Liz’s view

Most M&A dramas are simple enough for studio suits to grasp — capitalist rom-coms in which overeager bidders chase reluctant targets that eventually relent.

The spectacle unfolding at Warner Bros. Discovery looks curiously like the opposite. The home of CNN, Harry Potter, and HBO hung out a for-sale sign this week and has been backchanneling a willingness to hear out all comers. CEO David Zaslav, as we number-crunched, has 500 million-plus reasons to sell.

The short list of potential bidders, meanwhile, appear ambivalent, unprepared, or both. It’s a flipped script.

Semafor and others hear that Comcast is interested in … something … but two days in, there’s not even a public promise to take a look. That may be a pragmatic nod to the current dealmaking climate: “Everything,” President Donald Trump reminded us this week, “goes through the White House,” where Comcast chief Brian Roberts is not popular. Comcast could revive the spoiler role it played in the 2018 bidding for 21st Century Fox, ultimately getting nothing for itself but complicating life for a rival.

Netflix’s Ted Sarandos couldn’t be less interested in WBD’s cable channels — no surprise there — but was even lukewarm on Warner Bros. Pictures’ content factory. “Nothing is a must for us,” he said, backing up his co-CEO’s recent comments that Netflix is “more builders than buyers.” And the mere existence of WBD, which was created when AT&T spat out Time Warner, is a reminder that content and distribution are better off separate.

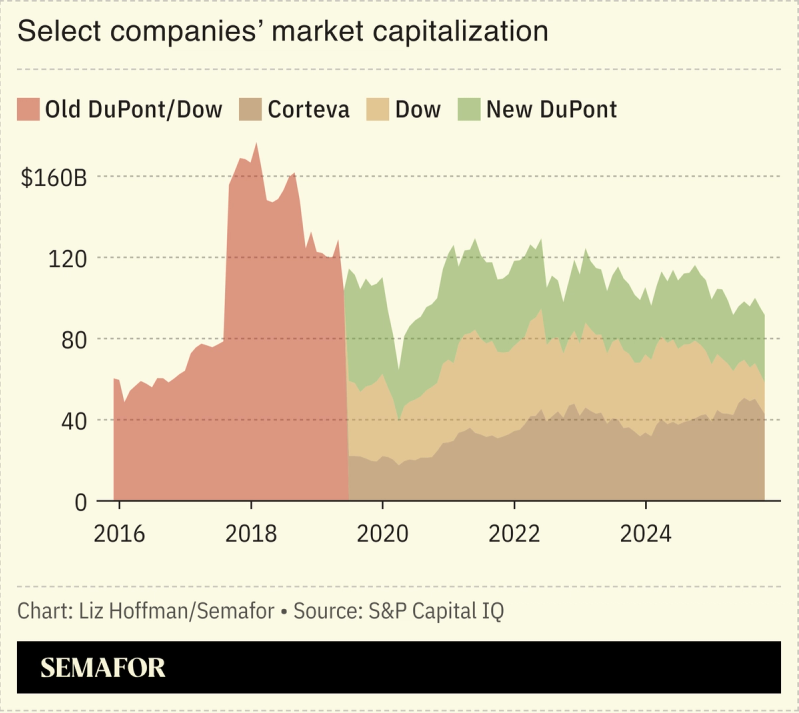

Bundling and unbundling keeps Wall Street busy. The M&A wheel has stopped on the media industry now, but it’s no more immune from the resulting chaos than industrial giants that went through this a decade ago.

Amazon learned an expensive lesson in wrangling Hollywood talent when it bought MGM. Apple has an inside man in former HBO boss Richard Plepler but essentially no M&A track record and investors who would rather the iPhone maker spend its time winning an AI race where it has fallen behind.

Those companies may ultimately show up to challenge Paramount, which has reportedly bid about $60 billion for WBD. Zaslav’s job here is to get a good price, and that means creating the on-screen magic of a competitive auction.

Notable

- “You long for the old-fashioned billionaire who made a lot of money on oil and just wants to hang out on a set with movie stars, or a soda company with stupid ideas about synergies,” Hollywood chronicler Richard Rushfield said on The Ankler’s podcast, lamenting the lack of credible bidders for WBD. “What we’re looking at is a lot of bad choices.”