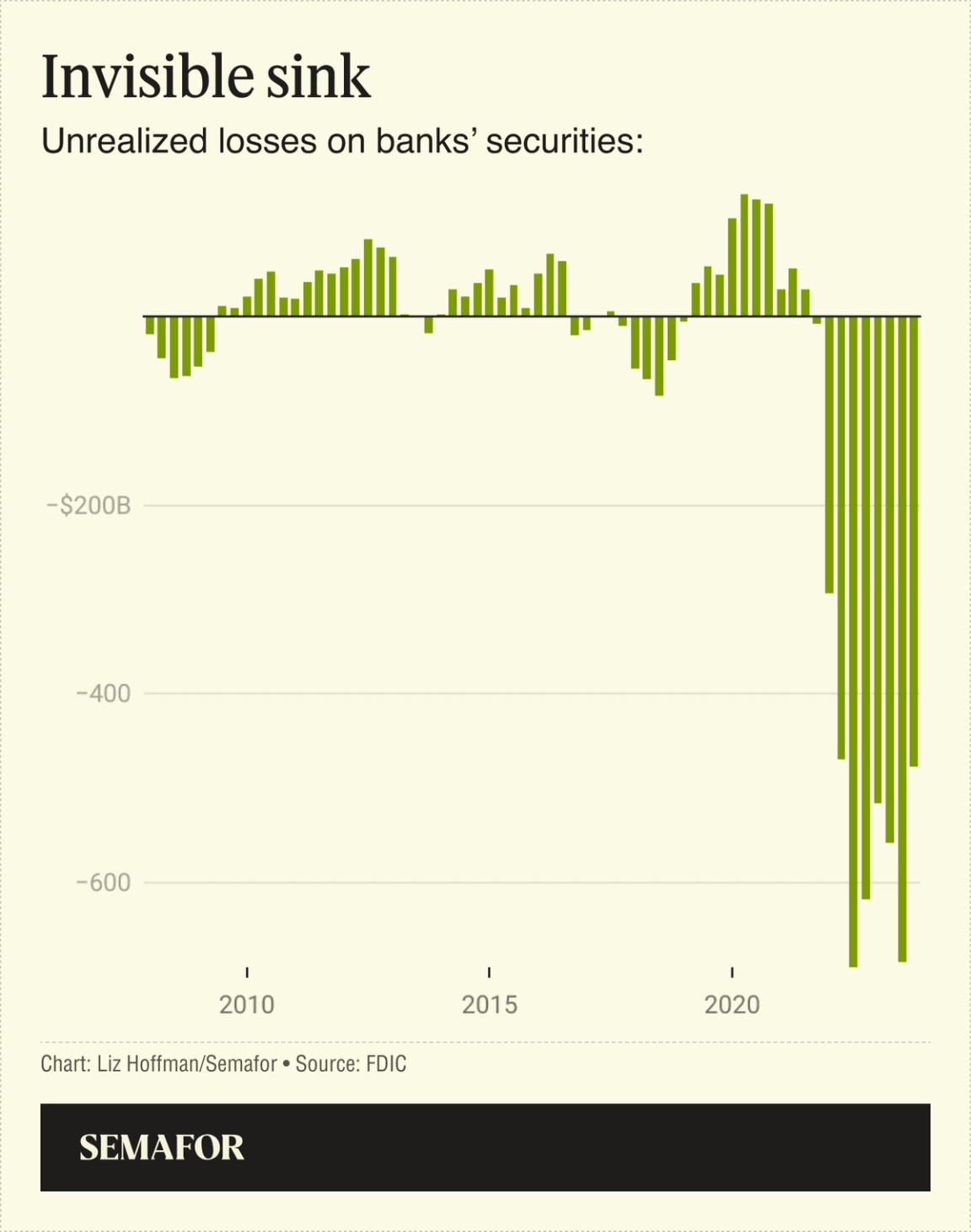

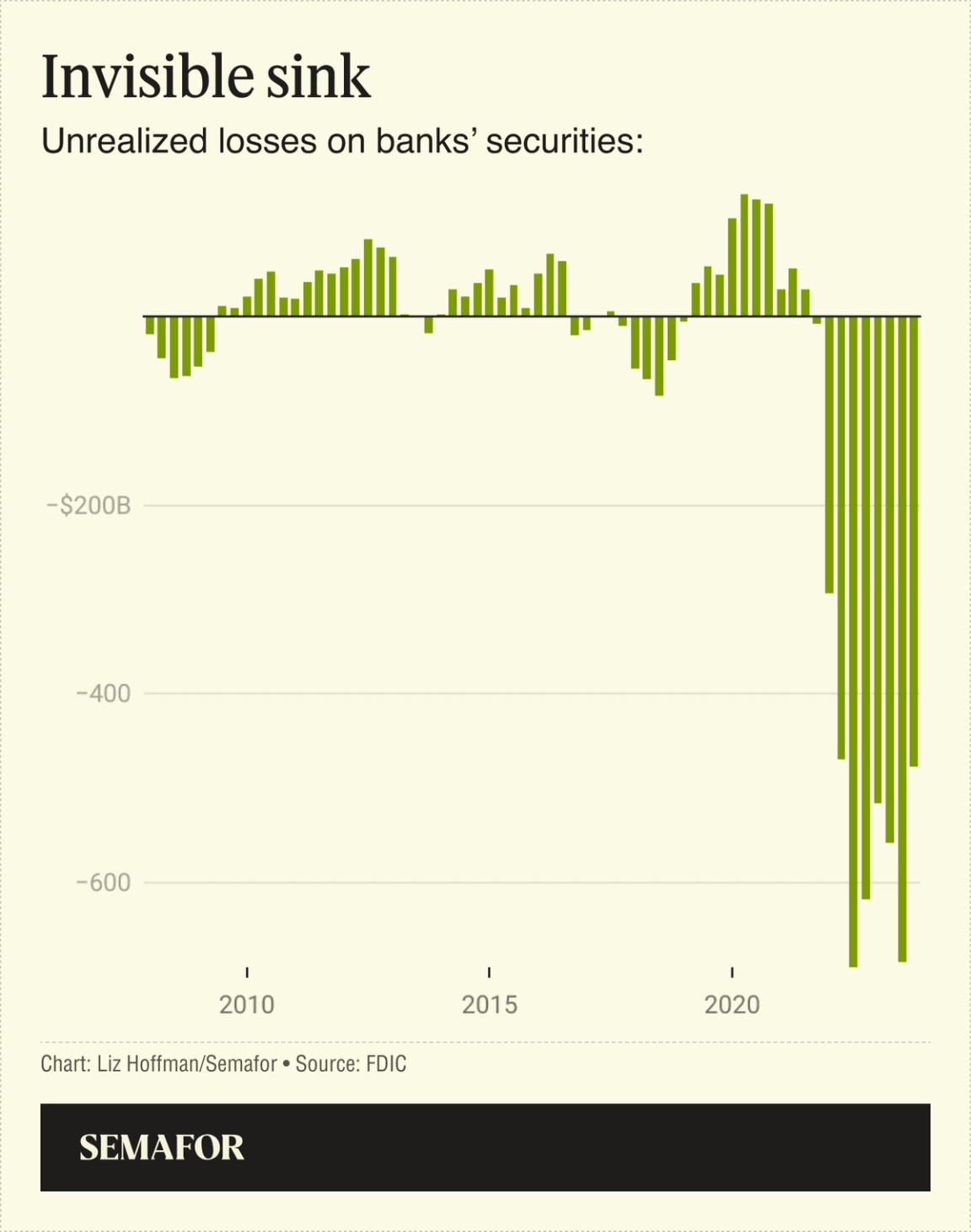

THE NEWS Former U.S. Treasury Secretary Steven Mnuchin is stepping in with $1 billion to save the latest teetering regional bank. The question is whether it’s the last. Since three regional lenders failed last spring, the entire sector’s profit margins have continued to shrink and bad loans have continued to pile up. At New York Community Bank, the $113 billion lender that Mnuchin and his co-investors are rescuing, the problem was commercial mortgages. At Silicon Valley Bank and First Republic, it was a wrong-way bet on interest rates. A deal to save a tiny community bank fell apart last week, apparently because it couldn’t file audited financials.  Reuters/Joshua Roberts Reuters/Joshua RobertsNew data out today from the FDIC shows that banks are sitting on $478 billion of unrealized losses in their holdings of older loans and bonds that are now less valuable because interest rates on newly issued securities are higher. That’s better than the $683 billion hole as of Sept. 30, but having to crystallize those losses — say, by selling assets to raise cash — would likely push at least some to the brink of failure. “I don’t think we’ve seen the last of this,” former Securities and Exchange Commission Chair Jay Clayton said in an interview. “I also don’t think it’s systemic.” Large banks are strong, he said. And even without an explicit government backing for deposits above $250,000, customers at midsized regional banks seem to think they’re safe.  LIZ’S VIEW NYCB should have taken the hit and revalued its entire loan book in 2019, when New York City passed a law making it harder for landlords to raise the rents that underpinned their mortgages. It didn’t. Silicon Valley Bank should have bought protection against higher interest rates. It didn’t. First Republic shouldn’t have been writing mortgages with its eyes closed. It was. But focusing on the idiosyncrasies of their troubles misses the bigger picture, one that goes beyond regional banks: Money is no longer free, and a lot of business models launched when it was just don’t make sense anymore. “You can say ‘this one is different, that one is different’ and that’s true. But there’s stress on the whole system,” Scott Rechler, CEO of RXR Realty, a major owner of office towers, told me. “What’s changed from a few years ago is that there’s no room for error.” The next place we’re likely to see this effect isn’t in banks at all, but in the $20 trillion world of private investments. Firms are clinging to valuations — “marks,” in Wall Street lingo — that an Excel model spit out six years ago after a 25-year-old analyst entered something approximating zero where the spreadsheet asked for cost of capital. Those assumptions were wrong the minute that the Federal Reserve started raising interest rates, and the industry hasn’t been quick to redo its math. This ability to tune out short-term noise is touted as a feature, not a bug, of private investing, because it allows managers to focus on long-term outcomes without being forced to sell. But a sustained downturn would test those blinders. Already, private-equity firms have gotten reluctant to sell assets at lower prices, which would force them to crystallize losses. Maybe they can hold on a few more years until rates fall and prices rebound, but many of their companies are already having trouble paying their bills. Room For Disagreement: Maybe private markets are right. → |

|