On The Record

Semafor Business’ signature interview series, On The Record, brings you conversations with the people running, shaping, and changing our economy. Read my earlier conversations with Mattel CEO Ynon Kreiz, Norfolk Southern CEO Alan Shaw, and Delta CEO Ed Bastian.

All around Citizens Bank’s New York office, there are signs of the new reality it faces.

A TD Bank branch across the street is offering 4% interest on savings accounts. At nearby Western Alliance, six-month certificates of deposit are paying 5.7%. Even at the Wells Fargo branch in the lobby of Citizens’ offices, a three-month CD pays more than 4%.

Banks are adjusting to a world where money is no longer free. The bite is especially hard on midsized lenders like Citizens, an East Coast firm that, with $225 billion in assets, is about 1/20th the size of JPMorgan. “The cheap funding woke up,” Bruce Van Saun, Citizens’ chief executive since 2013, told me in a conversation this week.

Citizens was born out of one crisis, spun out of a bailed-out Royal Bank of Scotland in the wake of the 2008 crash. It’s now been tested by another (though Van Saun, 66, has some thoughts on the terminology) and the CEO finds himself once again picking over the industry’s wreckage for hidden gems. This interview was condensed and edited for clarity.

Liz: We’re nine months out from the regional-bank crisis. Have we seen the last of it?

Bruce Van Saun: ‘Idiosyncratic bank failures,’ please. Or ‘West Coast banking crisis’ if you prefer.

Look, if rates are truly heading down and we avoid a meaningful recession, then I think most banks will live to see another day. There will still be some pressure at the smaller banks, and you can question whether they’re viable without some consolidation.

Regulators don’t seem friendly to that idea.

I think they might be coming around. Not at our level. I don’t think we’re going to get a lot of leeway on bigger deals. But why would you want to have a string of small bank failures that inflames the situation? They should be keen to allow some consolidation to avoid more failures.

The P&L is upside-down at a lot of these banks. The cost of funds is still high and is going to come down slowly. So they’re not going to be making a whole lot of money. We’re going to have walking zombies for a while.

If you were allowed to, would you be a buyer?

The question is, is it a prerequisite for success to continue to get bigger? I haven’t been a buyer of that theory. I think we can be successful at the size we are, although you have to be really good and you have to be really focused. We can’t be all things to all people.

It made sense, when deposits were plentiful and cheap, to engage in business that wasn’t really relationship business but was accretive. But now that deposits are more expensive and scarce, we’re taking a harder look where we’re playing. Where do we think we can become the lead bank? If that’s not happening, then let’s just exit. We’re getting rid of some consumer assets, things like [buy-now-pay-later] loans that we bought from SoFi and Affirm.

And then on offense, we launched our private bank with a bunch of First Republic teams that came over. We’ve set some ambitious targets for the private bank: $9 billion of loans, $11 billion of deposits, and $10 billion of assets by the end of 2025.

You bid for First Republic [in the government auction].

We did. Let’s just say when JPMorgan wants to sharpen their pencils and leave the super-regionals in the dust, it’s going to happen.

We had a sense that maybe JPM would not be allowed to bid. We and, I think, PNC thought right up to the end that we had a shot. We were given another opportunity on Sunday night to pick our pencils back up, but looking back, I think it was really just to put pressure on JPMorgan.

You were used as a stalking horse?

If we were, it feels good that we were invited to the party. And we showed ourselves well.

Buying First Republic would have doubled your size, which would have come with a bunch of new regulations.

We certainly would have hit $400 billion [of assets], which we were prepared to do. But the current regulatory posture coming out of the Fed and [supervision chief] Michael Barr, is that there’s one speed bump, and it’s at $100 billion. So we’re there already.

Some of your larger bank colleagues are in Washington today, making the case against that. But the argument in favor is that if we’re going to treat $100 billion banks like they’re systemically important and can’t be allowed to fail, which the Fed basically did in the spring, then we should regulate them like they are.

It goes back earlier than that. When two banks grew from $50 billion [in assets] to $220 billion in four years, there was bound to be a lot of risk that they were taking. There’s a lot of blame on management. But the [government] supervisors should have seen all that and kind of put the grips on them much sooner.

So just saying we all need lots more capital is killing an ant with a sledgehammer. Should there be some changes? Probably. But regulators have to ask themselves, what’s the endgame? They say they want a safer financial system. OK, but are they creating more incentives to consolidate if they pile on costs to the regional banks? Why do we have to pay for the sins of the dead?

Was there ever a moment where you thought you might be among them?

No.

The Monday after Silicon Valley Bank failed, a lot of our peers closed down 20 or 30%. Three banks closed down under 12%: PNC, us, and M&T. The market voted that these are the banks who’ve managed themselves well. And then you saw who got to play in the failed bank auction process, which tells you something.

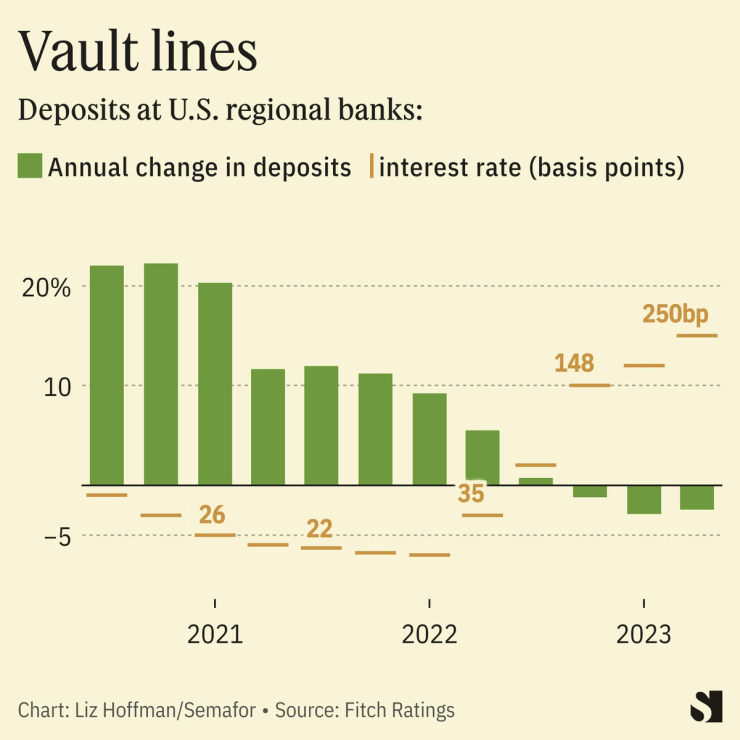

Your cost of deposits quadrupled over the past year, from about $200 million a quarter to $900 million. The interest you’re getting on loans went up by about 30%. That’s tough math.

The cheap funding woke up. All those deposits that cost us close to zero now cost 5%. That’s a real hurt. The good news is that most of that money has already moved, and you’re hitting a natural floor. People have to keep a certain amount in their checking account just to meet their expenses. So it’s slowing down pretty dramatically.

I don’t know what the magic rate is that allows the sloppiness or inertia to creep back in. We have to recognize that our cost of funds going forward will be higher. It’s not going to be [this high] forever, and it’s not going back to zero.

Banks like yours have historically been big buyers of Treasury bonds. They’re not that attractive right now for a bunch of reasons. How are you thinking about it?

I think the government should go on a diet. The deficits we’re running just exacerbate the whole equation. So one way to bring supply and demand back in balance is to have more fiscal prudence. But there will always be people who want to hold Treasuries. There’s a lot of geopolitical uncertainty in the world. The U.S. 10-year has been a huge beneficiary of flight to safety and flight to quality.

What are you seeing in demand for loans?

It’s tepid. Our line utilization is a little soft. I think companies are in good shape, but they’re also cautious. There’s a lot of uncertainty out there, so people aren’t looking to play offense. They’re not looking to make the next capital investment or expand their businesses right now, and they are reluctant to borrow when rates are so high.

Soft landing, hard landing, or no landing?

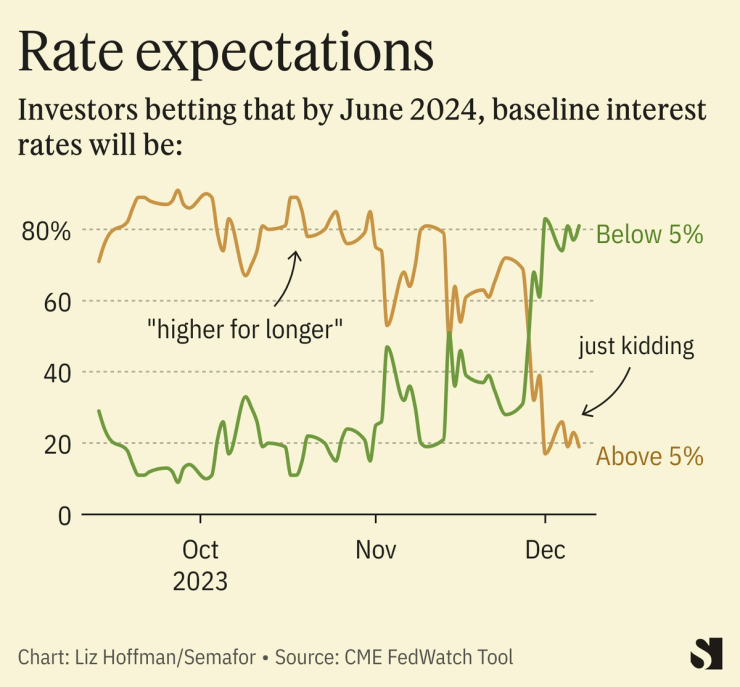

I think the Fed is still trying to jawbone a ‘higher for longer’ scenario, just because if the market rallies and people start having a party, then all of a sudden we have a financial loosening and it undoes a lot of what they’ve been trying to accomplish. They’ve tried to steer the market to the view that they may not be done, but I think the market has moved on and said that’s not going to happen.

They gave the medicine to the patient, the patient has taken it well, and so now they have to start to lower the dosage. Unemployment has gone from 3.4% to 3.7%, and it probably goes another 50 basis points higher, so there are some casualties. But it’s not the potential size of carnage that can accompany a forced contraction. So it is kind of a Goldilocks scenario. Part of that was just the supply side sorting itself out.

You’ve come into New York [with the purchase of Investors Bank and HSBC branches], the most competitive banking market in America.

When we announced these deals two years ago, [shareholders] said, ‘are you sure you want to go into the belly of the beast?’ This is a pretty big bet on ourselves.

And we put extra voltage on the branch signs. They’re really, really green.

Notable

- Citizens was once best known for its branches inside supermarkets. Now it wants to offer white-gloved service to millionaires — WSJ