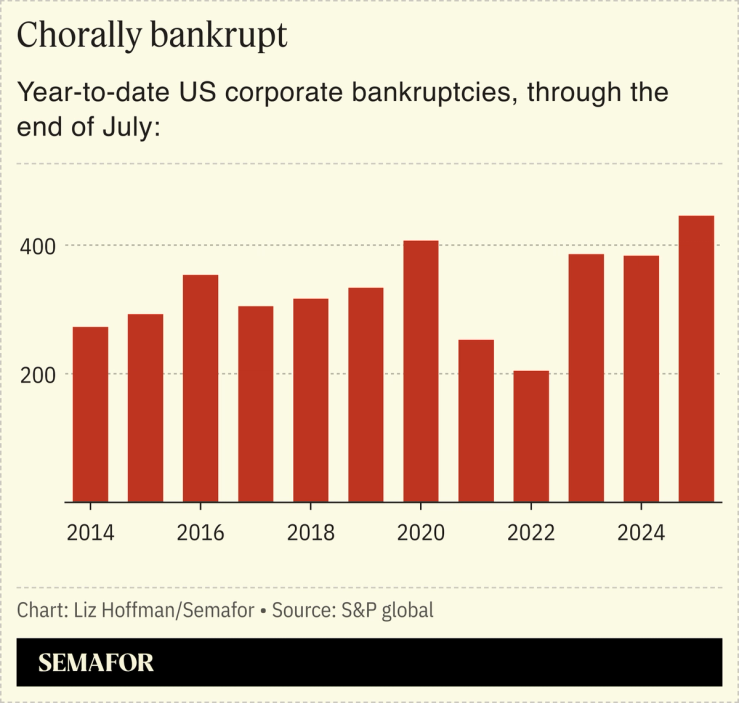

Fears are rising of a corporate debt wipeout as lenders scramble to fix a pair of companies in the car economy. Parts supplier First Brands is over its skis on a $6 billion debt pile and an additional, murky pile of off-balance sheet debt, days after a dealership catering to subprime buyers filed for Chapter 11. More US companies went bankrupt in July than in any month since 2020, offering some proof that corporate America’s borrowing binge couldn’t long survive this era of higher interest rates.

Investors (and journalists!) often look for patterns where none exist, so hold the panic. But financial irregularities — which appear to be a factor in both companies’ struggles, as the Justice Department reportedly investigates Tricolor and Deloitte does triage on First Brands’ accounting — tend to be a bad sign for the economy.