The Scoop

FTX’s bankers are quietly shopping what might be the most valuable asset inside the collapsed crypto exchange: a stake in Anthropic, a startup that has ridden the AI craze and is now worth billions of dollars.

Perella Weinberg, the boutique bank sorting out the mess left behind when FTX went bankrupt in November, has been teasing the sale of hundreds of millions of dollars of shares in Anthropic to potential investors, people familiar with the matter said. The privately-held company, which created the Claude chatbot that is taking on ChatGPT, has gone from virtually unknown to one of the hottest companies in the AI boom in a matter of months.

FTX appeared to own $500 million worth of Anthropic stock when it went bankrupt, though it’s unclear how former CEO Sam Bankman-Fried arrived at that valuation. The stake is now expected to fetch nine figures, money that would go to former customers.

Bankers are discussing whether to sell the entire stake now or hold some back, on the theory that AI valuations will keep rising. (Bankman-Fried is no longer an investor in Semafor).

Since the FTX investment last spring, AI fever has seized Wall Street and money is pouring into hot startups. Demand is outstripping supply, and Anthropic, just two years old, is valued at $4.6 billion after raising $750 million in venture money over just several months.

Representatives for FTX, Anthropic, and Perella declined to comment.

In this article:

Liz’s view

Bankruptcy trustees have to balance two things: getting the most possible for a failed company’s assets, and doing so quickly enough to preserve whatever value remains in the business and compensate creditors. It is built for companies with traditional assets like factories, inventory, and real estate, and traditional debts, like bonds and bank loans.

FTX has neither. For starters, its bankruptcy wasn’t “prepackaged” — that is, negotiated ahead of time with creditors. Its debts aren’t held by sophisticated banks but rather by millions of individual customers. And its assets are things like the stake in Anthropic, whose value has soared from the early (pre-ChatGPT) days of the bankruptcy process.

The bankruptcy estate’s advisers have already learned this lesson once. In March, they sold warrants to buy 800 million tokens of a then-obscure coin for $96 million. Two months later, those tokens started trading on crypto exchanges and soared in value. Today, FTX’s stake would be worth $730 million, even after a 40% drop in the token’s value over the past few weeks.

Reed’s view

There are now hundreds — maybe even thousands — of new AI companies getting funded all over the world, but there are only a handful of providers of the “foundational models” that power those startups. Anthropic is one of them. Others include OpenAI, Microsoft, Google, Amazon, and Cohere.

That puts Anthropic in an elite category. It has the technical talent capable of doing cutting-edge work in AI. It makes its money by selling access to its Application Program Interface, or API, allowing other companies to offer more customized services that take advantage of those models.

Sourcegraph, for example, uses Anthropic’s Claude model to offer big companies AI-assisted software development customized for their own needs.

But OpenAI, partnered with Microsoft, has the first-mover advantage in the field, and its ChatGPT is the fastest growing consumer product in history.

Anthropic might rise to the top, or at least near it, thanks to its technical talent. But it is up against giants and there is always the possibility that it gets crushed.

Betting that Anthropic’s valuation will continue to grow may be a great bet for venture capitalists, but it isn’t the kind of thing bankruptcy trustees are particularly good at or comfortable with.

Room for Disagreement

If FTX’s bankers sell their shares in Anthropic now, it could go down in history as one of the great missed opportunities of all time.

If you believe the current tech industry mantra, AI is paving the way for a new industrial revolution that will change the face of humanity. And Anthropic is leading. Recently, Anthropic made a tenfold improvement in the amount of text its large language model, Claude, can process.

What does that mean in practice? Anthropic tested the capability by changing a single sentence in The Great Gatsby and Claude caught the error in 22 seconds. That feature could prove very useful for customers that need to process large documents, such as law firms and scientific institutions.

Notable

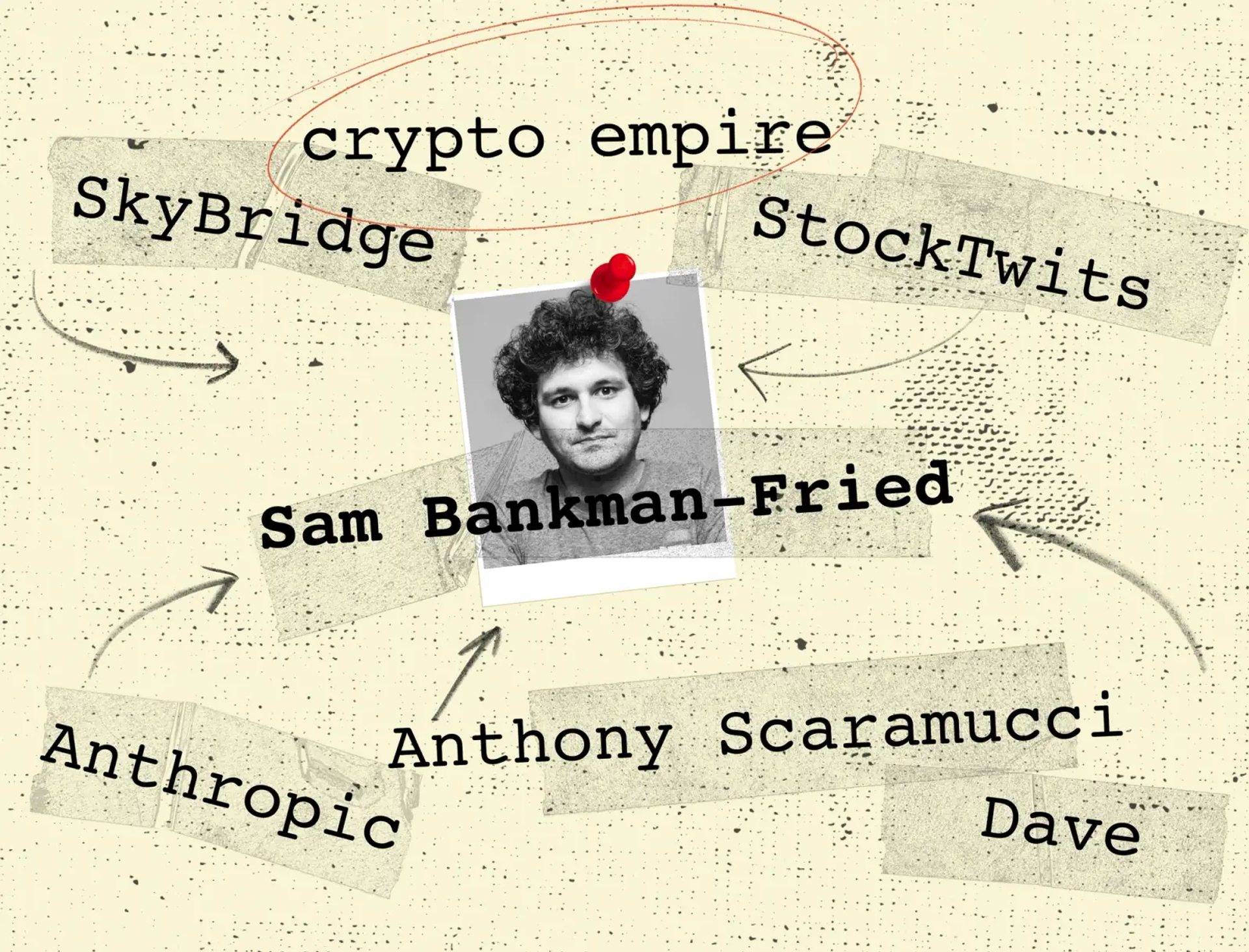

- Our scoop from November detailing some of FTX’s holdings, including stakes in a mobile bank called Dave and online forum Stocktwits.

- For more on the weirdness of the FTX bankruptcy, here’s The Wall Street Journal on desperate customers selling their claims for cents on the dollar to hedge funds.