other AI debate about long-termism is, of course, whether it will kill us all.