The News

BlackRock, State Street, and Vanguard offered slim support to activist nominees at proxy fights this year.

A new report from data provider Diligent shows that those three firms, whose roughly 20% ownership of the US stock market gives them huge power in corporate elections, overwhelmingly backed incumbent board members. Vanguard voted for just 8.6% of dissident nominees who sought board seats at Russell 3000 companies. State Street backed 11%, and BlackRock backed 14%. (State Street declined to comment. Vanguard and BlackRock didn’t return requests for comment.)

Know More

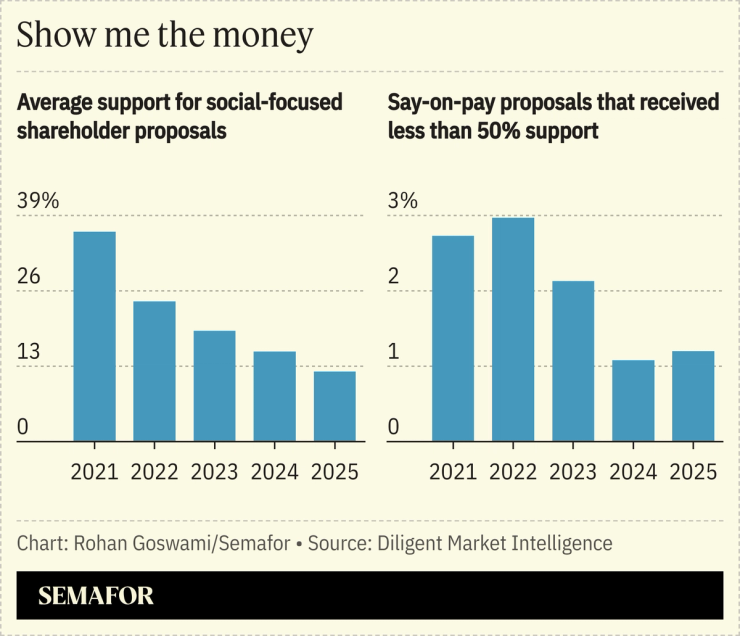

Activist shareholders have long complained that index funds are reflexively biased toward management. But in the 2010s and early 2020s, they won several high-profile fights with the support of the Big Three, whose more assertive stance on climate and social issues emboldened them to take a closer look at management’s track record in other areas, too.

Those fights proved to be high-water marks, not bellwethers, and index funds’ retreat from ESG appears to have sapped their fighting spirit in other areas. Only one activist campaign this year got support from all three of the investment giants.