There’s a new way to own the libs, but it’ll cost you.

The latest anti-DEI index fund — described by its founder to Semafor last year as “an S&P 500 fund without the woke sh*t” — launches today. Azoria’s Meritocracy ETF will own the S&P 500 except for 37 companies, including Nike and Airbnb, that it says prioritize diversity over merit in hiring. Azoria’s founder, James Fishback, said in an interview that Susquehanna, the trading firm run by conservative donor Jeffrey Yass, bought 75,000 shares at the open.

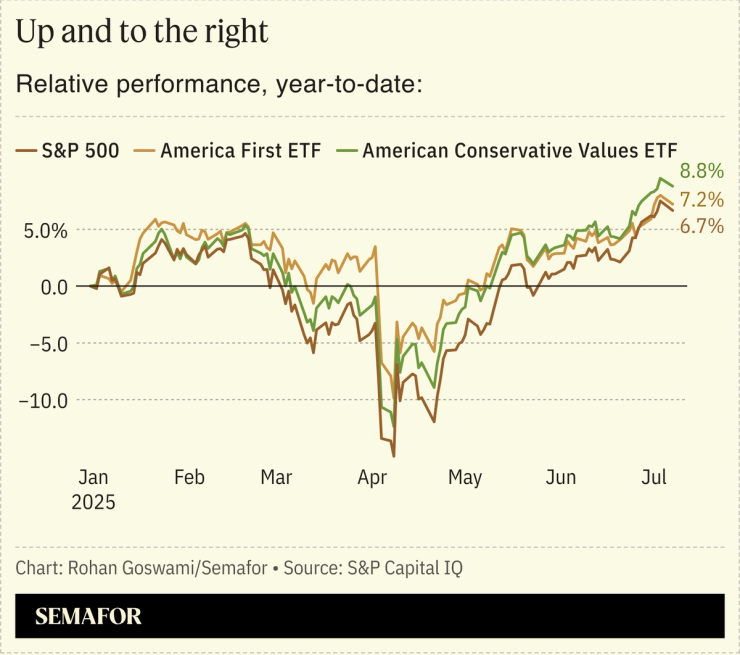

Conservative ETFs — and virtue-signaling funds of all political stripes — are proliferating in the Trump age. While a handful have beaten the broader market this year, they are far more expensive than the benchmarks they, to varying degrees, deviate from. The newly launched Meritocracy ETF charges $47 (for Trump) on every $10,000 invested, versus about $3 for the cheapest S&P 500 trackers.

As a FactSet researcher told The Wall Street Journal, a more efficient, though less satisfying, way to virtue-signal would be to buy a plain-vanilla index fund and donate the investment gains to a political cause.