The Scoop

The investment firm founded by anti-woke crusader Vivek Ramaswamy is dialing down the very rhetoric that made it prominent, hoping to court a wider audience, the firm acknowledged to investors in a letter last month.

Strive Asset Management is seen “as political over investment oriented,” turning off some investors and limiting its opportunities to grow, according to the letter, viewed by Semafor.

Now, even as Ramaswamy is riding his culture-war views to a surprising third on the presidential campaign trail, Strive is recalibrating its own outrage meter.

Its new chief executive, Matt Cole, spent 16 years running bond portfolios for CalPERS, the giant California pension fund. A deeply religious Christian but not outwardly political, Cole, who took the job in May, said ESG has outlived its usefulness in investing.

“Don’t get me wrong. We believe that shareholders are more important than other stakeholders,” he said in an interview. “And we do think the corporate ESG movement has been value-destructive and politically motivated. It started with ‘don’t hire slave labor in China’ and now it’s become something else.”

But “that’s an investing [disagreement], not a culture war,” he said.

Cole pointed to Strive’s largest fund, which invests in U.S. energy companies and urges them to keep drilling for oil so long as it’s profitable. He cited estimates from JPMorgan analysts of a $600 billion shortfall in oil and gas investment by 2030, which could lead to a spike in prices and crimp the global post-pandemic recovery.

“In 20 years, I highly doubt that Strive’s position would be oil companies should be drilling more,” he said, “but that’s true today.”

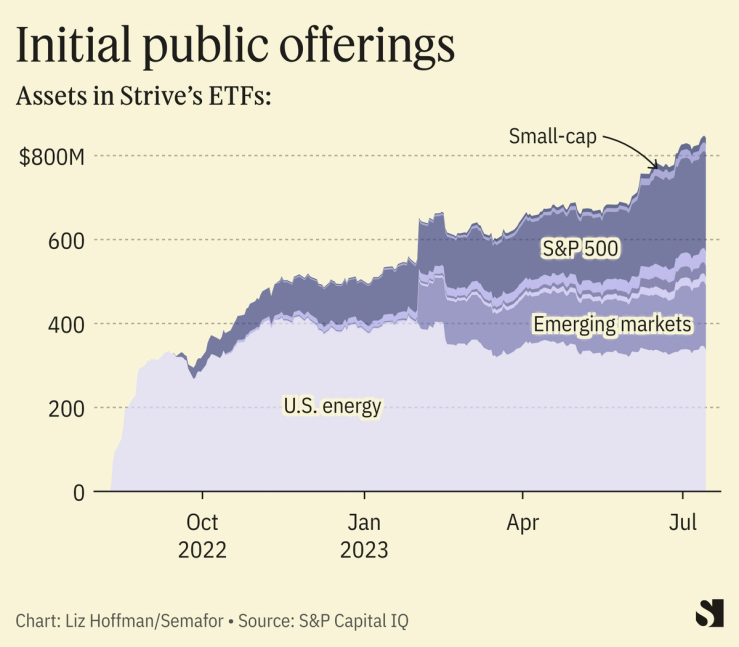

Strive runs eight exchange-traded funds, none of which would be out of place in a typical investment portfolio. Recent launches include a small-cap stock fund and a growth fund heavy on big tech names.

It has $845 million in assets — hardly a threat to the giants, like BlackRock and State Street, that Ramaswamy set out to unseat, but significant for a new manager with no track record. (JPMorgan, which got into the ETF business in 2014, took two years to raise its first $1 billion.)

Strive eventually plans to raise a private, activist fund to run proxy fights and seek corporate influence, but that’s on the back burner, people familiar with the matter said. First up is something more mundane: bond funds.

In this article:

Liz’s view

Both sides in the red-versus-blue investing world are dialing down the rhetoric.

BlackRock’s Larry Fink won’t use the term ESG anymore, which he says has been “weaponized” by both the far left and the far right. BlackRock dropped the term from its proxy-voting guidelines this year, and yesterday added the CEO of Saudi Aramco, the world’s largest oil company, to its board.

And pension managers are pushing back against political mandates to invest in, or get out of, certain stocks. Vermont recently passed a law requiring its pension funds, which are already underfunded, to divest from fossil fuels, over the strong objections of the people doing the investing. Similar efforts on the right have failed in Kentucky and North Dakota. An Arkansas bill penalizing asset managers and banks that shun oil companies was tailored to exempt situations that would cause “a negative financial impact to the state.”

Even in deep-blue California, a law requiring the state’s massive pensions to sell their fossil-fuel investments by 2027 passed the Senate but was quietly shelved by the state assembly.

While Strive has fundraised successfully from red-state officials — it got $100 million investment from Texas’ $34 billion state employee retirement plan earlier this year, documents show — Cole sees the limits to nakedly political fundraising.

The firm’s priorities, according to the letter viewed by Semafor, would match those of any startup firm: launch new funds, sell them directly to retail investors, court family offices, get into the 401(k) business.

The move will shift the firm further away from the vision Ramaswamy and his co-founder, Anson Frericks, sketched out two years ago. The original idea, a person familiar with the matter said, was a venture firm that would seed right-wing corporate alternatives, like a conservative beer company (Frericks is a former AB InBev executive), and a rival software to Salesforce, whose CEO, Marc Benioff, had become an outspoken supporter of LBGTQ rights.

Room for Disagreement

A push in Congress could reinvigorate partisan efforts at the state level. House Republicans kicked off “ESG Month” last week, unveiling a slate of 18 bills meant to “get politics out of corporate boardrooms and discourage financial regulation from being weaponized to drive far-left environmental and social policy,” said Rep. Patrick McHenry, R-N.C., who chairs the House Financial Services Committee.

While his caucus doesn’t seem to have the votes to pass them, “red states may pick up lines of inquiry,” Joshua Lichtenstein, a lawyer at Ropes & Gray who’s been tracking ESG policies, told The New York Times.

Notable

- Ropes & Gray’s state-by-state analysis of efforts to restrict, or mandate, investments based on ESG criteria.

- Strive courted GOP state officials including Florida’s Jimmy Patronis and West Virginia’s Riley Moore, both outspoken critics of BlackRock, CNBC reported.

- “When I told her he was in town to talk about ESG, she asked me whether he was for or against it.” Politico’s Daniel Lippman on the trail with Ramaswamy.