The News

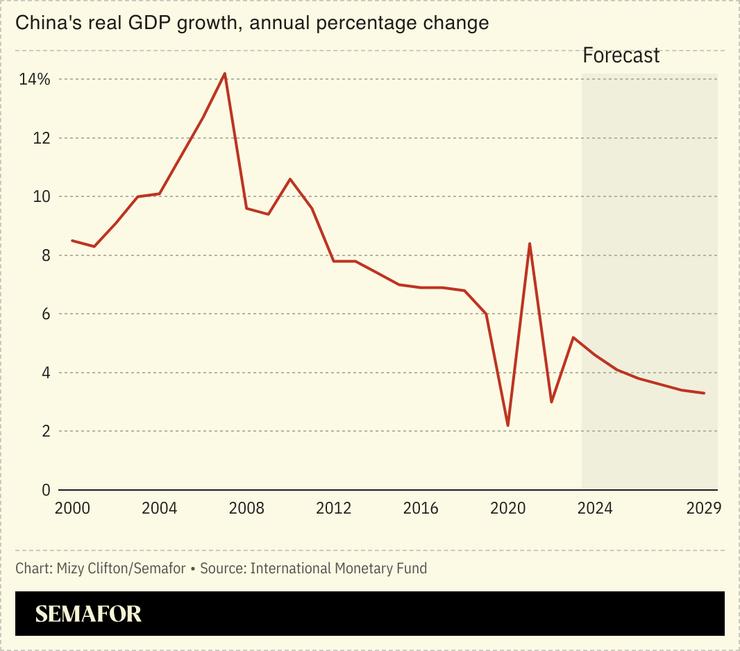

China’s economic slowdown is deepening more than expected, new data on industrial output, investment, and consumer spending indicated. Unemployment also appeared to be on the rise.

Major banks, including Goldman Sachs and Morgan Stanley, cut their 2024 growth forecasts for the country, and warned Beijing may need to deploy a huge fiscal stimulus to stop the downturn. Chinese authorities, however, have shown little willingness to do so.

SIGNALS

Policymakers could continue to defer a stimulus

Chinese policymakers are unlikely to enact a stimulus package while the economy “broadly holds up,” Bloomberg wrote, adding that exports reached a two-year high in August despite US and European Union tariffs on many Chinese imports. “It is unlikely that China’s senior policymakers don’t care about growth anymore,” an economist told the outlet. “But it is hard to know how weak the economy needs to get before they will agree to a more expansionary fiscal policy.”

China’s economy is struggling, but true crisis may be yet to come

China’s disappointing economic data comes as the country grapples with an aging population, spiraling debt, and a flailing property market. The housing downturn has been particularly tough, even as Beijing has seemed to avoid a broader, systemic financial fallout of the kind triggered by the US’ 2007-2008 subprime mortgage crisis, an analyst told CNBC: “So instead, they’re going through this sort of slow, painful, grinding adjustment.”

Trade war with the US may be ‘a gift’ for China

While Western countries have sought to impose more restrictions and tariffs on China in recent years, these obstacles may not hold so much negative impact in practice, an economist told South China Morning Post. Instead, the limitations could become “a gift” for Beijing: Such restrictions could boost domestic innovation, and China has seen “a national mobilisation around climbing up the value chain and pursuing more technological advancement,” the economist added, particularly in artificial intelligence and green tech.