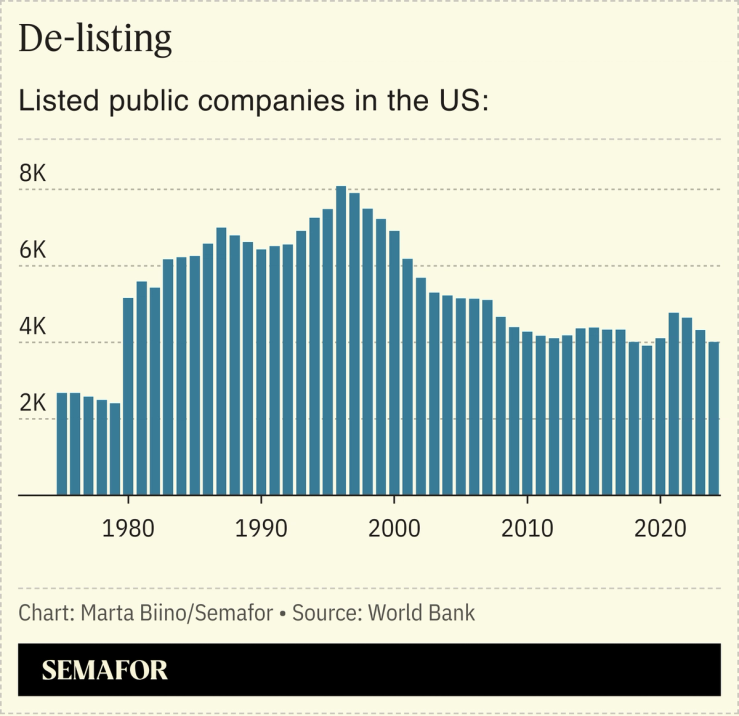

SEC Chair Paul Atkins has a 250th birthday gift for America’s CEOs: less paperwork. In a NYSE speech Tuesday, the regulator vowed to cut the “regulatory creep” of “voluminous disclosure requirements.” Atkins, noting in his speech that public-market listings have fallen 40% since the mid-1990s, has been beating this drum for a while. Earlier this year, he blessed the idea of companies moving to twice-yearly earnings reports, the standard in Europe.

Overhauling reporting requirements burdens could make IPOs more appealing at a time when more companies are staying private for longer. The 2012 JOBS Act, which loosened reporting requirements for smaller companies, did coax some startups to list — one academic study found a 25% increase, controlling for other factors — but there’s more private capital available now than ever before.