| A wave of mergers and acquisitions shows oil company shareholders know the energy transition is inev͏ ͏ ͏ ͏ ͏ ͏ |

| Tim McDonnell |

|

Hi everyone, welcome back to Net Zero.

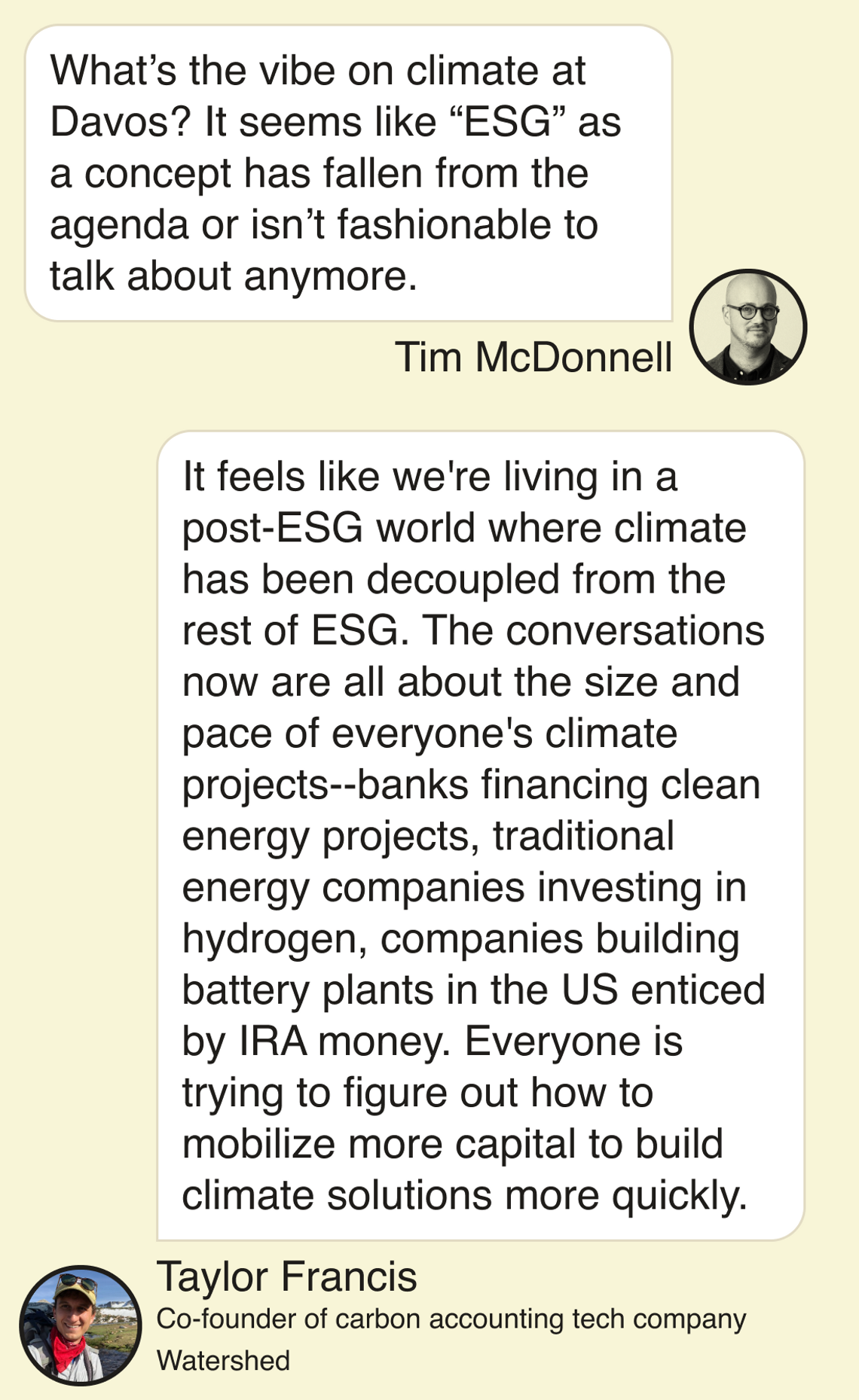

After Donald Trump’s sweep of the Iowa Republican caucus this week, it’s an appropriate time to ask: How damaging would Trump 2.0 be for the climate?

There’s reason to be concerned. The former president remains committed to diehard climate-science denial, a position that’s increasingly rare in Republican circles. Politico reported this week that his advisors are already plotting ways to tone down the findings of federal climate-science reports. With little effort, a second Trump administration could walk back emissions regulations drafted during the Biden administration; stop financial regulators from finishing long-overdue carbon disclosure rules; and, perhaps most damagingly, slow-walk the rollout of grants and loans from the Department of Energy and other agencies that are providing irreplaceable support to scaling up cutting-edge climate tech. His administration, anticipating lame-duck status by its third year, would be highly motivated to move quickly.

But, as outgoing climate envoy John Kerry noted at the World Economic Forum in Davos this week, there’s a limit to the damage Trump can cause: “This economic revolution is underway and it’s much bigger than any politician, any one person.” At least $225 billion has been invested in clean energy ventures in the U.S. in the last year alone. Investors aren’t going to walk away from those bets, and few members of Congress will ultimately be willing to vote against tax incentives that are creating working-class jobs in their districts. And from the private sector perspective, any change in U.S. federal policy will be backstopped by other jurisdictions that have no intention of slowing down on climate. Obstructing the energy transition will only hurt how competitive U.S. companies can be in it, not change its course.

If you like what you’re reading, spread the word.

The World Today |  - Europe’s battery kingpin

- Acceptable profits

- Big Oil gets bigger

- Planning for the future

- Lights still on

The climate vibe at Davos, and Hyundai’s plan to tempt EV buyers. |

|

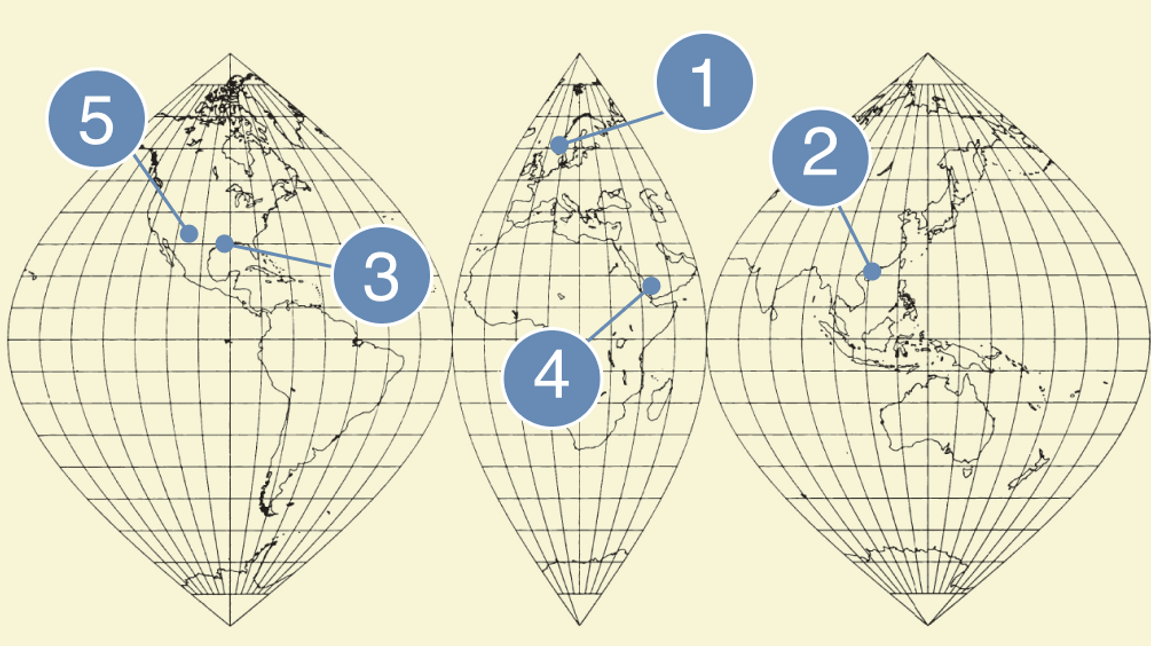

JONATHAN NACKSTRAND/AFP via Getty Images JONATHAN NACKSTRAND/AFP via Getty ImagesThe race to build massive electric-vehicle battery factories is heating up, after the Swedish startup Northvolt this week landed Europe’s biggest-ever green loan. The company had already locked in nearly $1.5 billion last year in venture equity, in two of the year’s biggest global climate tech deals. Now it has an additional $3.4 billion in debt issued by the European Union’s investment bank and about two dozen private lenders which it plans to use to expand a manufacturing and recycling facility located just south of the Arctic Circle. The EU bank’s heavy involvement — nearly one-third of the new lending — makes Northvolt a case study in how policymakers there are working overtime to counter the strong allure of the U.S. Inflation Reduction Act. Northvolt already has $55 billion in pre-orders for its batteries, for customers including Volkswagen and BMW, making it one of Europe’s dominant players in the EV supply chain. And with plans to expand in the U.S. and Canada, it also presents stiff competition for rival U.S. startups like Redwood Materials. |

|

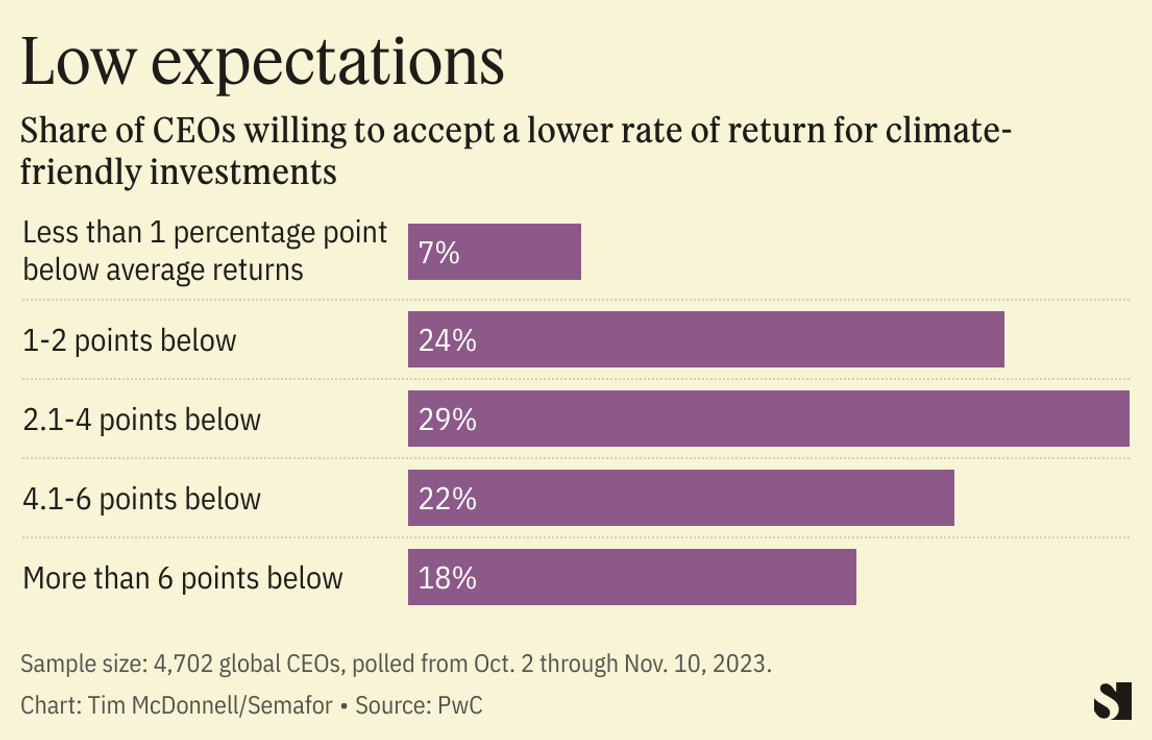

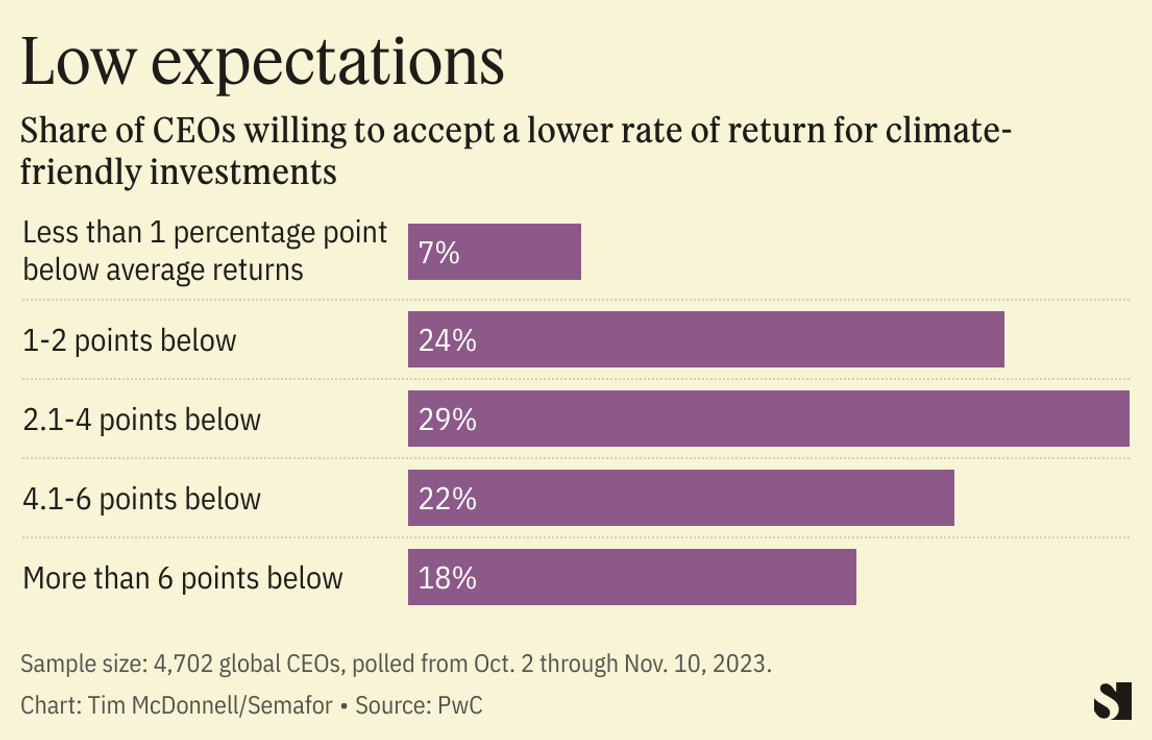

41% of global CEOs are willing to accept below-average returns on climate-related investments, according to a survey of nearly 5,000 of them by consulting firm PwC.  That’s in part because of emissions cuts mandated by regulation, and in part because many CEOs recognize that inaction bears its own high costs, the study concludes. CEOs in the Asia-Pacific region were especially willing to countenance lower acceptable rates of return. Overall, most of the surveyed CEOs say they are taking actions to cut their emissions and capitalize on climate-related opportunities: 75% are investing in energy efficiency, and 56% said they now sell products or services “that support climate resilience.” |

|

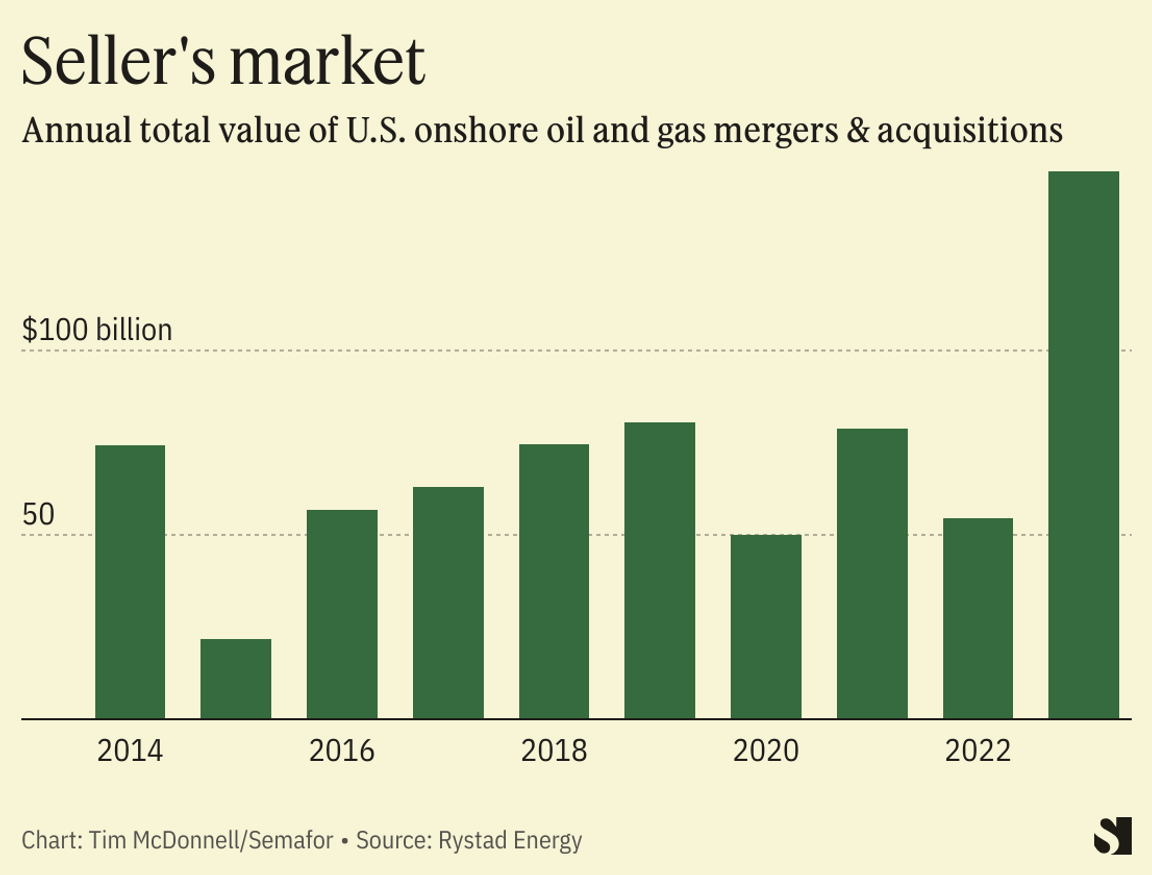

Big Oil’s climate-friendly deals |

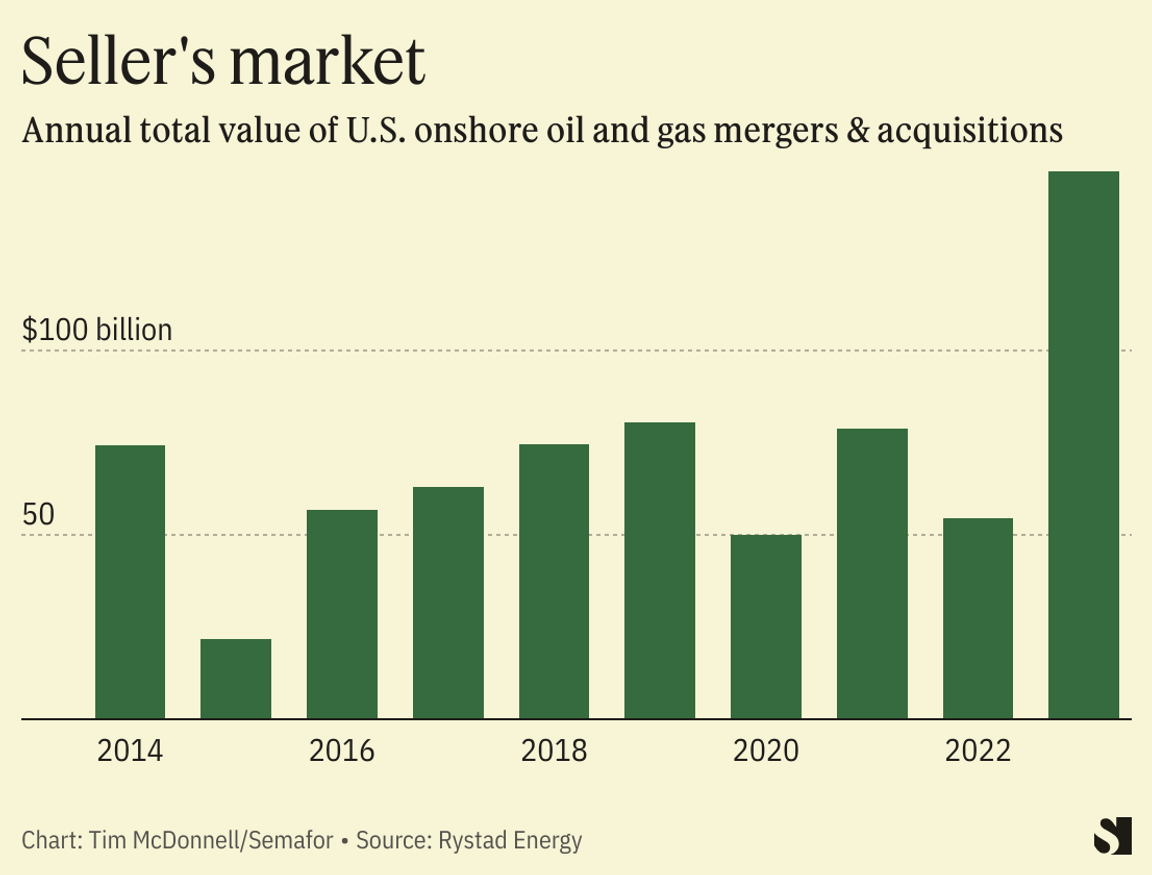

Chesapeake Energy, a midsized Oklahoma-based natural gas producer, merged last week with Texas-based Southwestern Energy in a $7.4 billion all-stock transaction, creating what is now the country’s largest gas company. The deal was designed to give the new company a competitive edge in the Gulf Coast gas fields that are feeding a major boom in liquefied natural gas exports. It comes amid a record wave of consolidation in the sector over the last six months, driven by a race among investors to snap up the most profitable drilling sites as they face the impending decline of fossil-fuel demand.  “The name of the game is securing the inventory so the company can still exist as a business within the next couple of decades,” said Matt Bernstein, senior analyst at Rystad Energy. That trend should help the sector drive down its carbon footprint. Smaller producers are more reactive to short-term price trends; when prices rise, they race to open new drilling rigs, usually leading to overproduction and price crashes. A larger post-merger company will in theory have a steadier hand, and a production budget that is smaller than the sum of the two pre-merger companies, both of which should result in lower overall output, said Andrew Logan, senior director of oil and gas at the sustainable finance advocacy group Ceres. Larger production companies are also more willing and able to reduce their own operational (scope 1 and 2) emissions. In general, the consolidation wave is a sign that Big Oil investors know the end is near, Logan said: “An industry with decades of growth ahead of it doesn’t need to consolidate. An industry that is approaching sunset does.”

|

|

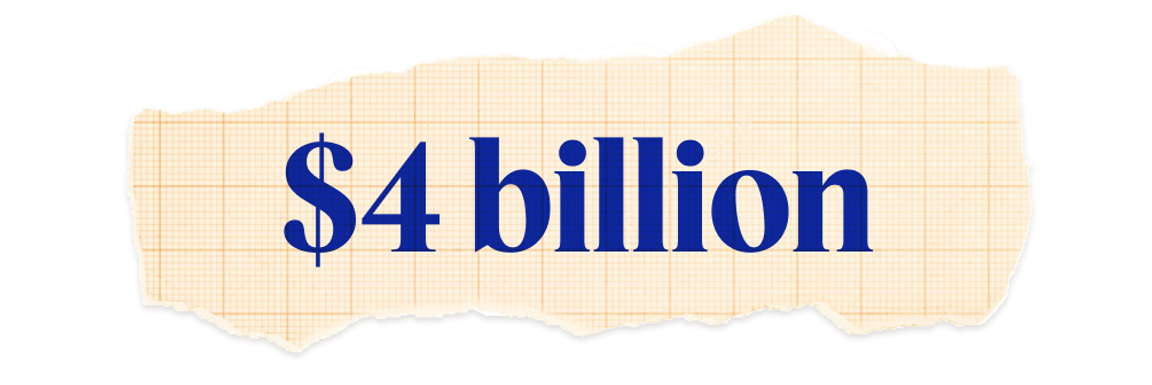

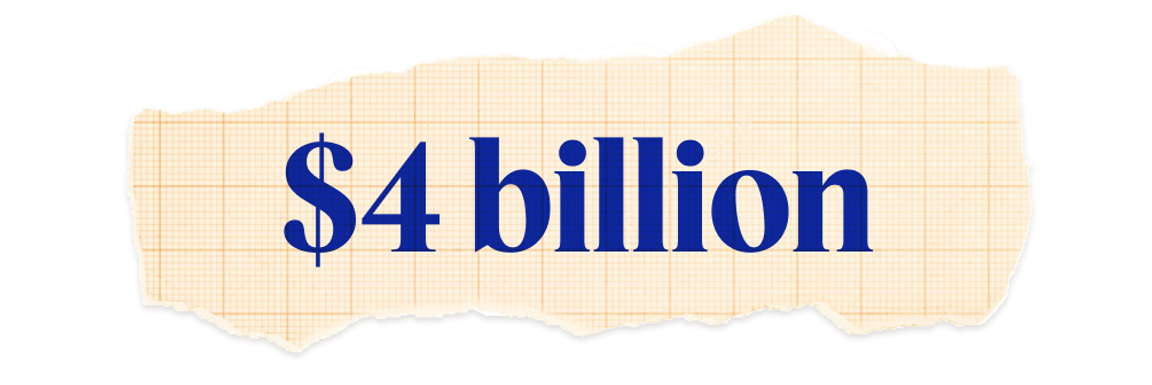

Increase in the investment budget of the venture capital arm of Saudi Aramco. Saudi Arabia was among the countries at COP28 most resistant to a political agreement to “transition away from fossil fuels.” But its state-owned oil company, the world’s largest, is now stepping up its efforts to diversify the country’s economy away from fossil fuel production. Aramco Ventures will invest in clean energy as well as alternative chemicals and software. |

|

Bill Clark/CQ-Roll Call, Inc via Getty Images Bill Clark/CQ-Roll Call, Inc via Getty ImagesRenewable energy additions to the electric grid in Texas are helping to keep the lights on in the face of the latest “polar vortex” cold snap, two years after winter storms plunged the state into deadly blackouts. This week’s winter storm is not expected to be as long or cold as the one that crippled the state’s grid in 2021. But electricity demand in the state is already surging to summer-like highs to accommodate electric heaters, and is nearing its production capacity. Compared to the 2021 storms, the Texas grid is now much better prepared for extreme weather. The main cause of 2021 blackouts was frozen gas pipelines, and investments that utilities made after the storm to insulate many of these seem to have paid off. Moreover, Texas has tripled its installations of utility-scale batteries, which are well-suited to respond quickly to sudden demand upticks. Grid operators have also doubled the number of participants in demand response programs, in which homeowners or businesses can volunteer to use less power during times of high demand, for a fee. Texas has also tripled its solar power capacity, which may not be too helpful in the middle of a storm but can help bring power back quickly if gas systems freeze up. The grid is also much cleaner: Most of the solar and wind additions of the last few years have gone toward replacing coal. But the future of renewables in Texas is uncertain, as Republican state legislators pursue a series of legal changes to raise costs and bureaucratic barriers for the industry. |

|

Semafor’s 2024 World Economy Summit, on April 17-18, will feature conversations with global policymakers and power brokers in Washington, against the backdrop of the IMF and World Bank meetings. Chaired by former U.S. Commerce Secretary Penny Pritzker and Carlyle Group co-founder David Rubenstein, and in partnership with BCG, the summit will feature 150 speakers across two days and three different stages, including the Gallup Great Hall. Join Semafor for conversations with the people shaping the global economy. |

|

Personnel- U.S. climate envoy John Kerry confirmed this week that he will step down in the spring to help Joe Biden campaign for re-election. Rumored replacement candidates include Washington Governor Jay Inslee and senior Biden administration advisor John Podesta. In the short term, his duties will likely be assumed by one of his deputies.

- Azerbaijan appointed no women to its 28-person organizing committee for COP29 in Baku. Almost two-thirds of the members of the COP28 organizing committee were women. The Azerbaijan committee also includes fossil fuel executives.

- BP named Murray Auchincloss as permanent CEO, elevating him from the acting role he has held since Bernard Looney stepped down last year.

Batteries & Minerals- The first uranium mine to operate in the U.S. for nearly a decade opened near the Grand Canyon. Renewed global interest in nuclear power, and Russia’s invasion of Ukraine, have pushed uranium prices to record highs.

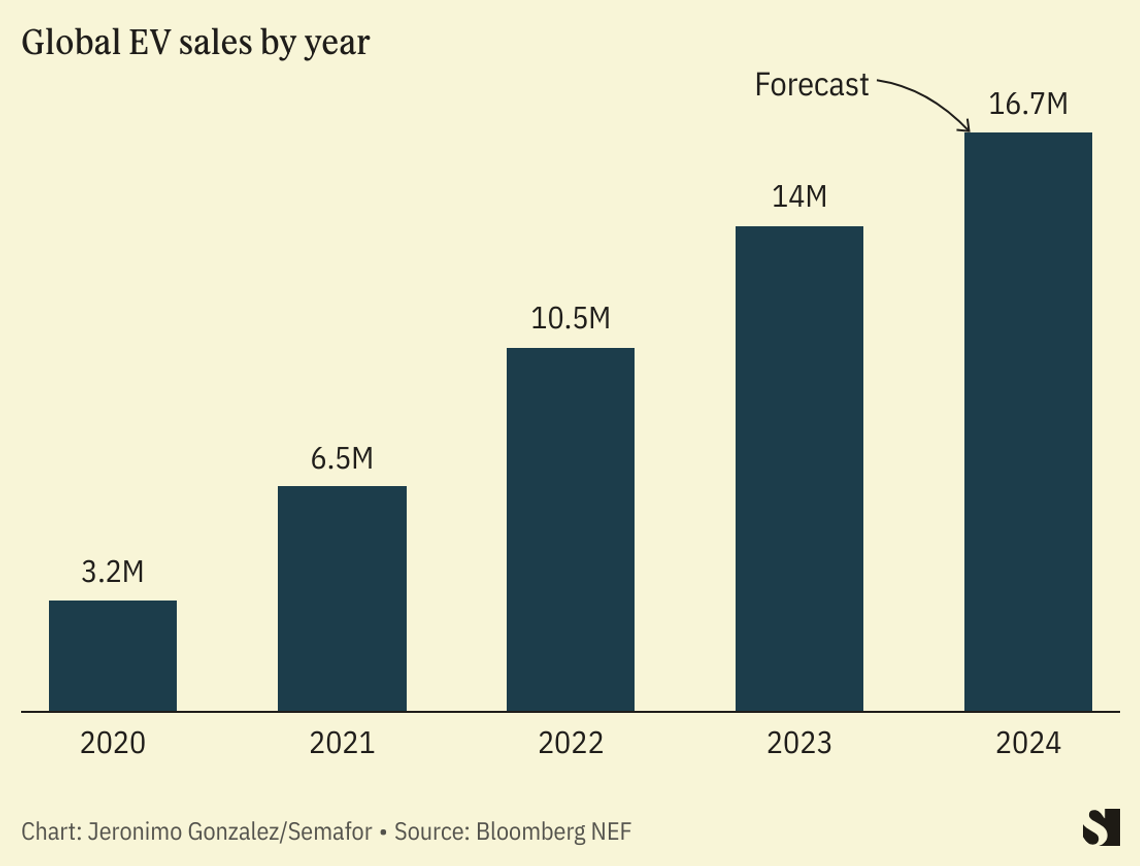

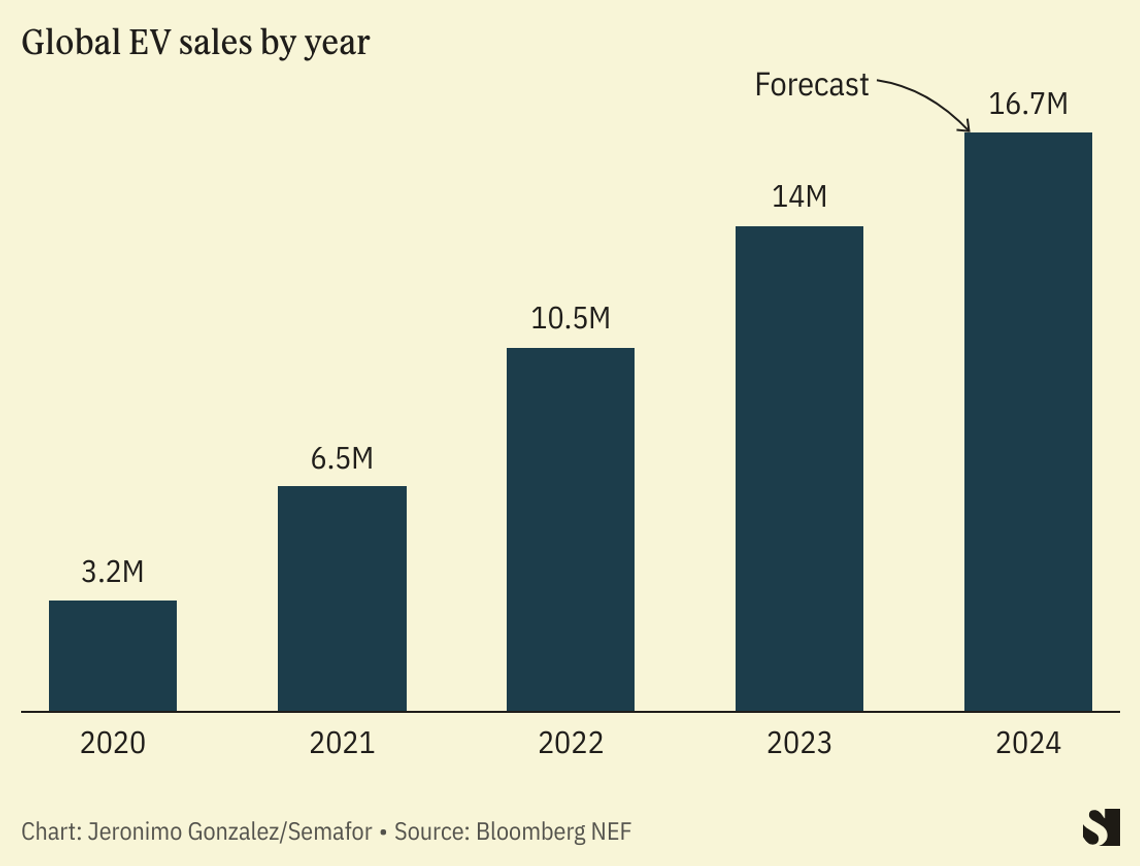

EVs- BMW said demand for its gasoline-powered cars peaked last year, adding that it expects electric vehicles to drive future growth. Although sales have slowed in the U.S. and Europe, the company’s share price was up more than 75% last year on the back of new all-electric models.

- Hyundai launched a cash incentive of up to $7,500 for U.S.-based buyers in response to missing out on valuable tax credits that are part of the Inflation Reduction Act. Under IRA rules, cars must be assembled in the U.S. or have key components sourced there in order to qualify for a credit. The Seoul-based company is targeting a $7.6 billion EV plant in Georgia.

Fossil Fuels- The U.S. will charge oil and gas companies up to $1,500 per ton for methane emissions, starting in 2026. The fee, which is opposed by industry groups, is one of the few punitive measures mandated by the Inflation Reduction Act.

- China’s coal production hit a record high of 4.7 billion tons in 2023. The country’s coal imports are also rising.

Finance- Europe’s largest asset manager, Amundi, joined a group of investors demanding Shell improve its climate policy. The group, which holds about 5% of Shell’s shares, is calling for the oil major to set a specific target to reduce its scope 3 emissions, among other measures, in a resolution it plans to bring to a vote at the company’s annual meeting.

|

|

Taylor Francis is co-founder of carbon accounting tech company Watershed.  |

|