| | In today’s edition, we look at the role of Jeff Yass’ Susquehanna in the former president’s platform͏ ͏ ͏ ͏ ͏ ͏ |

| Liz Hoffman |

|

Hi and welcome back to Semafor Business. In our age of heightened conspiracy theories, the timeless financial boogeymen — Rothschilds, the Bilderberg Group, Davos — are being replaced by single-use-case theories, spun up to explain why our economy isn’t fair. The real reasons are often boring. It was a collateral shortfall and arcane clearinghouse rules, not Ken Griffin, that made Robinhood remove the “buy” button on GameStop shares. When Bill Ackman went on TV in March 2020 with his “hell is coming” rant, he wasn’t trying to tank the market for profit. He’d already made his profits by then. He did it because that’s the kind of thing he does. So this week, when amateur sleuths (and a few professional ones) noted that Jeff Yass is both a big Republican donor and the founder of a financial firm that owned 2% of Donald Trump’s newly public media company, they reached for a political explanation. The truth is more mundane and, as it often does, involves market structure. Read on for our look at $DJT — which was worth about as much as American Airlines when it went public this morning — and the money that’s actually behind it. Plus, Larry Fink’s thematic journey. ➚ BUY: Selling high: FTX is selling much of its stake in AI startup Anthropic, and getting a pretty full price for one of its most valuable remaining assets. Among the buyers is Jane Street, the trading firm where Sam Bankman-Fried, who will be sentenced Thursday for his role in the crypto exchange’s collapse, used to work. ➘ SELL: Buying low: Adam Neumann, who founded WeWork and ran it into the ground, now wants to buy back it back out of bankruptcy. WSJ reports he’s offered $500 million, though it’s unclear how he plans to pay for it. (Dan Loeb is a no.)  Michael Kovac/Getty Images for WeWork Michael Kovac/Getty Images for WeWork |

|

|

THE FACTS Susquehanna International Group makes its money buying and selling stocks in milliseconds, eking out fractions of a penny each time. At one millisecond at the end of last year, its holdings included a 2% stake in a blank-check company that this week merged with Donald Trump’s social-media company. That has fed theories that Susquehanna’s founder, Republican mega-donor Jeff Yass, is funneling money to a cash-strapped Trump by pumping up shares of a company that began trading today under the ticker DJT and owns Truth Social, where Trump has spent most of his online time since being kicked off Twitter after Jan. 6, 2021. It’s a fun theory for this conspiracy-happy age. But Susquehanna told The New York Times that it was neutral on the stock and owned other securities — likely options, where it’s one of the biggest players in the world — that offset its holdings. That tracks with Susquehanna’s business not as a discerner of value but as a supplier of bids and offers that occasionally ends up with some inventory. Digital World, the blank-check company that merged with Trump Media & Technology Group, has been especially attractive to algorithmic market-makers and quant funds as a measure of the mood of Trump supporters. Quantitative traders love retail trading because it’s uninformed by, and generally unrelated to, big macro trends. (Susquehanna also has a private-equity and venture-capital arm, which is where it owns a large stake in TikTok. Trump’s recently softened stance on a TikTok ban has fueled still more theories about Yass’s influence.)  Win McNamee/Getty Images Win McNamee/Getty ImagesLIZ’S VIEW Underlying the speculation about Yass is broad puzzlement about why anyone would buy shares in Trump Media & Technology Group. The company has lost at least $57 million since its inception in 2021; has said it won’t release user data, the key metric for mainstream social-media companies; and has a single product, which not that many people use. It also had to refile its financial statements with the Securities and Exchange Commission after it put its revenue in the wrong line in an Excel spreadsheet. This company is obviously overvalued by any traditional Wall Street yardstick. Shares of Disney, to which Trump has compared his company’s ambitions, trade around 15 times its earnings. Trump Media opened today with a market value of $9.5 billion, which suggests investors expect $600 million in earnings over the coming year. Trump Media lost $50 million in the first nine months of last year, according to barebones financial data from the company. Its model is that of a mid-2010s social-media platform: charging advertisers to get in front of users. While they manage to fill ad space, many blue chip advertisers have steered clear of X and certain programming hours of Fox News out of a fear of damaging their brands by association with questionable content. More broadly, the enthusiasm that accompanied the launch of Rumble, Parler, and other social-media companies catering to conservatives never translated into user engagement. It turns out right-wing social media enthusiasm thrives on conflict — and the system breaks down when there aren’t libs to own. |

|

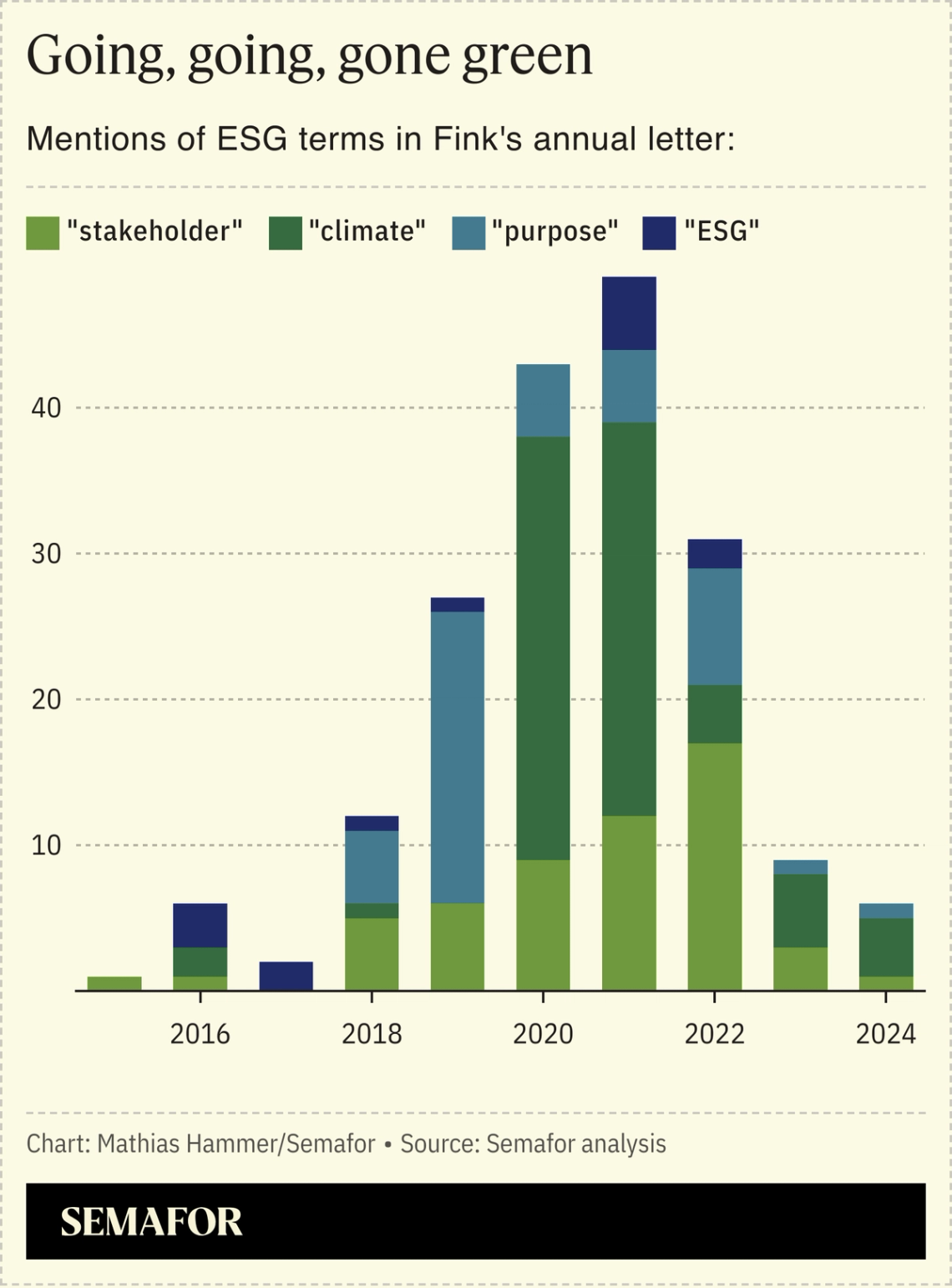

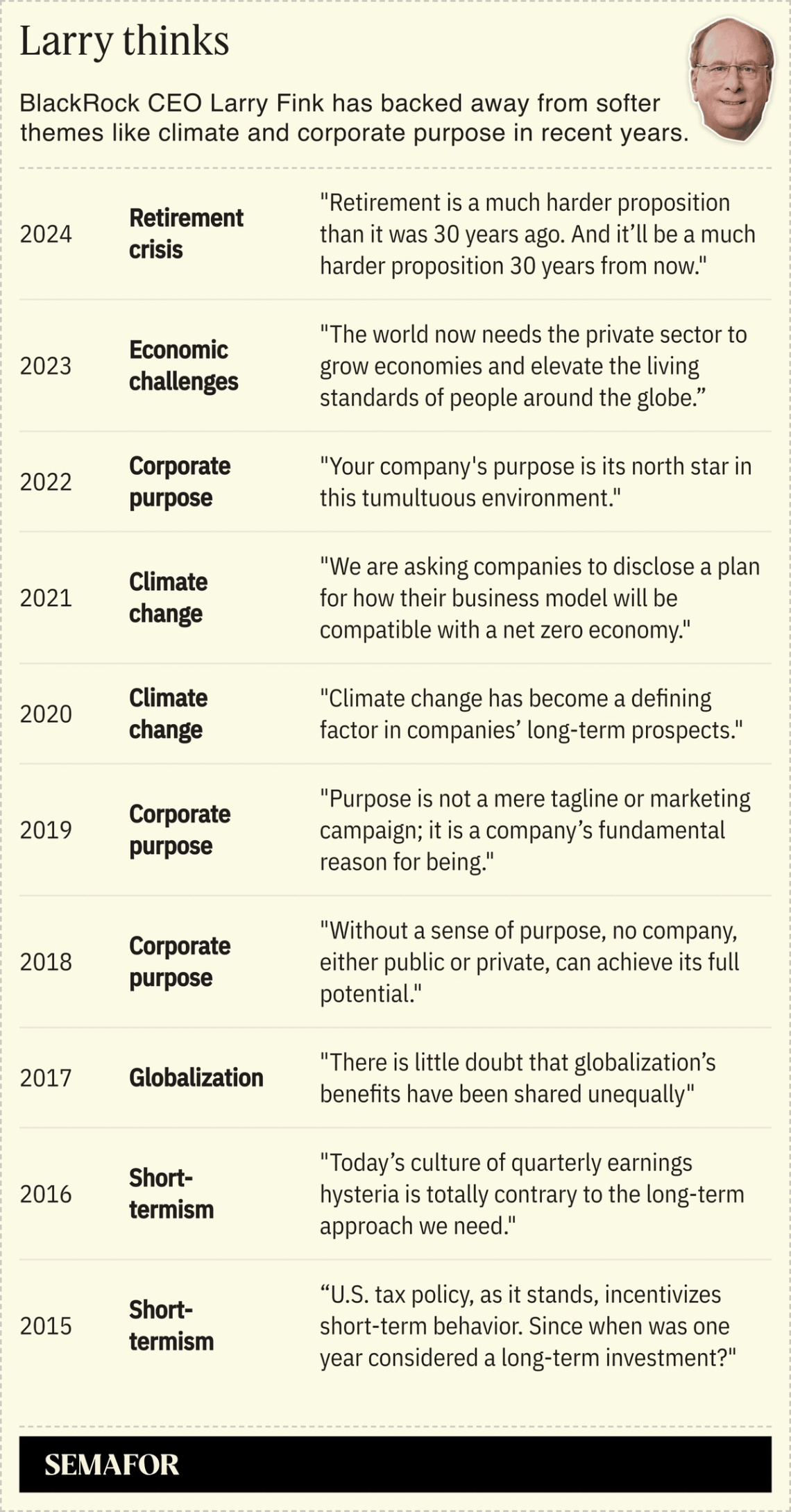

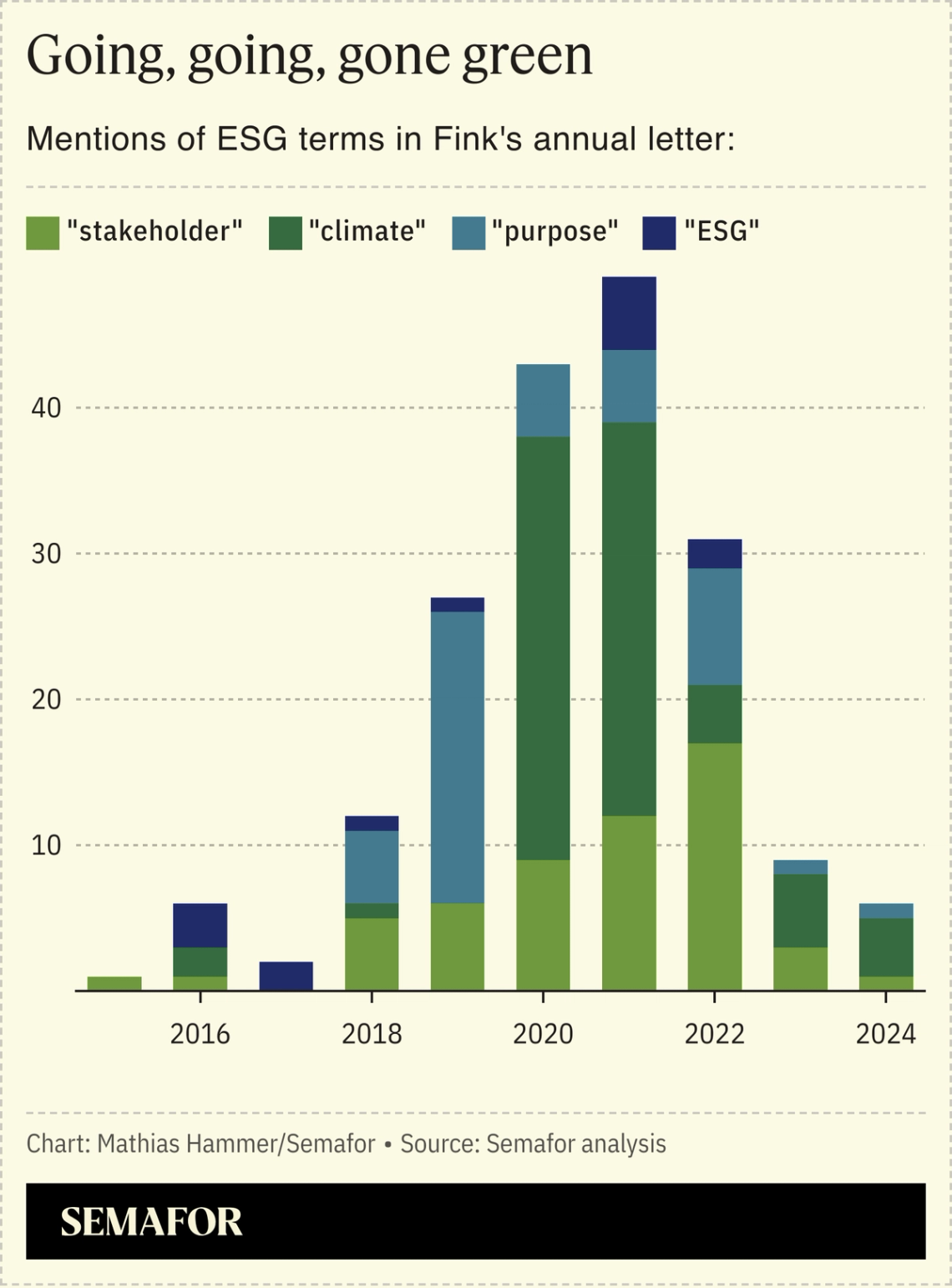

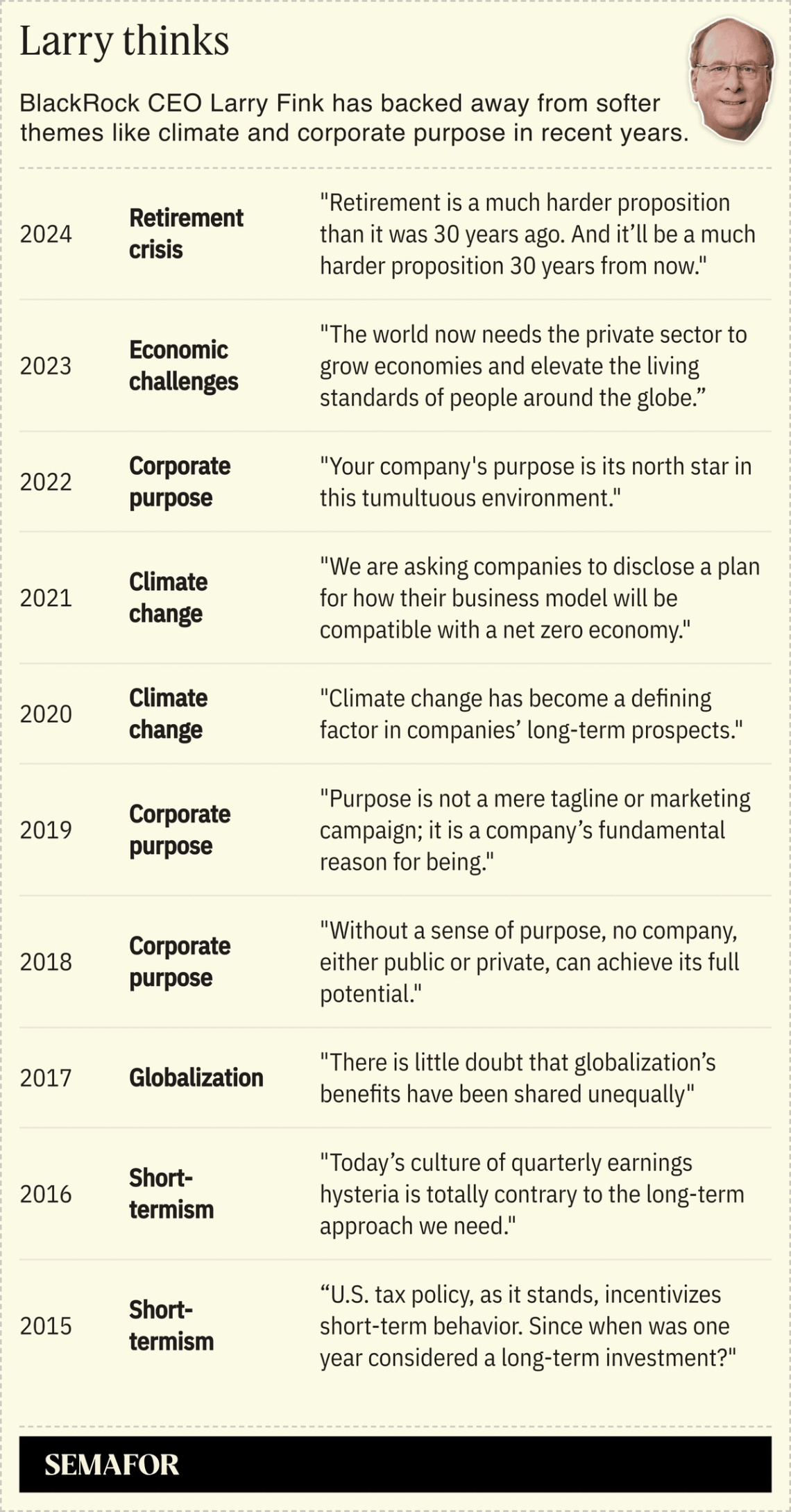

Larry Fink’s annual letters have become something of a corporate bible over the past decade. Previous missives have pushed companies to embrace environmental protection, diversity, and good governance, and to elevate, as he said in 2019, “corporate purpose” alongside pursuit of profits. But the mood around ESG has soured over the past year, and Fink, once its most vocal proponent, has gone all but silent on the topic. This year’s letter is about a looming retirement crisis, citing U.N. estimates that one in six people in the world will be older than 65 by 2050, up from one in 11 five years ago. Fink’s here with ideas — and a self-aware dig at Boomers. He advocates for bringing American-style investing to countries where people rely instead on bank savings to build wealth. “People are living longer lives. They’ll need more money,” he writes. “The capital markets can provide it — so long as governments and companies help people invest.” (That, of course, would be good for BlackRock; about half of its $9 trillion is held in retirement accounts.) Here’s a look at Fink’s thematic journey over the past decade:  |

|

Closed for business: A ship crash and bridge collapse has shut down traffic in and out of the port of Baltimore, stoking fears of shipping bottlenecks. Baltimore is the fifth-largest import node on the East Coast, and it’s unclear whether New York, Virginia, or points further south can handle diverted cargo ships. About 20% of cars imported to the U.S. are unloaded in Baltimore, which has major contracts with Nissan, Volkswagen, and Jaguar, according to a trade database maintained by MIT. The tax man cometh: A bipartisan proposal in the U.S. Senate would target tax-free corporate mergers. The bill would require investors who receive stock as part of any takeover to pay taxes immediately, rather than when they sell their shares later on. It targets what Senator Sheldon Whitehouse called a “massive tax giveaway” for big companies, though of course the costs would be borne by shareholders — whose tax bills, one corporate lawyer told WSJ, aren’t a high priority for CEOs in deal heat. About half of corporate mergers use stock as currency, a split that’s been pretty consistent over time, though all-cash deals (which are immediately taxable) tend to be more successful. |

|

| |