The Scoop

Apollo and a Qatari investment fund have made a bid for Papa John’s that would value the pizza chain at around $2 billion, according to people familiar with the matter.

It’s an unlikely pairing: Apollo, one of Wall Street’s deepest pockets; and Irth Capital, which is backed by Sheikh Mohamed al Thani, a member of the Qatari royal family, and managed just $190 million as of Dec. 31, regulatory filings show. With Papa John’s stock now trading around $48 a share, the consortium made a bid in the low $60s, people familiar with the matter said.

Irth brings a 5% stake in Papa John’s and some expertise in buying consumer brands in need of a turnaround. One of its cofounders bought mattress maker Casper in 2021 and Bojangles, the fried-chicken house, in 2017. But the smaller fund still needs to sort out its financing, and it’s possible that Apollo could go at it alone, according to people familiar with the matter.

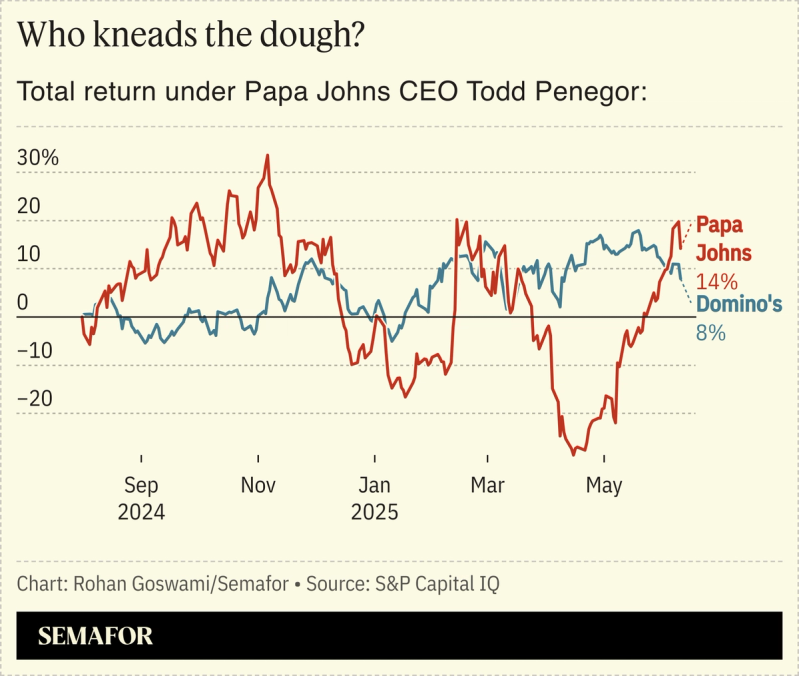

The pizzeria’s shares have outperformed competitors under CEO Todd Penegor, and while the stock still trades at a slight discount to Yum! and Domino’s, management has publicly said it is making progress changing that.

“We know we can deliver good value for the money and keep building on the trends that we’re seeing,” Penegor said at an investor conference Tuesday. Apollo and Papa John’s declined to comment. Irth did not return requests for comment.

Know More

Irth began exploring a takeover of the American icon earlier this year, Semafor first reported in February.

Apollo has made forays into fast food before. It acquired Wagamama’s parent, Restaurant Group, in a $620 million deal in 2023, and until 2022 owned Mexican fast-casual chain Qdoba. But private equity represents a smaller and smaller part of its business these days — more than 80% of its $785 billion under management is made up of loans.

Any formal sales process would bring other bidders eager for a shot at a leveraged buyout in a quiet market. Inspire Brands, the owner of Arby’s and Buffalo Wild Wings, has historically been a voracious buyer and hasn’t done a big deal since 2020, when it bought Dunkin’ Donuts. Roark Capital, which owns Subway, is likely still digesting a $1 billion deal for Dave’s Hot Chicken announced last week, though Papa John’s franchise model — in which the company licenses out menus, logos, and ingredients to independent owners — aligns with their investment strategy.