The News

The largest maker of electric buses in the U.S. filed for bankruptcy this week, a move blamed on new product lines failing to overcome the high costs of e-bus manufacturing. But Proterra’s demise points to another issue: Even with unprecedented levels of government support and customer interest, some sectors cannot compete against top manufacturers in China.

The company will continue operations as normal for now while it uses the bankruptcy proceedings to either sell off or recapitalize the different sections of its business.

Tim’s view

Proterra’s struggles reveal how difficult it is to run a profitable electric vehicle business in the U.S., even in a post-Inflation Reduction Act world.

Buses make a good candidate for electrification because they run on predictable schedules, in fleets. The high fuel consumption of traditional buses makes the lifetime ownership cost of an e-bus competitive or, depending on state and local subsidies, even cheaper than an internal combustion engine bus, according to BloombergNEF.

But they have drawbacks as a business. Unlike passenger vehicles, buses are typically customized for each customer, limiting automation and factory efficiency. They get ordered in batches (when a city gets a new budget, for example), leading to inconsistent production schedules and orders with suppliers. They take a long time to build — 12 to 18 months from when a contract is signed to when a bus is delivered and paid for, in Proterra’s case — which makes them vulnerable to having their margins eaten away by inflation.

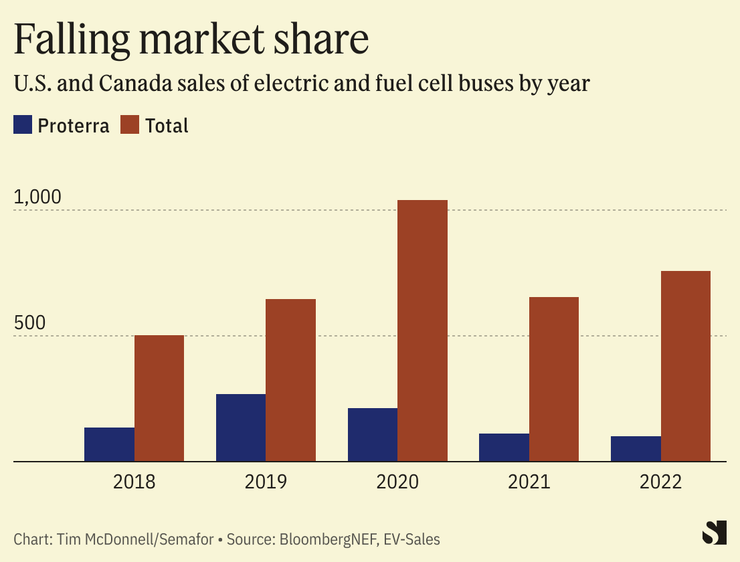

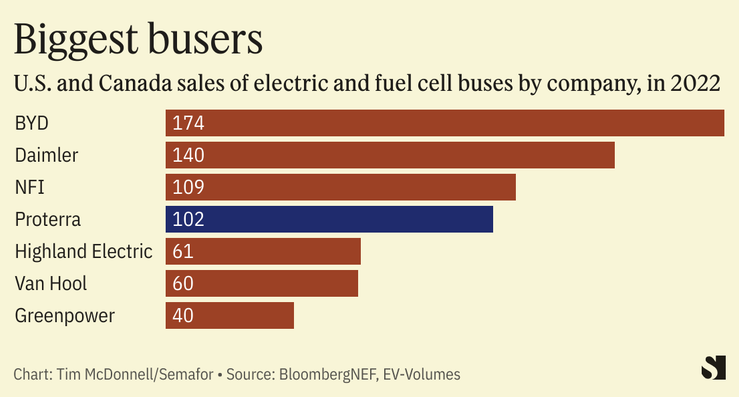

Proterra’s nickel-based battery chemistry was also more expensive than the lithium batteries used by most of its competitors, said Nikolaos Soulopoulos, head of commercial transport research at BloombergNEF. Its earnings report indicates the company spent $6.5 million more on materials for its products in the first quarter than the revenue those products generated. And ultimately, the domestic market is small: 750 e-buses were sold in the U.S. and Canada in 2022.

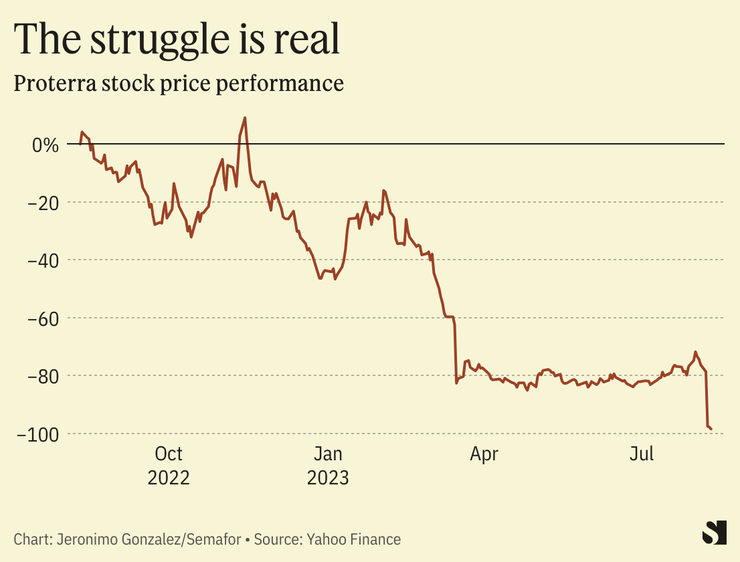

The company reported a loss of $250 million in the first quarter of this year, five times more than in the same quarter last year, and laid off 300 staff in January.

“It’s not something where you can change the fundamentals from one day to the next,” Soulopoulos said.

High production costs are universal for EV makers, from the tiniest startup to Ford and GM. BYD — Proterra’s main rival in the U.S. electric bus market — has addressed this problem through unparalleled economies of scale and by vertically integrating its supply chain. Tesla has cultivated a profitable side hustle in dominating the charging network. Major automakers still lean on their traditional internal combustion business for profit.

In Proterra’s case, new business lines it launched over the last few years in batteries, charging stations, and electric drivetrains could have had a similar effect on cash flow (in addition to $10 million in forgiven pandemic stimulus loans the company accepted in 2020). Instead, according to the company’s bankruptcy filing, they held it back. (A Proterra spokesperson declined to comment, and referred all questions to the filing.) The company wrote that its bus business “requires a large amount of working capital” but that potential investors were more interested in the new sideline businesses and “not inclined to invest” in the company if it meant being exposed to losses from the bus division.

Room for Disagreement

If Proterra’s bus division can survive the bankruptcy — either on its own, acquired by a rival, or another way — it may be in a stronger position for its next iteration. Demand for commercial e-vehicles, especially school buses, a market Proterra never entered, and last-mile delivery vehicles is rapidly growing as more municipalities and retailers like Amazon push to eliminate their transportation emissions. The Inflation Reduction Act came too little, too late to help Proterra in this case, but does offer a tax credit of up to $40,000 for buyers of electric commercial vehicles.

“It’s unfortunate timing,” said Matt Petersen, president of the Los Angeles Cleantech Incubator. “Had the IRA come a couple years earlier it could have created a different situation for [Proterra].” Petersen’s suggestion: “With the Olympics in LA in 2028 I hope we will see Proterra restructure, and a lot of their buses on the road moving athletes and visitors around.”

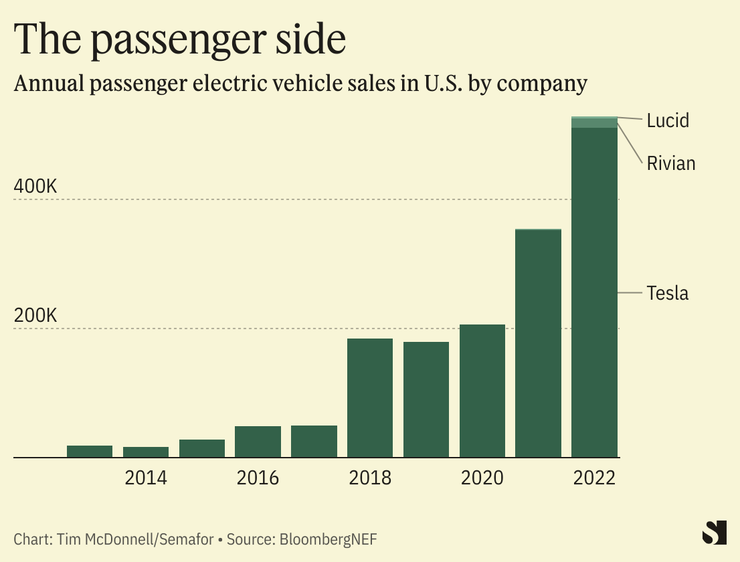

The View From the passenger side

Proterra’s bankruptcy comes amid mixed progress for other EV startups. Rivian is ahead of schedule on production, Lucid and Fisker are behind. All still operate at a loss, and risk running into the same kind of cash crunch that hit Proterra. The challenge for all these companies is to strike a balance between branching out with new models and products to underwrite the core vehicle while production scales up — the feat Tesla has accomplished — without being spread too thin.

“Earlier in the EV transition, there was this common sentiment that ‘everyone will be a winner’,” said Corey Cantor, passenger EV analyst at BloombergNEF. “But everyone being a winner is just not going to happen.”

Notable

- Another headache for EV makers: The first wave of early adopters has passed. Just at the moment when scaling up is crucial to bring down production costs, falling demand is forcing most automakers to scale back, Axios reported, cutting profit margins even deeper.

- Correction: An earlier version of this article implied that Proterra is slowing battery production as a result of the bankruptcy. In fact it is consolidating battery production across its facilities, a decision that was taken before the bankruptcy.