The News

Intel is on its way to being one of the strangest and most economically vital utilities in modern history. The company is seeking an investment from Apple, a person familiar with the matter said, confirming a Bloomberg report. That would follow the 4% stake Intel sold to Nvidia, the 2% it sold to SoftBank, and the 10% it forked over to the US government.

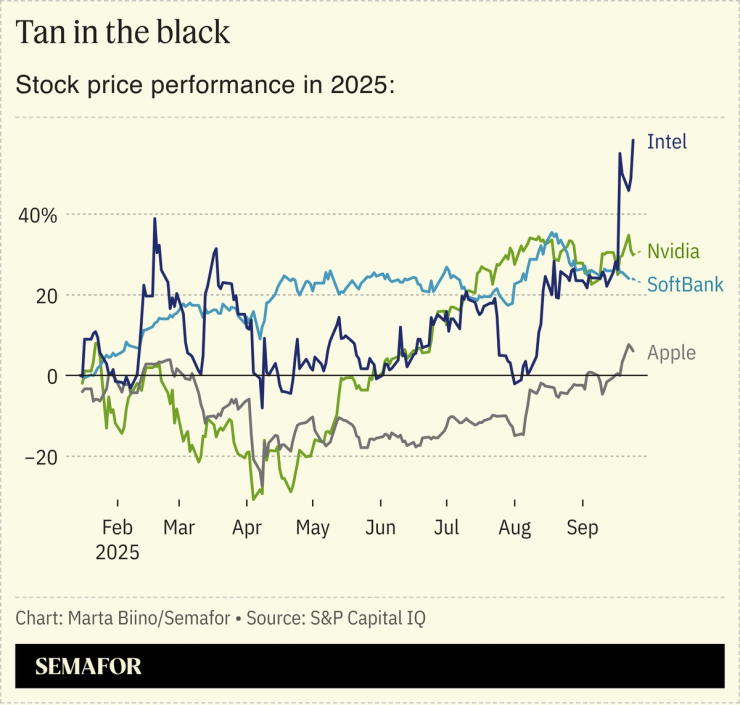

Talks with other chip companies predated the White House’s move, which began as a pressure campaign on CEO Lip-Bu Tan but has become a badly needed vote of confidence in a company with a long history of missteps and complacency. Intel shares are now outperforming the three companies whose money it sought.

Intel is behind in both cutting-edge AI chips and more prosaic models used in mobile phones, which cost it Apple’s Mac business back in 2020. Apple has since perfected its own M-series chips, and is unlikely to switch back. But Western AI companies see the value in a strong US manufacturer, and like much of corporate America, are taking cues from the White House.

Know More

Intel’s struggles amplified last year, as a turnaround effort championed by former CEO Pat Gelsinger struggled. That led to Gelsinger’s ouster, Tan’s appointment, and within half a year, a dramatic government intervention led by Commerce Secretary Howard Lutnick.

Intel’s potential strategic importance to the United States — in the event of a Chinese invasion of Taiwan, the US would need a homegrown chip foundry — is what led the government to convert the CHIPS Act grants awarded to Intel into an equity stake. But for Intel’s foundry business to be viable, it needs customers. Customers expect a level of manufacturing precision that Intel cannot yet deliver.

In theory, the outside dollars from Apple (a former customer), Nvidia (a potential foundry customer), and others would allow Intel’s chip manufacturing to catch up to TSMC, which is far and away the world leader.