| | The Inflation Reduction Act was too little, too late to help the top U.S. electric bus maker compete͏ ͏ ͏ ͏ ͏ ͏ |

| Tim McDonnell |

|

Hi everyone, welcome back to Net Zero. The U.S. climate tech world suffered a minor shock this week when Proterra, a 20-year veteran of the electric bus business, filed for bankruptcy. What happened? The short answer is, making EVs is hard, and Proterra is hardly alone in feeling financially precarious. The market fundamentals for e-bus manufacturing are mixed: Demand is growing and the economics can pencil out for buyers, but production costs are high, especially if you’re competing against China’s top EV maker. Also today: A text from the front lines of Maui’s devastating wildfires, and a chat with the spendiest climate tech VC. If you like what you’re reading, spread the word.  - $1.2B carbon removal bet

- Oil demand hits record

- 🟡 Why Proterra went bust

- Minerals vs. rainforests

- 🟡 ‘Burned to the ground’

- Seizing a new energy market

- Flight prices take off

- Emissions wins

- 🟡 Unions vs. EVs

- 🟡 The spendiest climate VC

|

|

$1.2 billion carbon removal bet |

Courtesy Climeworks Courtesy ClimeworksThe U.S. awarded $1.2 billion to projects in Texas and Louisiana that will withdraw carbon pollution directly from the atmosphere. The projects, which will be the biggest of their kind globally, are the first block in a larger Department of Energy effort to boost the global capacity for “direct air capture” 400-fold. Occidental Petroleum, which has reinvented itself as a “carbon management” major, and a consortium led by applied science company Batelle and startups Climeworks and Heirloom, were the recipients. Meanwhile, the DOE said it will pay for carbon removal credits directly from projects like these, effectively pushing and pulling an industry that remains prohibitively expensive and needs to scale up much more quickly. |

|

Barrels of oil consumed per day globally in August, a record. The oil market is getting tighter as a result of OPEC+ production cuts and surging demand in China, the International Energy Agency warned. Prices for gasoline and other refined products will likely rise more this year, but the IEA predicts they will level out next year as the rate of demand growth cools. |

|

Why Proterra went bankrupt |

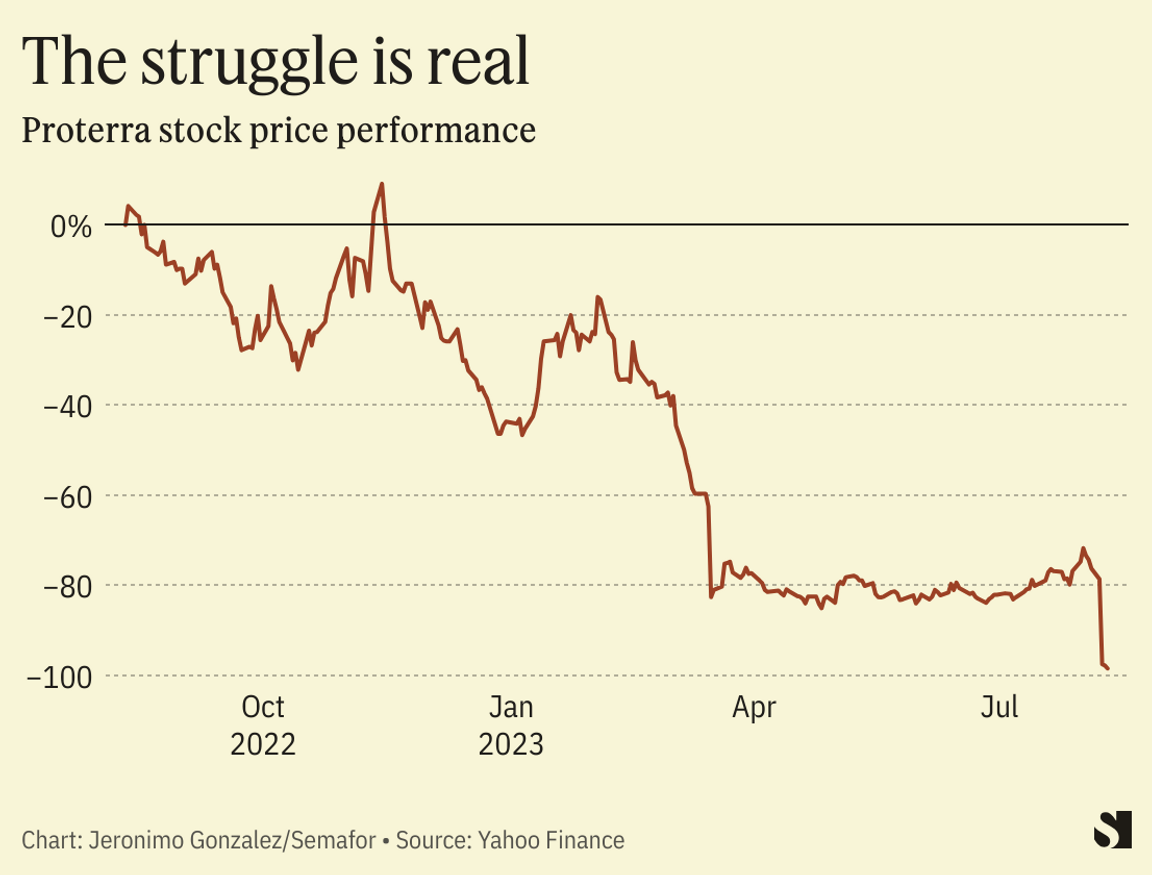

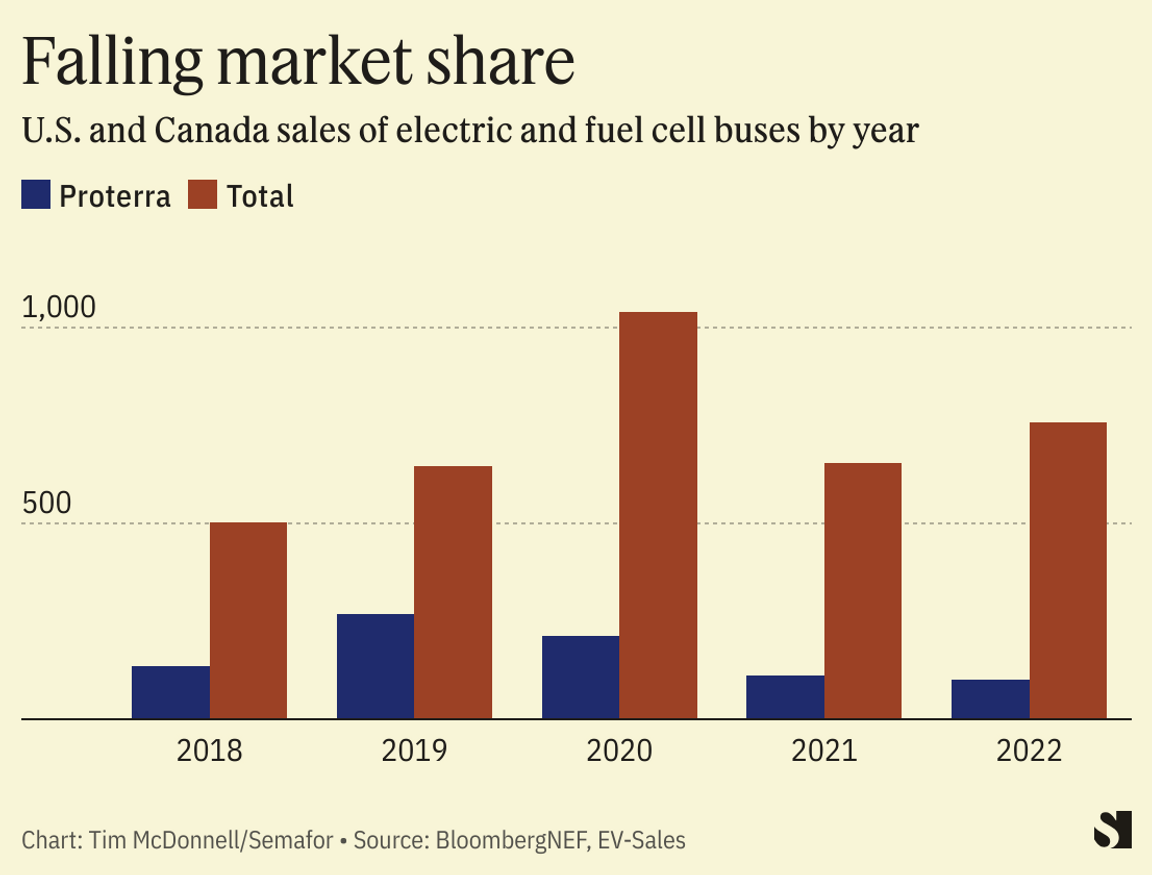

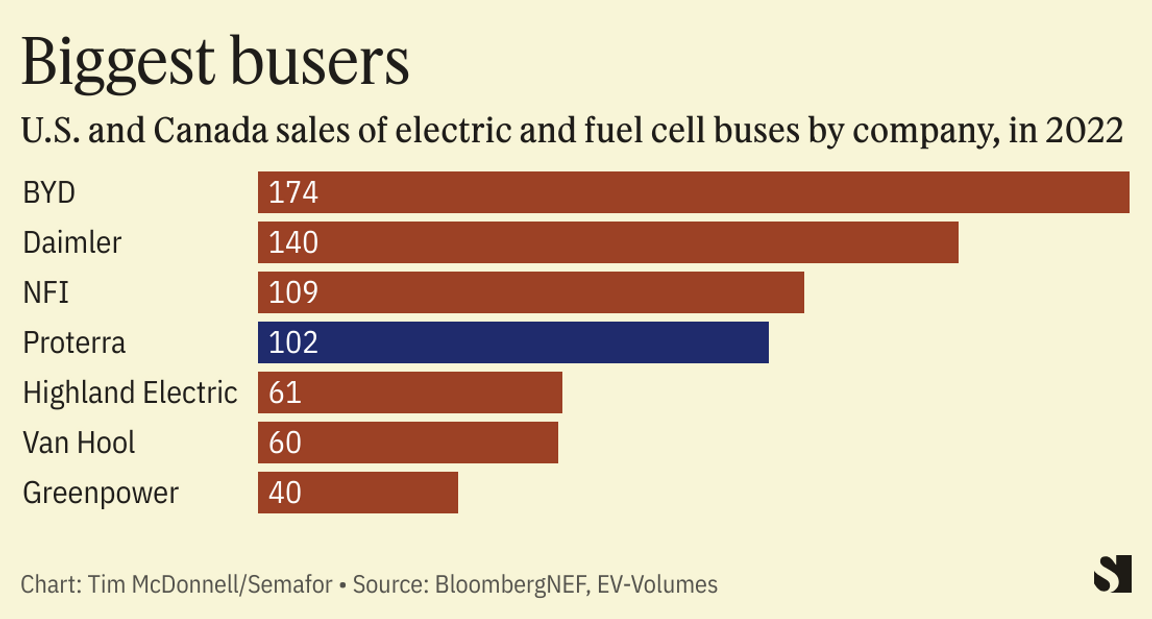

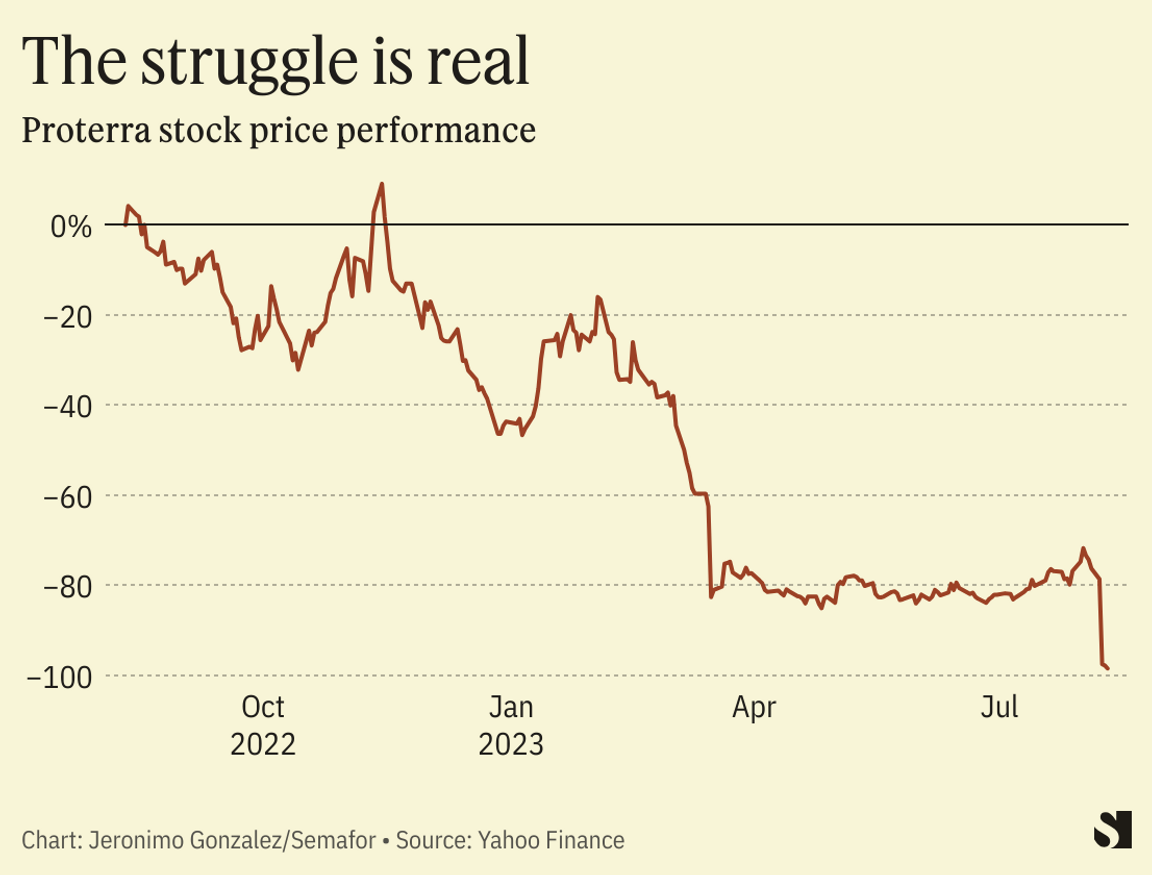

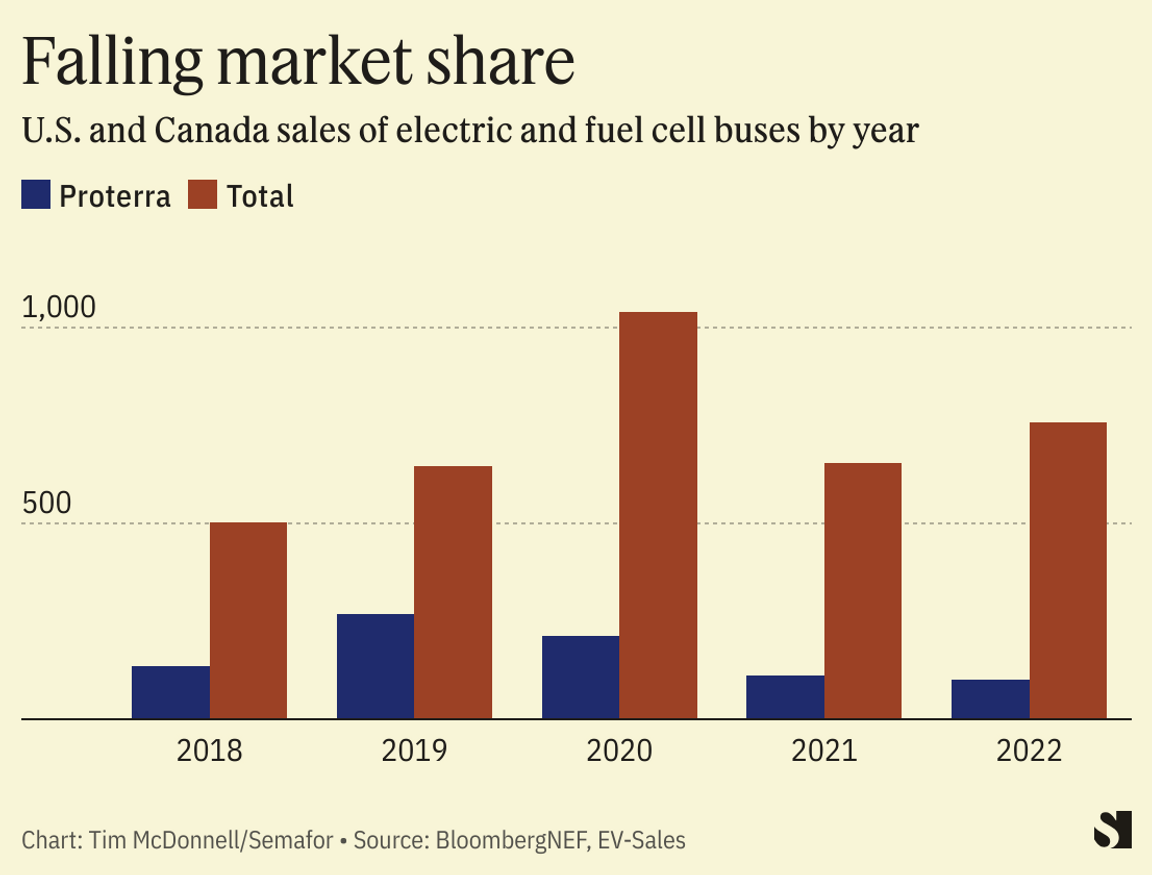

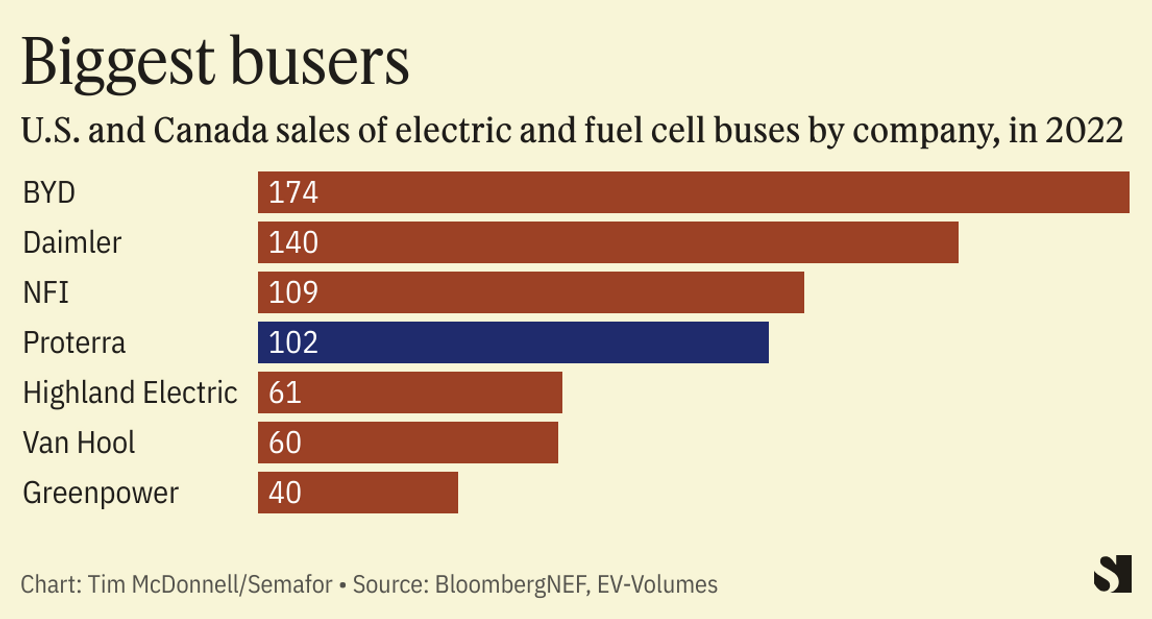

Courtesy Proterra Courtesy ProterraBy Tim McDonnell THE NEWS The largest maker of electric buses in the U.S. filed for bankruptcy this week, a move blamed on new product lines failing to overcome the high costs of e-bus manufacturing. But Proterra’s demise points to another issue: Even with unprecedented levels of government support and customer interest, some sectors cannot compete against top manufacturers in China. The company will slow down battery production but otherwise continue operations as normal for now while it uses the bankruptcy proceedings to either sell off or recapitalize the different sections of its business. TIM’S VIEW Proterra’s struggles reveal how difficult it is to run a profitable electric vehicle business in the U.S., even in a post-Inflation Reduction Act world.  Buses make a good candidate for electrification because they run on predictable schedules, in fleets. The high fuel consumption of traditional buses makes the lifetime ownership cost of an e-bus competitive or, depending on state and local subsidies, even cheaper than an internal combustion engine bus, according to BloombergNEF. But they have drawbacks as a business. Unlike passenger vehicles, buses are typically customized for each customer, limiting automation and factory efficiency. They get ordered in batches (when a city gets a new budget, for example), leading to inconsistent production schedules and orders with suppliers. They take a long time to build — 12 to 18 months from when a contract is signed to when a bus is delivered and paid for, in Proterra’s case — which makes them vulnerable to having their margins eaten away by inflation.  Proterra’s nickel-based battery chemistry was also more expensive than the lithium batteries used by most of its competitors, said Nikolaos Soulopoulos, head of commercial transport research at BloombergNEF. Its earnings report indicates the company spent $6.5 million more on materials for its products in the first quarter than the revenue those products generated. And ultimately, the domestic market is small: 750 e-buses were sold in the U.S. and Canada in 2022. The company reported a loss of $250 million in the first quarter of this year, five times more than in the same quarter last year, and laid off 300 staff in January. “It’s not something where you can change the fundamentals from one day to the next,” Soulopoulos said.  High production costs are universal for EV makers, from the tiniest startup to Ford and GM. BYD — Proterra’s main rival in the U.S. electric bus market — has addressed this problem through unparalleled economies of scale and by vertically integrating its supply chain. Tesla has cultivated a profitable side hustle in dominating the charging network. Major automakers still lean on their traditional internal combustion business for profit. In Proterra’s case, new business lines it launched over the last few years in batteries, charging stations, and electric drivetrains could have had a similar effect on cash flow (in addition to $10 million in forgiven pandemic stimulus loans the company accepted in 2020). Instead, according to the company’s bankruptcy filing, they held it back. (A Proterra spokesperson declined to comment, and referred all questions to the filing.) The company wrote that its bus business “requires a large amount of working capital” but that potential investors were more interested in the new sideline businesses and “not inclined to invest” in the company if it meant being exposed to losses from the bus division. To read the Room for Disagreement and View from the Passenger Side, click here. |

|

The leaders of eight Amazonian nations failed to reach an agreement on deforestation after a two-day summit. Brazil, the host, faces a conundrum when it comes to protecting the Amazon: It has pledged to protect the rainforest, but it may have to cut down swathes of it to reach the huge deposits of rare earths and minerals — many of which are essential for the green transition — that lie beneath. “That this scramble for resources is centered on the Amazon lays bare an uncomfortable truth: Climate policy and environmental protection are not the same thing,” Robert Muggah and Mac Margolis wrote in Foreign Policy. |

|

Seizing a new energy market |

Indonesia is seizing tighter control over its energy future. The country is moving to keep more of its natural gas for domestic consumption, a risky strategy that in the last month drove both Shell and Chevron away from planned investments in drilling projects there. And in a bid to harness more profit from its booming critical mineral mining industry, the country is banning the export of nickel, copper, and other raw materials, the Financial Times reported. The idea is to induce foreign investment in domestic refining facilities. Meanwhile, government efforts to curb a huge source of emissions — peatland wildfires — are falling short. |

|

Amount that an average one-way long-haul flight ticket could go up soon as airline executives pass more of their $5 trillion decarbonization bill onto their customers. In a deep dive, Bloomberg reports that airlines are one of the hardest sectors to decarbonize. Although there are measures they can take to incrementally trim their carbon footprint, the only existing technology to make deep cuts at scale is with advanced biofuels, which are far more expensive than fossil aviation fuels. Airlines will also likely pass along the cost of purchasing carbon offset credits, one way they can make their footprint shrink overnight, at least on paper. |

|

Emissions wins for India and China |

Adnan Abidi/Reuters Adnan Abidi/ReutersThe carbon intensity — CO2 per dollar of GDP — of India’s economy fell by one-third in the last 14 years, according to new government data, putting the country on track to meet its stated emissions targets under the Paris Agreement. The drop came as renewable energy and reforestation projects kept pace with economic growth. In China, meanwhile, planned low-carbon energy projects are now projected to fully cover growth in electricity demand, which means that the country’s peak emissions could arrive earlier than anticipated. |

|

REUTERS/Jonathan Ernst REUTERS/Jonathan ErnstTHE NEWS Up to 150,000 hourly workers at General Motors, Ford, and Stellantis are prepared to strike to demand a 40% wage increase and, as the industry pivots to electric vehicles, guarantees that contracts at new plants will be comparable in terms of salary and safety. The fallout could have massive implications beyond Detroit. President Joe Biden has made his handling of the economy one of the central themes of his reelection campaign, and a protracted auto workers’ hold out — on top of Hollywood’s lengthy strike — could negate that. We’ve gathered key reporting and analysis on the potential implications of an auto workers’ strike. INSIGHTS - Companies may agree to higher wages because they can afford those, but not to the union’s demands for a shorter work week or the ability to strike over plant closings. “The companies can’t afford anything that puts them in a straitjacket,” said Erik Gordon, a University of Michigan business professor, and with the pivot to EVs, automakers will need “flexibility” to adjust or even close facilities. — The New York Times

- Biden and the Democrats are caught between trying to gain the United Auto Workers’ support in 2024 voting efforts, while also addressing the UAW’s concerns over the administration’s EV push. The union — which has not yet endorsed Biden’s reelection — may cause headaches for the administration that has tried to portray itself as the most pro-labor in history. — Politico

- Last year, an Ohio-based joint venture between General Motors and LG Chem became the first U.S. plant making electric vehicle batteries to unionize. The vote, which had the backing of 694 out of 710 voters, was heralded as a milestone event. Unionizing showed that workers at EV battery plants “want to be part of maintaining the high standards and wages that UAW members have built in the auto industry,” the union’s then-president said. — Financial Times

To share this story, click here. — Jeronimo |

|

Real estate development companies have become the driving force behind climate tech investment. In an analysis by Crunchbase, New York-based venture capital firm Fifth Wall, which focuses on the real estate and property-development industries, led investment in climate tech globally over the last six months. In an interview, Greg Smithies, a partner at the firm who leads climate tech investments, said the company’s interest in climate tech was a response to what the large real estate corporations it partners with were asking for: Help sourcing heat pumps, low-carbon concrete, recycling solutions, electric vehicle charging, even physical barriers for flooding and new forms of insurance. “We find startups who are solving those problems, then everyone laughs all the way to the bank,” Smithies said. Dollar-wise, climate tech investment tends to be dominated by electric mobility startups. Building-related climate tech is often overlooked, Smithies said, even though it represents a massive addressable market both in terms of how widely it can be deployed — steel is a $1.5 trillion global market — and the potential impact it can have on lowering economy-wide emissions, since buildings consume so much energy. One consistent challenge is how fragmented the real estate industry is: There are countless thousands of developers and contractors, and pitching some climate-related widget or service to each one is tedious and expensive. “We have startups whose products are deployed in thousands of buildings and they haven’t even cracked 1% market share in New York City alone,” Smithies said. The fact that Fifth Wall, which is relatively new to climate, topped its peers in the Crunchbase ranking is nevertheless an indictment of how little money is flowing into climate tech overall at the moment, Smithies said: “It’s actually depressing.” |

|

- Trump’s ex-attorney-turned-critic is considering a run for Congress — and potentially mounting a primary challenge against a powerful Democrat.

- Biden wants $24 billion to send to Ukraine. Will he get it?

- China might change one of its most hated laws.

|

|

| |