The News

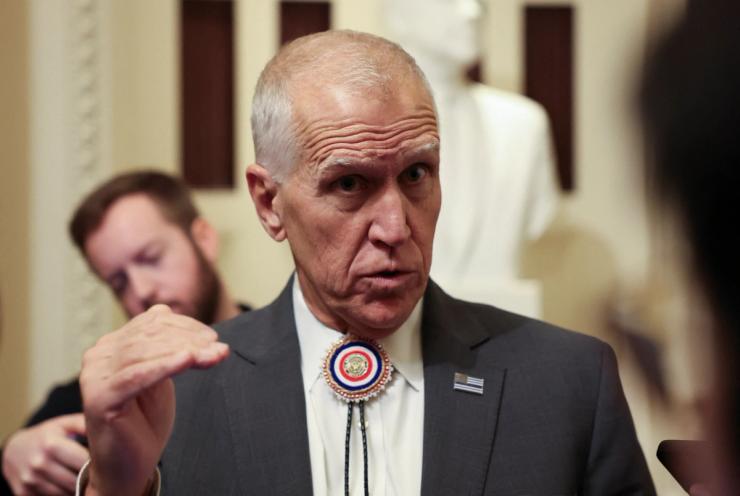

President Donald Trump has a Thom Tillis problem.

The retiring North Carolina Republican senator recently doubled down on his pledge to keep the Senate Banking Committee from advancing any of Trump’s nominees to the Federal Reserve until the Justice Department abandons its investigation into Fed Chair Jerome Powell.

If the White House thought tapping former Fed Governor Kevin Warsh might change Tillis’ mind, it’ll have to find another way.

“I actually sent a note to the president saying, ‘It’s a great pick,’” Tillis told Semafor Friday after Trump made the announcement. “But I’m not changing.”

“This could have been frictionless,” Tillis added. “But if they choose friction, what else can I do except create more friction?”

It’s not an empty threat: Tillis’ opposition would tie the Senate Banking Committee, leaving GOP leaders no good options to get Warsh to the floor. They could try and bypass the panel, but it would require the support of 60 senators — and with moderate and progressive Democrats already signaling their opposition, that’s next to impossible.

“I’m pretty sure that they wouldn’t get 51,” Tillis said.

Tillis would not comment on whether any of his fellow Republicans have asked him to back down. Asked whether any have expressed their support for his position, he replied: “Many of them understand the profound importance of Fed independence.”

“And people said, ‘Why are not other ones getting out [in opposition]?’” Tillis recalled. “I said, ‘Why should they? I’m not running for reelection.’”

Trump signaled Friday that he grasped the impasse, telling reporters that “if [Tillis] doesn’t approve, we’ll just have to wait until somebody comes in that will.” Tillis’ response: “That’s fair, but it could be next Congress.”

“And that Congress may or may not be with the Senate Republican majority,” Tillis said. “Do the math.”

And even if Republicans hold the Senate, they could lose seats — making confirmations more difficult than they would be now.

Until then, Powell is expected to remain chair, Senate Banking Committee ranking member Elizabeth Warren, D-Mass., said: “That’s always been the rule.” Though his term as chief ends in May, he’d join previous Fed chairs who have stayed on in an acting capacity.

In this article:

Know More

Warsh beat out Trump adviser Kevin Hassett and BlackRock executive Rick Rieder, among others, for the job. With many investors seeing Warsh as a highly credible pick, markets had little reaction to Friday’s news.

Even Canadian Prime Minister Mark Carney, who’s recently clashed with Trump, praised Warsh as “a fantastic choice to lead the world’s most important central bank at this crucial time.”

The Senate agreed in 2006, when lawmakers confirmed Warsh to the Fed by voice vote. But two decades later, Democrats are wary of greenlighting any of Trump’s picks given the president’s ongoing campaign to bend the central bank to his will.

Some senators on Friday questioned Warsh’s pivot from warning about inflation to matching Trump’s calls for lower interest rates.

“Donald Trump makes clear this past spring and summer he only wants a Fed chair who’s going to lower interest rates — and suddenly, Kevin is a convert,” Warren said. “He has made it pretty clear that if Donald Trump wants a sock puppet, that’s what he’s willing to be.”

More moderate lawmakers also expressed concerns. Sen. Mark Warner, D-Va., said in a statement that “it is difficult to trust that any chair of the Federal Reserve selected by this president will be able to act with the independence required of the position.”

— Additional reporting by Shelby Talcott and Burgess Everett

Room for Disagreement

The administration’s Senate GOP allies are still projecting confidence that they’ll be able to advance Warsh’s nomination.

“Federal Reserve independence remains paramount, and I am confident Kevin will work to instill confidence and credibility in the Fed’s monetary policy,” Senate Banking Chair Tim Scott, R-S.C., said in a statement. “I look forward to leading a thoughtful, timely confirmation process that carefully examines his vision for focusing the Federal Reserve on its core mission.”

Notable

- Warsh and Treasury Secretary Scott Bessent’s shared mentor, billionaire Stanley Druckenmiller, told the Financial Times he’s “seen [Warsh] go both ways” on monetary policy: “The branding of Kevin as someone who’s always hawkish is not correct.”

- A former Fed attorney told Reuters that Warsh would be less of a “moderating influence” on deregulation than Powell was.

- Warsh is also expected to try to shrink the Fed’s balance sheet and overhaul its economic models, per Bloomberg.