The News

NAIROBI — A lack of local investment in African electric vehicle companies threatens the growth of the continent’s green transportation sector. It undermines efforts to introduce cleaner forms of mass transport that would reduce pollution in heavily congested cities.

Demand among individuals and companies for e-buses, electric two-wheelers and three-wheelers is surging across the continent, say industry insiders and analysts.

As of March 2023, e-bike manufacturer Ampersand had a waitlist of over 7,000 in Kigali alone. Kenya has an estimated 2,000 e-bikes on the road and the government plans to increase the figure to 200,000 by the end of 2024. Swedish e-mobility company Roam in July opened a plant in Nairobi with the capacity to produce 50,000 e-bikes a year. And Uganda signed a five-year deal with e-bike and battery swapping company Spiro to replace 140,000 internal combustion engine (ICE) bikes with electric bikes.

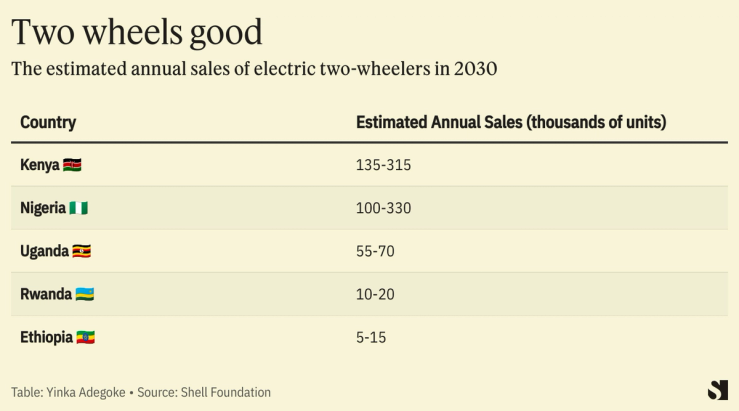

However, limited financing has fallen well short of the levels needed to keep up with that demand, making it hard for companies to produce vehicles and keeping the cost of EVs high for consumers. As much as $9 billion in financing may be required by 2030 to grow a sustainable market for electric two-wheelers in Kenya, Nigeria, Uganda, Rwanda and Ethiopia, according to a report by the Shell Foundation charity.

Local banks and investors have been slow to back the EV sector for reasons including low risk appetite, lack of information and the nascent stage of the sector in Africa, Edwin Muchoki, an e-mobility investment consultant at VBD Autotech, told Semafor Africa. He said investment in EV companies on the continent has been primarily led by international investment firms.

Know More

Even in Kenya, which has over 40 EV companies and is considered a regional leader in the space, lack of sufficient investment is cited as the primary reason behind the under-development of local EV manufacturing capabilities according to a new report by e-mobility research and advocacy group AfEMA.

In countries such as Kenya and Rwanda, the adoption of e-bikes in particular is being driven by asset finance companies such as Watu, Bboxx and M-Kopa, which allow riders to pay daily, weekly or monthly installments, typically from their earnings as motorcycle taxis (boda bodas) or delivery riders. The promise of savings, especially amid rising fuel prices, has been a big draw for riders.

Martin’s view

Many local banks and investors are risk averse, but their interest in the EV sector is bound to grow as EVs become more prominent in Africa. The uptake of e-bikes confirms demand and the industry’s potential viability.

Global investment firms are also thinking of ways to spur local investment in the sector. Speaking at Africa e-Mobility Week (AEW) in Nairobi last week, David Ekabouma of New York-based Greenmax Capital said blended finance instruments could help. That approach, whereby public sources of money such as grants from development finance institutions are used to reduce the risk for private investors, could incentivize local capital to play a “significant role” in providing financing for the EV sector. That, in turn, would reduce the cost of EV vehicles.

“It’s not just about funding the companies, but also individuals taking up e-bikes or e-vehicles,” Muchoki told me. “Once you fund a few people and you see they’re able to pay, and the technology is working, you’ll definitely scale that.”

Erick Massawe — Kenya manager at Watu Credit, which helps finance e-bikes in East Africa countries including Uganda, Rwanda and Tanzania — said more investment in EV companies and the supporting infrastructure, such as charging and battery swapping stations, could really encourage EV adoption in Africa. This, he said, could help the green transport sector to grow beyond public transportation, which is currently a key driver of demand, to cover private transportation as well.

But more needs to change beyond fundraising for the EVs to genuinely take off.

More government incentives are also needed to enable the success of EVs in Africa. In October, Ethiopia exempted electric vehicles from VAT, surtax and excise tax. Kenya lowered the power tariff for charging stations by 30% for domestic users, and plans to halve excise duty for electric vehicles. Meanwhile, Nigeria in May 2023 announced a 10-year tax relief program for EV manufacturers. More countries need to follow their example to create lasting change.

The View From Tanzania

Tanzania boasts more electric vehicles than the rest of East Africa combined, with over 5,000 on the road. That is despite just over $1 million having been raised in EV sector capital so far, compared to over $50 million in Kenya. Tanzanian entrepreneurs increasingly import electric vehicles or convert vehicles running on fossil fuels to electric.

Despite the growing popularity of electric vehicles in Tanzania, industry experts say limited funding is a key factor slowing their adoption, along with high import taxes, low electricity grid access and the presence of few technicians.

Room for Disagreement

Kenya Commercial Bank (KCB), one of Kenya’s largest commercial banks, has helped finance at least 100 e-buses in the past year for some of Nairobi’s largest public transportation companies.

KCB’s head of micro banking Zacharia Cheruiyot acknowledged that local lenders had been slow to back the EV sector but said this was changing. “The opportunity is big,” he said at AEW. He argued that the growth of customers consistently paying off their EV loans would attract more financiers. He also argued that EV companies should target the mass market with their products.

Notable

Chinese companies are flocking to Morocco as the North African country positions itself at the center of the electric vehicle revolution, reports the South China Morning Post.