The News

The trillions of dollars managed by BlackRock, State Street, and Vanguard gave them huge power over corporate America. Retreating from political criticism, they’re trying to give it up to everyday investors.

The Big Three investment firms have rolled out programs over the past three years that let individual investors vote their own shares in corporate elections, rather than governance experts at HQ. Clients can choose “archetypes” — pro-environment, deferential to management, socially-minded — that distill their stances, and then automatically vote accordingly on ballot measures.

Vanguard on Wednesday said that the number of investors opting into their program had more than doubled from 2023 to 2024. State Street and BlackRock have had similar uptake to their own programs. “It’s giving voice to investors that have a perspective,” John Galloway, global head of investment stewardship at Vanguard, told Semafor.

In this article:

Know More

A side benefit is reducing the power of these firms, which is both real — BlackRock, Vanguard, and State Street together control around 20% of the average S&P 500 company — and magnified by conservatives who see a vast left-wing conspiracy in corporate boardrooms.

The challenge is getting investors to care. Vanguard has more than 50 million investors on their platform, 10 million of whom are eligible for its Investor Choice program. Just 82,000 of them opted to control their votes in 2024.

Getting shareholders to “open up an email [informing them about voting choice], understand what you’re even talking about, and then make a decision” is an uphill battle, said Alex Thaler, CEO of Iconik, a startup that offers default profiles as well as interactive questions — a shareholder democracy version of BuzzFeed’s “which Disney princess are you?” quizzes.

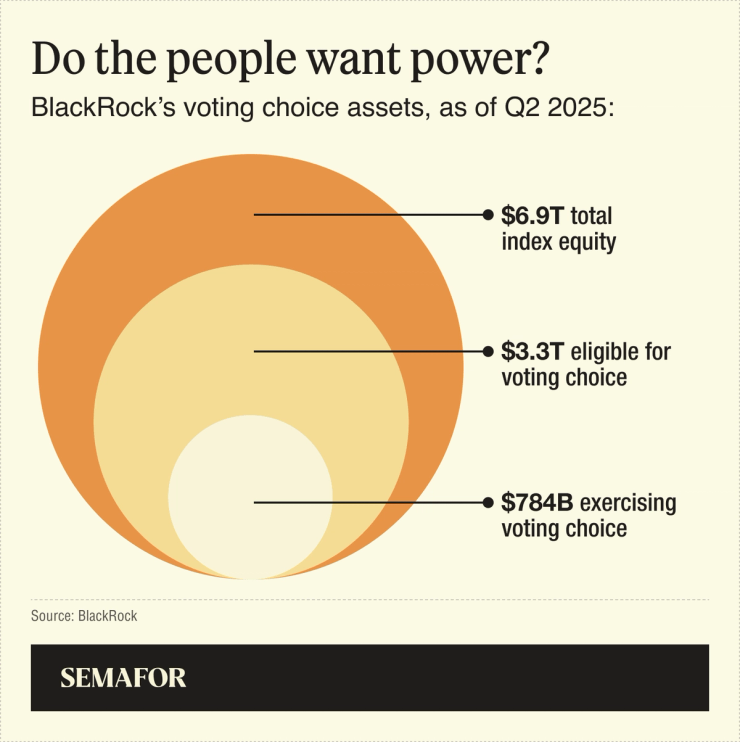

Vanguard and other investment firms are still building out the technology to make more investors eligible: Currently, a little more than 26% of BlackRock’s $12.5 trillion in assets qualify. The question of which individual investor owns which share of which company is surprisingly murky, an artifact of arcane market plumbing made more difficult by the rise of ETFs and fractional share ownership. Galloway says Vanguard is three to five years away from perfecting the system.

Another challenge is parsing millions of pages of corporate documents to figure out what shareholders are actually being asked to decide. Some are simple — should Spirit Aerosystems have had to disclose its political contributions? Others, particularly around social issues, are harder to distill.

“Maybe I want to follow this person’s policy, or this policy that’s already set up by a nonprofit, or maybe it’s Vanguard[’s house policy], Thaler said. “Or I want to follow parts of that policy, but I also want to have my own rules.”

Rohan’s view

A world in which BlackRock and Vanguard’s power is dispersed to millions of individual investors would upend how activist board battles are waged. Their ability to swing elections brings some efficiency to proxy battles, corralling the efforts of corporate management and the hedge funds trying to pressure them, and winning over the Big Three is usually enough for either side to secure victory. Activists, fairly or not, perceive those big passives as in favor of management. (All three voted with Phillips 66 management in its battle against Elliott earlier this year, while BlackRock’s and Vanguard’s support for Quentin Koffey’s Politan was enough to win a proxy fight at Masimo in 2024.)

Putting the voting power back in the hands of shareholders — where it arguably belongs, and where passive giants might prefer, for political reasons, that it rests — will fragment the fight for corporate influence and make those battles more expensive. Disney and Nelson Peltz spent tens of millions of dollars on old-school mailers, phone calls, and advertisements trying to win over individual investors, a large block of the House of Mouse’s shareholder base.

The View From John Galloway

“I can categorically reject the assertion that there is some kind of blanket approach [to supporting companies over activists],” Galloway told Semafor. “We look at each [proxy fight] independently.”

“Activists are a really important part of a corporate governance ecosystem,” he noted.