French Finance Minister Roland Lescure — the country’s third in just over a year — is in New York this week reassuring investors that the EU’s second-biggest economy can get it together.

France is on its fifth government in less than two years after a series of no-confidence votes, the latest of which put Lescure in the job this month under a new prime minister. Government borrowing costs have spiked and French stocks have wavered.

Lescure met this week with Wall Street executives from KKR, Morgan Stanley, Citigroup, and others before sitting down with Semafor at the consulate.

“The first hurdle is to prove we can have political stability,” he said. “Then it’s all about the economy.” The French economy grew faster than expected in the third quarter, new numbers show today, and high savings rates create “a reservoir of growth if we give people confidence again,” Lescure said.

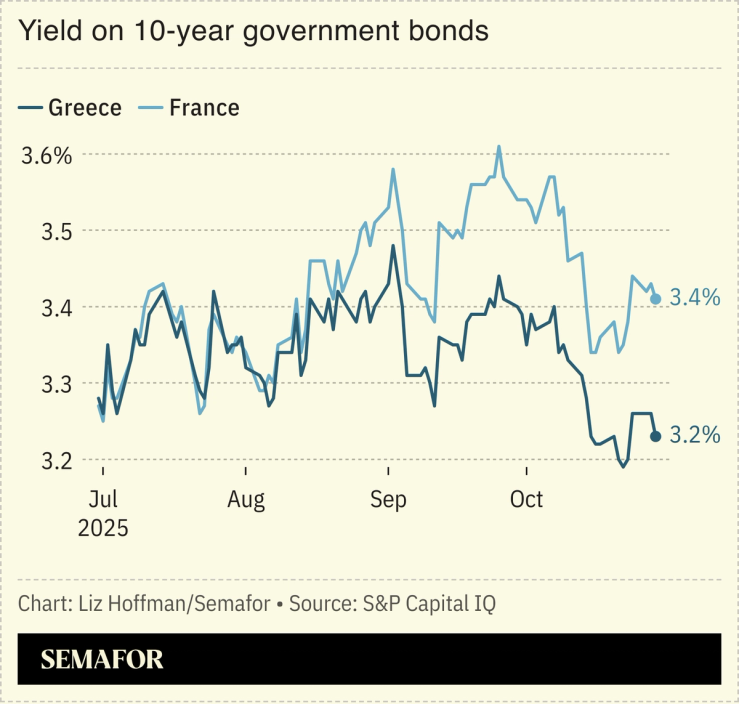

But government borrowing costs have surged: France’s benchmark bonds trade worse than those of Greece, Europe’s former fiscal basket case, and are competing with hefty issuance from the US, Germany, and the EU. As Lescure’s government works to deliver a budget that cuts spending without nuking President Emmanuel Macron’s pro-business agenda, it risks sparking a bond revolt similar to the UK’s 2022 crisis, which bounced a PM from office.